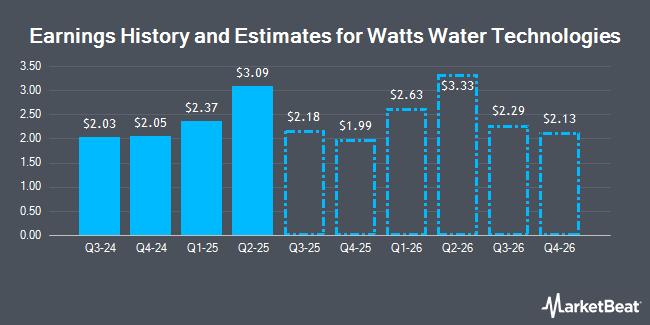

Watts Water Technologies, Inc. (NYSE:WTS - Free Report) - Stock analysts at Seaport Res Ptn boosted their FY2024 earnings estimates for Watts Water Technologies in a research note issued on Tuesday, November 5th. Seaport Res Ptn analyst W. Liptak now expects that the technology company will post earnings per share of $8.75 for the year, up from their previous estimate of $8.65. The consensus estimate for Watts Water Technologies' current full-year earnings is $8.72 per share. Seaport Res Ptn also issued estimates for Watts Water Technologies' Q4 2024 earnings at $1.93 EPS, Q1 2025 earnings at $2.18 EPS, Q3 2025 earnings at $2.23 EPS, Q4 2025 earnings at $2.14 EPS and FY2025 earnings at $9.01 EPS.

Watts Water Technologies (NYSE:WTS - Get Free Report) last announced its quarterly earnings data on Wednesday, October 30th. The technology company reported $2.03 EPS for the quarter, beating the consensus estimate of $1.99 by $0.04. The business had revenue of $543.60 million during the quarter, compared to analyst estimates of $541.83 million. Watts Water Technologies had a return on equity of 18.49% and a net margin of 12.37%. During the same quarter last year, the firm posted $2.04 earnings per share. The company's revenue for the quarter was up 7.8% on a year-over-year basis.

WTS has been the subject of several other research reports. StockNews.com raised shares of Watts Water Technologies from a "hold" rating to a "buy" rating in a research report on Friday, August 16th. Robert W. Baird reduced their price target on shares of Watts Water Technologies from $225.00 to $199.00 and set a "neutral" rating for the company in a research note on Friday, August 9th. Northcoast Research raised Watts Water Technologies from a "neutral" rating to a "buy" rating and set a $225.00 price objective for the company in a report on Monday. Finally, Stifel Nicolaus dropped their price target on shares of Watts Water Technologies from $217.00 to $202.00 and set a "hold" rating for the company in a research report on Friday, August 9th. Three equities research analysts have rated the stock with a hold rating and two have assigned a buy rating to the company's stock. According to MarketBeat.com, the company has a consensus rating of "Hold" and a consensus target price of $200.25.

View Our Latest Stock Report on WTS

Watts Water Technologies Stock Up 0.9 %

Shares of Watts Water Technologies stock traded up $1.78 during midday trading on Friday, hitting $209.02. The company had a trading volume of 69,437 shares, compared to its average volume of 145,698. Watts Water Technologies has a 52-week low of $175.37 and a 52-week high of $219.52. The company has a debt-to-equity ratio of 0.13, a quick ratio of 1.55 and a current ratio of 2.55. The company has a 50 day moving average of $200.61 and a 200 day moving average of $197.22. The stock has a market capitalization of $6.97 billion, a P/E ratio of 25.03, a P/E/G ratio of 3.04 and a beta of 0.90.

Institutional Trading of Watts Water Technologies

A number of institutional investors have recently modified their holdings of WTS. HWG Holdings LP acquired a new position in Watts Water Technologies during the 2nd quarter valued at about $28,000. V Square Quantitative Management LLC acquired a new stake in shares of Watts Water Technologies during the third quarter worth about $30,000. Gradient Investments LLC purchased a new stake in Watts Water Technologies in the second quarter valued at approximately $31,000. Blue Trust Inc. raised its holdings in shares of Watts Water Technologies by 520.5% during the second quarter. Blue Trust Inc. now owns 273 shares of the technology company's stock worth $50,000 after purchasing an additional 229 shares during the last quarter. Finally, EntryPoint Capital LLC purchased a new position in Watts Water Technologies during the first quarter valued at approximately $53,000. 95.02% of the stock is currently owned by institutional investors.

Insider Buying and Selling

In other news, CEO Robert J. Pagano, Jr. sold 20,810 shares of the company's stock in a transaction that occurred on Wednesday, November 6th. The stock was sold at an average price of $212.20, for a total transaction of $4,415,882.00. Following the transaction, the chief executive officer now owns 176,045 shares of the company's stock, valued at approximately $37,356,749. This represents a 0.00 % decrease in their ownership of the stock. The transaction was disclosed in a filing with the SEC, which can be accessed through this link. In other Watts Water Technologies news, CEO Robert J. Pagano, Jr. sold 20,810 shares of the firm's stock in a transaction on Wednesday, November 6th. The stock was sold at an average price of $212.20, for a total transaction of $4,415,882.00. Following the transaction, the chief executive officer now directly owns 176,045 shares in the company, valued at $37,356,749. This trade represents a 0.00 % decrease in their position. The transaction was disclosed in a document filed with the SEC, which is available through the SEC website. Also, insider Elie Melhem sold 1,710 shares of the firm's stock in a transaction on Wednesday, August 21st. The shares were sold at an average price of $185.16, for a total value of $316,623.60. Following the transaction, the insider now owns 11,516 shares in the company, valued at approximately $2,132,302.56. This represents a 0.00 % decrease in their position. The disclosure for this sale can be found here. Insiders have sold 34,999 shares of company stock valued at $7,299,786 in the last ninety days. 1.10% of the stock is owned by company insiders.

Watts Water Technologies Announces Dividend

The company also recently announced a quarterly dividend, which will be paid on Friday, December 13th. Stockholders of record on Friday, November 29th will be issued a $0.43 dividend. The ex-dividend date of this dividend is Friday, November 29th. This represents a $1.72 annualized dividend and a dividend yield of 0.82%. Watts Water Technologies's dividend payout ratio (DPR) is presently 20.62%.

Watts Water Technologies Company Profile

(

Get Free Report)

Watts Water Technologies, Inc, together with its subsidiaries, supplies products and solutions that manage and conserve the flow of fluids and energy into, through, and out of buildings in the commercial, industrial, and residential markets in the Americas, Europe, the Asia-Pacific, the Middle East, and Africa.

Read More

Before you consider Watts Water Technologies, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Watts Water Technologies wasn't on the list.

While Watts Water Technologies currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking to generate income with your stock portfolio? Use these ten stocks to generate a safe and reliable source of investment income.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.