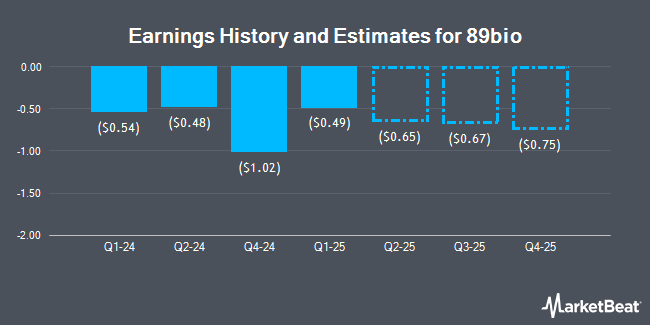

89bio, Inc. (NASDAQ:ETNB - Free Report) - Equities research analysts at Cantor Fitzgerald reduced their FY2024 earnings per share (EPS) estimates for 89bio in a research note issued to investors on Monday, November 11th. Cantor Fitzgerald analyst K. Kluska now anticipates that the company will earn ($2.98) per share for the year, down from their previous forecast of ($2.78). Cantor Fitzgerald currently has a "Overweight" rating and a $29.00 target price on the stock. The consensus estimate for 89bio's current full-year earnings is ($2.83) per share.

Other analysts have also recently issued research reports about the stock. Royal Bank of Canada reduced their price objective on shares of 89bio from $13.00 to $12.00 and set a "sector perform" rating on the stock in a research note on Tuesday, August 6th. HC Wainwright reaffirmed a "buy" rating and issued a $29.00 price objective on shares of 89bio in a research note on Monday. Finally, Raymond James decreased their target price on shares of 89bio from $53.00 to $49.00 and set a "strong-buy" rating for the company in a research report on Friday, November 8th. Two analysts have rated the stock with a hold rating, four have issued a buy rating and one has assigned a strong buy rating to the company. According to MarketBeat.com, the company presently has a consensus rating of "Moderate Buy" and an average price target of $30.33.

View Our Latest Analysis on 89bio

89bio Trading Up 0.1 %

ETNB traded up $0.01 during trading on Thursday, reaching $8.93. 463,829 shares of the company's stock were exchanged, compared to its average volume of 946,327. The firm has a fifty day moving average price of $8.20 and a two-hundred day moving average price of $8.42. The stock has a market capitalization of $947.74 million, a PE ratio of -3.06 and a beta of 1.07. 89bio has a one year low of $7.00 and a one year high of $16.63. The company has a current ratio of 11.66, a quick ratio of 11.66 and a debt-to-equity ratio of 0.09.

Hedge Funds Weigh In On 89bio

Several institutional investors have recently added to or reduced their stakes in ETNB. Swiss National Bank raised its holdings in shares of 89bio by 3.1% during the first quarter. Swiss National Bank now owns 147,200 shares of the company's stock valued at $1,713,000 after purchasing an additional 4,400 shares during the period. ProShare Advisors LLC boosted its holdings in 89bio by 34.5% in the first quarter. ProShare Advisors LLC now owns 20,737 shares of the company's stock worth $241,000 after acquiring an additional 5,319 shares in the last quarter. Westfield Capital Management Co. LP grew its stake in 89bio by 22.9% in the first quarter. Westfield Capital Management Co. LP now owns 2,164,147 shares of the company's stock valued at $25,191,000 after acquiring an additional 402,999 shares during the period. Vanguard Group Inc. raised its position in shares of 89bio by 9.6% during the first quarter. Vanguard Group Inc. now owns 4,722,971 shares of the company's stock worth $54,975,000 after purchasing an additional 415,386 shares during the period. Finally, Ameritas Investment Partners Inc. lifted its holdings in shares of 89bio by 28.4% in the 1st quarter. Ameritas Investment Partners Inc. now owns 7,886 shares of the company's stock worth $92,000 after purchasing an additional 1,744 shares in the last quarter.

89bio Company Profile

(

Get Free Report)

89bio, Inc, a clinical-stage biopharmaceutical company, focuses on the development and commercialization of therapies for the treatment of liver and cardio-metabolic diseases. Its lead product candidate is pegozafermin, a glycoPEGylated analog of fibroblast growth factor 21 for the treatment of nonalcoholic steatohepatitis; and for the treatment of severe hypertriglyceridemia.

Featured Stories

Before you consider 89bio, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and 89bio wasn't on the list.

While 89bio currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Market downturns give many investors pause, and for good reason. Wondering how to offset this risk? Click the link below to learn more about using beta to protect yourself.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.