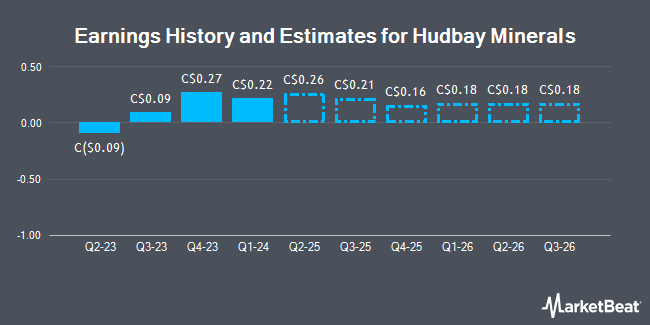

Hudbay Minerals Inc. (TSE:HBM - Free Report) NYSE: HBM - Scotiabank lifted their FY2024 earnings estimates for Hudbay Minerals in a note issued to investors on Wednesday, January 8th. Scotiabank analyst O. Wowkodaw now forecasts that the mining company will post earnings per share of $0.73 for the year, up from their prior estimate of $0.66. Scotiabank currently has a "Outperform" rating and a $15.00 target price on the stock. The consensus estimate for Hudbay Minerals' current full-year earnings is $1.12 per share. Scotiabank also issued estimates for Hudbay Minerals' FY2025 earnings at $1.10 EPS.

Several other equities research analysts also recently weighed in on the stock. Jefferies Financial Group increased their target price on shares of Hudbay Minerals from C$14.00 to C$15.00 in a research note on Friday, October 4th. National Bankshares increased their price target on Hudbay Minerals from C$15.50 to C$16.75 and gave the stock an "outperform" rating in a report on Tuesday, October 15th. Twelve equities research analysts have rated the stock with a buy rating and two have given a strong buy rating to the company's stock. Based on data from MarketBeat.com, Hudbay Minerals currently has an average rating of "Buy" and a consensus target price of C$15.54.

View Our Latest Report on HBM

Hudbay Minerals Stock Performance

TSE:HBM traded up C$0.27 during trading hours on Thursday, reaching C$12.96. 522,992 shares of the company's stock were exchanged, compared to its average volume of 1,307,439. The company has a quick ratio of 0.85, a current ratio of 1.87 and a debt-to-equity ratio of 49.37. The firm has a market capitalization of C$5.10 billion, a price-to-earnings ratio of 35.03, a P/E/G ratio of 3.97 and a beta of 1.83. Hudbay Minerals has a 1-year low of C$6.72 and a 1-year high of C$14.33. The company has a 50-day moving average of C$12.38 and a 200 day moving average of C$11.83.

Insider Buying and Selling

In other Hudbay Minerals news, Senior Officer Robert Alan Carter sold 8,014 shares of the firm's stock in a transaction dated Tuesday, December 10th. The shares were sold at an average price of C$13.24, for a total transaction of C$106,105.36. Insiders own 0.07% of the company's stock.

Hudbay Minerals Company Profile

(

Get Free Report)

Hudbay Minerals Inc, a diversified mining company, focuses on the exploration, development, operation, and optimization of properties in North and South America. It produces copper concentrates containing gold, silver, and molybdenum; gold concentrates containing zinc; zinc concentrates; molybdenum concentrates; and silver/gold doré.

See Also

Before you consider Hudbay Minerals, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Hudbay Minerals wasn't on the list.

While Hudbay Minerals currently has a "Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering where to start (or end) with AI stocks? These 10 simple stocks can help investors build long-term wealth as artificial intelligence continues to grow into the future.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.