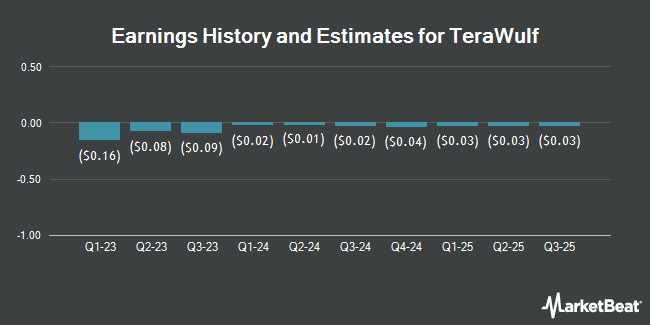

TeraWulf Inc. (NASDAQ:WULF - Free Report) - Research analysts at Roth Capital decreased their FY2024 earnings estimates for shares of TeraWulf in a research report issued on Wednesday, November 13th. Roth Capital analyst D. Aftahi now anticipates that the company will post earnings of ($0.17) per share for the year, down from their previous forecast of ($0.09). The consensus estimate for TeraWulf's current full-year earnings is ($0.10) per share. Roth Capital also issued estimates for TeraWulf's Q4 2024 earnings at ($0.04) EPS, Q4 2025 earnings at $0.03 EPS and FY2026 earnings at $0.16 EPS.

TeraWulf (NASDAQ:WULF - Get Free Report) last posted its quarterly earnings results on Monday, August 12th. The company reported ($0.03) earnings per share (EPS) for the quarter. TeraWulf had a negative return on equity of 17.02% and a negative net margin of 41.88%. The company had revenue of $35.57 million during the quarter, compared to analysts' expectations of $35.73 million.

A number of other equities analysts also recently weighed in on the stock. Cantor Fitzgerald reaffirmed an "overweight" rating and issued a $10.00 price target on shares of TeraWulf in a research note on Thursday, October 3rd. Rosenblatt Securities reaffirmed a "buy" rating and issued a $5.00 target price on shares of TeraWulf in a research report on Tuesday, October 8th. Stifel Canada lowered TeraWulf from a "strong-buy" rating to a "moderate buy" rating in a report on Tuesday, October 29th. B. Riley restated a "buy" rating and issued a $6.00 price objective on shares of TeraWulf in a report on Monday, October 7th. Finally, Needham & Company LLC raised their price objective on shares of TeraWulf from $6.00 to $9.50 and gave the company a "buy" rating in a research report on Wednesday. Seven research analysts have rated the stock with a buy rating and one has issued a strong buy rating to the stock. Based on data from MarketBeat.com, the company has an average rating of "Buy" and a consensus target price of $7.21.

View Our Latest Report on TeraWulf

TeraWulf Stock Up 3.4 %

TeraWulf stock traded up $0.23 during trading hours on Friday, hitting $7.18. The company had a trading volume of 22,941,138 shares, compared to its average volume of 21,229,932. The firm's fifty day moving average is $5.42 and its 200-day moving average is $4.35. TeraWulf has a fifty-two week low of $1.01 and a fifty-two week high of $9.30.

Institutional Investors Weigh In On TeraWulf

Large investors have recently added to or reduced their stakes in the stock. Vanguard Group Inc. grew its position in shares of TeraWulf by 17.7% in the first quarter. Vanguard Group Inc. now owns 11,722,320 shares of the company's stock valued at $30,830,000 after purchasing an additional 1,764,115 shares during the last quarter. SG Americas Securities LLC increased its position in TeraWulf by 260.8% in the 2nd quarter. SG Americas Securities LLC now owns 193,304 shares of the company's stock worth $860,000 after buying an additional 139,722 shares during the period. Bank of New York Mellon Corp lifted its holdings in shares of TeraWulf by 97.8% during the second quarter. Bank of New York Mellon Corp now owns 844,292 shares of the company's stock worth $3,757,000 after buying an additional 417,369 shares during the last quarter. Central Asset Investments & Management Holdings HK Ltd bought a new stake in shares of TeraWulf in the second quarter valued at approximately $1,095,000. Finally, Wealth Enhancement Advisory Services LLC grew its stake in shares of TeraWulf by 43.6% in the third quarter. Wealth Enhancement Advisory Services LLC now owns 656,520 shares of the company's stock worth $3,073,000 after acquiring an additional 199,345 shares during the last quarter. Institutional investors own 62.49% of the company's stock.

TeraWulf Company Profile

(

Get Free Report)

TeraWulf Inc, together with its subsidiaries, operates as a digital asset technology company in the United States. The company develops, owns, and operates bitcoin mining facilities in New York and Pennsylvania. It is also involved in the provision of miner hosting services to third-party entities. The company was founded in 2021 and is headquartered in Easton, Maryland.

Read More

Before you consider TeraWulf, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and TeraWulf wasn't on the list.

While TeraWulf currently has a "Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat has just released its list of 20 stocks that Wall Street analysts hate. These companies may appear to have good fundamentals, but top analysts smell something seriously rotten. Are any of these companies lurking around your portfolio? Find out by clicking the link below.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.