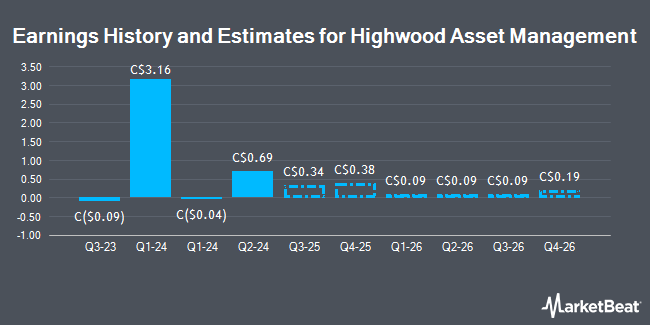

Highwood Asset Management Ltd. (CVE:HAM - Free Report) - Equities research analysts at Ventum Cap Mkts boosted their FY2024 EPS estimates for Highwood Asset Management in a research note issued on Wednesday, March 12th. Ventum Cap Mkts analyst A. Gill now expects that the company will post earnings per share of $1.93 for the year, up from their prior estimate of $1.70. The consensus estimate for Highwood Asset Management's current full-year earnings is $1.78 per share. Ventum Cap Mkts also issued estimates for Highwood Asset Management's Q1 2025 earnings at $0.30 EPS.

Highwood Asset Management Price Performance

Shares of HAM stock traded up C$0.15 on Thursday, hitting C$5.65. The stock had a trading volume of 7,100 shares, compared to its average volume of 7,208. The business has a 50 day moving average of C$5.83 and a 200 day moving average of C$5.85. Highwood Asset Management has a 12-month low of C$4.85 and a 12-month high of C$7.59. The stock has a market cap of C$83.85 million, a price-to-earnings ratio of 1.04 and a beta of -0.90.

Insider Buying and Selling

In other news, Director Raymond Kwan bought 11,900 shares of the stock in a transaction on Thursday, December 19th. The shares were purchased at an average cost of C$5.75 per share, for a total transaction of C$68,425.00. 54.00% of the stock is currently owned by corporate insiders.

Highwood Asset Management Company Profile

(

Get Free Report)

Highwood Asset Management Ltd., together with its subsidiary, engages in the acquisition, exploration, development, and production of oil and gas reserves in the Western Canadian Sedimentary basin. The company operates through Metallic Minerals, Midstream Operations, and Upstream Operations segments.

Featured Articles

Before you consider Highwood Asset Management, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Highwood Asset Management wasn't on the list.

While Highwood Asset Management currently has a Strong Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's list of seven best retirement stocks and why they should be in your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.