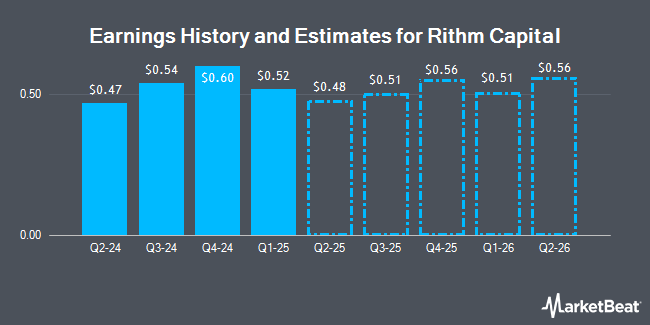

Rithm Capital Corp. (NYSE:RITM - Free Report) - Analysts at B. Riley upped their FY2024 EPS estimates for shares of Rithm Capital in a research note issued to investors on Monday, December 16th. B. Riley analyst M. Howlett now anticipates that the real estate investment trust will post earnings per share of $1.96 for the year, up from their prior forecast of $1.88. The consensus estimate for Rithm Capital's current full-year earnings is $1.93 per share.

Rithm Capital (NYSE:RITM - Get Free Report) last announced its quarterly earnings data on Tuesday, October 29th. The real estate investment trust reported $0.54 EPS for the quarter, beating the consensus estimate of $0.42 by $0.12. The company had revenue of $619.51 million for the quarter, compared to the consensus estimate of $1.11 billion. Rithm Capital had a net margin of 14.99% and a return on equity of 17.54%. During the same period in the prior year, the firm posted $0.58 EPS.

Other equities analysts have also recently issued reports about the company. Royal Bank of Canada reaffirmed an "outperform" rating and issued a $13.00 price objective on shares of Rithm Capital in a research report on Thursday, November 21st. Keefe, Bruyette & Woods increased their price objective on Rithm Capital from $13.00 to $13.50 and gave the company an "outperform" rating in a research report on Tuesday, December 3rd. Finally, Wedbush reissued an "outperform" rating and issued a $14.00 target price on shares of Rithm Capital in a research report on Thursday, November 7th. One analyst has rated the stock with a hold rating and seven have given a buy rating to the company. Based on data from MarketBeat, Rithm Capital has a consensus rating of "Moderate Buy" and a consensus price target of $12.94.

Read Our Latest Analysis on RITM

Rithm Capital Stock Down 3.2 %

Shares of NYSE:RITM traded down $0.35 during trading on Wednesday, reaching $10.70. 4,129,193 shares of the stock traded hands, compared to its average volume of 3,500,183. The stock has a market cap of $5.56 billion, a P/E ratio of 10.81 and a beta of 1.80. The company has a debt-to-equity ratio of 1.63, a quick ratio of 1.35 and a current ratio of 1.35. The stock has a 50-day moving average of $10.84 and a two-hundred day moving average of $11.12. Rithm Capital has a 52-week low of $9.97 and a 52-week high of $12.02.

Rithm Capital Announces Dividend

The company also recently disclosed a quarterly dividend, which will be paid on Friday, January 31st. Investors of record on Tuesday, December 31st will be given a dividend of $0.25 per share. This represents a $1.00 dividend on an annualized basis and a yield of 9.35%. The ex-dividend date is Tuesday, December 31st. Rithm Capital's dividend payout ratio (DPR) is presently 101.01%.

Hedge Funds Weigh In On Rithm Capital

Institutional investors and hedge funds have recently made changes to their positions in the business. Charles Schwab Investment Management Inc. lifted its position in Rithm Capital by 7.3% during the third quarter. Charles Schwab Investment Management Inc. now owns 5,364,962 shares of the real estate investment trust's stock valued at $60,892,000 after purchasing an additional 366,600 shares in the last quarter. Van ECK Associates Corp lifted its position in shares of Rithm Capital by 20.7% during the 3rd quarter. Van ECK Associates Corp now owns 2,004,057 shares of the real estate investment trust's stock valued at $21,163,000 after buying an additional 343,678 shares in the last quarter. Neo Ivy Capital Management bought a new position in shares of Rithm Capital during the 3rd quarter valued at approximately $1,476,000. Waterfall Asset Management LLC purchased a new stake in Rithm Capital in the 2nd quarter worth approximately $2,209,000. Finally, SG Americas Securities LLC bought a new stake in Rithm Capital during the 3rd quarter worth approximately $4,112,000. Hedge funds and other institutional investors own 44.92% of the company's stock.

Rithm Capital Company Profile

(

Get Free Report)

Rithm Capital Corp. operates as an asset manager focused on real estate, credit, and financial services. It operates through Origination and Servicing, Investment Portfolio, Mortgage Loans Receivable, and Asset Management segments. Its investment portfolio primarily comprises of mortgage servicing rights (MSR), and MSR financing receivables, title, appraisal and property preservation, excess MSRs, and services advance investments; real estate securities, call rights, SFR properties, and residential mortgage loans; consumer and business purpose loans; and asset management related investments.

Featured Articles

Before you consider Rithm Capital, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Rithm Capital wasn't on the list.

While Rithm Capital currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Discover the next wave of investment opportunities with our report, 7 Stocks That Will Be Magnificent in 2025. Explore companies poised to replicate the growth, innovation, and value creation of the tech giants dominating today's markets.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.