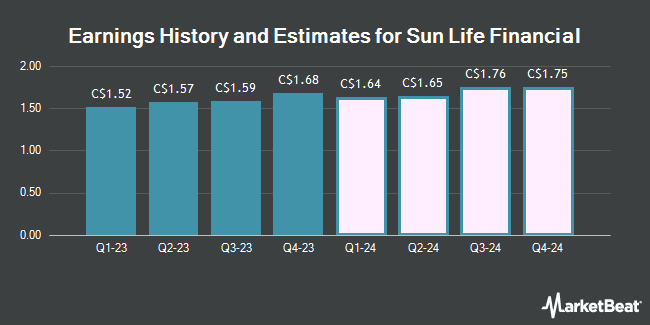

Sun Life Financial Inc. (TSE:SLF - Free Report) NYSE: SLF - Analysts at Desjardins boosted their FY2024 earnings estimates for Sun Life Financial in a research note issued on Tuesday, November 5th. Desjardins analyst D. Young now forecasts that the financial services provider will post earnings of $6.75 per share for the year, up from their previous forecast of $6.68. The consensus estimate for Sun Life Financial's current full-year earnings is $6.92 per share. Desjardins also issued estimates for Sun Life Financial's Q4 2024 earnings at $1.78 EPS.

Sun Life Financial (TSE:SLF - Get Free Report) NYSE: SLF last posted its quarterly earnings data on Monday, August 12th. The financial services provider reported C$1.71 earnings per share (EPS) for the quarter, topping analysts' consensus estimates of C$1.58 by C$0.13. The company had revenue of C$8.92 billion during the quarter, compared to the consensus estimate of C$9.18 billion. Sun Life Financial had a net margin of 9.90% and a return on equity of 13.65%.

A number of other brokerages have also recently weighed in on SLF. Barclays raised their price objective on Sun Life Financial from C$76.00 to C$79.00 in a report on Tuesday. Royal Bank of Canada boosted their price objective on shares of Sun Life Financial from C$78.00 to C$82.00 in a report on Wednesday. Scotiabank increased their target price on shares of Sun Life Financial from C$73.00 to C$85.00 and gave the company an "outperform" rating in a report on Wednesday, October 30th. Evercore lowered their price target on shares of Sun Life Financial from C$76.00 to C$75.00 in a research note on Thursday, July 11th. Finally, TD Securities upped their price target on shares of Sun Life Financial from C$77.00 to C$81.00 in a research report on Tuesday. Three research analysts have rated the stock with a hold rating and seven have assigned a buy rating to the stock. Based on data from MarketBeat.com, Sun Life Financial currently has an average rating of "Moderate Buy" and a consensus target price of C$81.36.

Read Our Latest Stock Report on SLF

Sun Life Financial Price Performance

SLF stock traded up C$0.55 during mid-day trading on Thursday, hitting C$82.63. 1,479,197 shares of the stock were exchanged, compared to its average volume of 2,038,733. The business has a fifty day moving average price of C$77.10 and a 200 day moving average price of C$71.66. Sun Life Financial has a 12 month low of C$64.38 and a 12 month high of C$82.86. The company has a debt-to-equity ratio of 53.77, a current ratio of 65.29 and a quick ratio of 84,866.00. The stock has a market capitalization of C$47.64 billion, a price-to-earnings ratio of 15.60, a PEG ratio of 1.33 and a beta of 0.94.

Sun Life Financial Increases Dividend

The firm also recently declared a quarterly dividend, which will be paid on Tuesday, December 31st. Investors of record on Wednesday, November 27th will be issued a dividend of $0.84 per share. This represents a $3.36 dividend on an annualized basis and a yield of 4.07%. The ex-dividend date of this dividend is Wednesday, November 27th. This is an increase from Sun Life Financial's previous quarterly dividend of $0.81. Sun Life Financial's payout ratio is currently 61.36%.

Insider Activity at Sun Life Financial

In other news, Director Stephanie Coyles bought 500 shares of the firm's stock in a transaction dated Thursday, August 15th. The stock was purchased at an average price of C$70.00 per share, with a total value of C$35,000.00. Following the transaction, the director now owns 500 shares of the company's stock, valued at approximately C$35,000. In related news, Senior Officer Linda Dougherty sold 2,000 shares of the company's stock in a transaction that occurred on Thursday, September 12th. The stock was sold at an average price of C$75.30, for a total value of C$150,590.00. Also, Director Stephanie Coyles acquired 500 shares of Sun Life Financial stock in a transaction that occurred on Thursday, August 15th. The shares were bought at an average cost of C$70.00 per share, with a total value of C$35,000.00. Following the transaction, the director now owns 500 shares in the company, valued at C$35,000. 0.03% of the stock is owned by corporate insiders.

About Sun Life Financial

(

Get Free Report)

Sun Life Financial Inc, a financial services company, provides savings, retirement, and pension products worldwide. The company operates in five segments: Asset Management, Canada, U.S., Asia, and Corporate. It offers various insurance products, such as term and permanent life; personal health, which includes prescription drugs, dental, and vision care; critical illness; long-term care; and disability, as well as reinsurance.

See Also

Before you consider Sun Life Financial, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Sun Life Financial wasn't on the list.

While Sun Life Financial currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's guide to investing in 5G and which 5G stocks show the most promise.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.