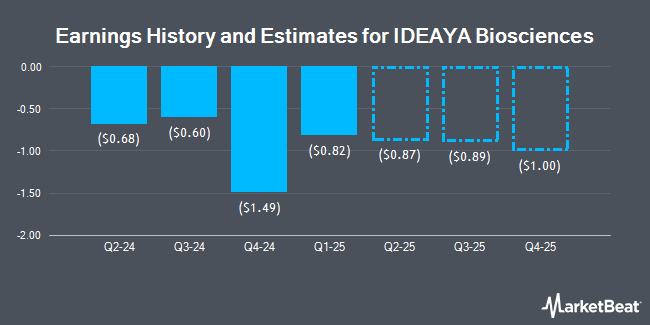

IDEAYA Biosciences, Inc. (NASDAQ:IDYA - Free Report) - Research analysts at Wedbush increased their FY2024 EPS estimates for IDEAYA Biosciences in a research note issued to investors on Monday, November 4th. Wedbush analyst R. Driscoll now forecasts that the company will earn ($2.40) per share for the year, up from their previous estimate of ($2.67). Wedbush currently has a "Outperform" rating and a $52.00 target price on the stock. The consensus estimate for IDEAYA Biosciences' current full-year earnings is ($2.51) per share. Wedbush also issued estimates for IDEAYA Biosciences' Q4 2024 earnings at ($0.63) EPS, Q1 2025 earnings at ($0.68) EPS, Q2 2025 earnings at ($0.72) EPS, Q3 2025 earnings at ($0.78) EPS, Q4 2025 earnings at ($0.82) EPS, FY2025 earnings at ($3.01) EPS, FY2026 earnings at ($3.40) EPS, FY2027 earnings at ($3.07) EPS and FY2028 earnings at ($1.59) EPS.

IDEAYA Biosciences (NASDAQ:IDYA - Get Free Report) last issued its earnings results on Monday, November 4th. The company reported ($0.60) earnings per share for the quarter, topping analysts' consensus estimates of ($0.63) by $0.03. During the same quarter last year, the firm earned ($0.46) EPS.

A number of other analysts have also recently weighed in on the stock. Royal Bank of Canada reaffirmed an "outperform" rating and issued a $61.00 price objective on shares of IDEAYA Biosciences in a report on Tuesday, September 24th. Leerink Partnrs cut shares of IDEAYA Biosciences from a "strong-buy" rating to a "hold" rating in a research note on Tuesday. UBS Group assumed coverage on shares of IDEAYA Biosciences in a research note on Thursday, October 24th. They set a "buy" rating and a $50.00 target price on the stock. JPMorgan Chase & Co. lowered their target price on shares of IDEAYA Biosciences from $69.00 to $66.00 and set an "overweight" rating on the stock in a research note on Thursday, August 8th. Finally, Oppenheimer reissued an "outperform" rating and set a $53.00 target price on shares of IDEAYA Biosciences in a research note on Tuesday, October 29th. Two research analysts have rated the stock with a hold rating, thirteen have issued a buy rating and one has assigned a strong buy rating to the company's stock. According to data from MarketBeat, the company has a consensus rating of "Moderate Buy" and an average price target of $53.08.

Read Our Latest Report on IDEAYA Biosciences

IDEAYA Biosciences Stock Down 1.4 %

Shares of NASDAQ:IDYA traded down $0.42 on Thursday, reaching $29.99. 505,714 shares of the company's stock were exchanged, compared to its average volume of 851,221. The firm has a market capitalization of $2.53 billion, a price-to-earnings ratio of -12.87 and a beta of 0.86. IDEAYA Biosciences has a fifty-two week low of $27.52 and a fifty-two week high of $47.74. The business's 50-day moving average is $32.57 and its two-hundred day moving average is $36.79.

Hedge Funds Weigh In On IDEAYA Biosciences

Several institutional investors have recently modified their holdings of the stock. Allworth Financial LP grew its position in shares of IDEAYA Biosciences by 800.0% in the 3rd quarter. Allworth Financial LP now owns 900 shares of the company's stock valued at $29,000 after purchasing an additional 800 shares during the period. Covestor Ltd boosted its position in IDEAYA Biosciences by 23,050.0% during the 3rd quarter. Covestor Ltd now owns 926 shares of the company's stock worth $29,000 after acquiring an additional 922 shares during the last quarter. Quest Partners LLC acquired a new position in IDEAYA Biosciences during the 2nd quarter worth approximately $41,000. US Bancorp DE boosted its position in IDEAYA Biosciences by 67.2% during the 3rd quarter. US Bancorp DE now owns 1,714 shares of the company's stock worth $54,000 after acquiring an additional 689 shares during the last quarter. Finally, Comerica Bank boosted its position in IDEAYA Biosciences by 723.5% during the 1st quarter. Comerica Bank now owns 1,507 shares of the company's stock worth $66,000 after acquiring an additional 1,324 shares during the last quarter. 98.29% of the stock is currently owned by institutional investors and hedge funds.

About IDEAYA Biosciences

(

Get Free Report)

IDEAYA Biosciences, Inc, a synthetic lethality-focused precision medicine oncology company, discovers and develops targeted therapeutics for patient populations selected using molecular diagnostics in the United States. The company's products in development include IDE196, a protein kinase C inhibitor that is in Phase 2/3 clinical trials for genetically defined cancers having GNAQ or GNA11 gene mutations; IDE397, a methionine adenosyltransferase 2a inhibitor that is in Phase 1/2 clinical trials for patients with solid tumors having methylthioadenosine phosphorylase gene deletions, such as non-small cell lung, bladder, gastric, and esophageal cancers; IDE161, a poly ADP-ribose glycohydrolase inhibitor that is in Phase 1 clinical trial to treat tumors with homologous recombination deficiency (HRD), and other genetic or molecular signatures; GSK101, a Pol Theta Helicase inhibitor that is in Phase 1 clinical trial for the treatment of tumors with BRCA or other homologous recombination, and HRD mutations; and Werner Helicase inhibitors for tumors with high microsatellite instability.

Featured Articles

Before you consider IDEAYA Biosciences, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and IDEAYA Biosciences wasn't on the list.

While IDEAYA Biosciences currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's guide to investing in electric vehicle technologies (EV) and which EV stocks show the most promise.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.