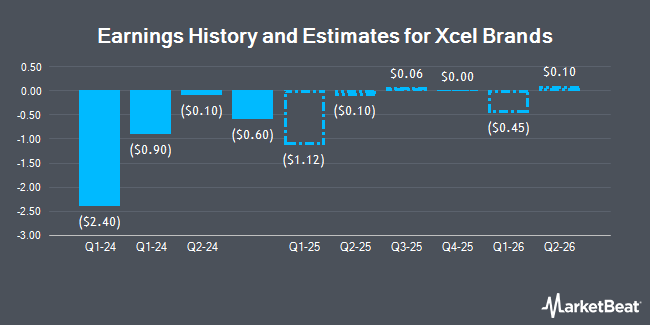

Xcel Brands, Inc. (NASDAQ:XELB - Free Report) - Investment analysts at Sidoti Csr lowered their FY2024 EPS estimates for shares of Xcel Brands in a research note issued on Tuesday, March 25th. Sidoti Csr analyst A. Lebiedzinski now anticipates that the textile maker will post earnings per share of ($2.37) for the year, down from their previous forecast of ($2.30). The consensus estimate for Xcel Brands' current full-year earnings is ($0.23) per share. Sidoti Csr also issued estimates for Xcel Brands' Q4 2024 earnings at ($0.82) EPS, Q1 2025 earnings at ($0.55) EPS, Q2 2025 earnings at ($0.06) EPS, Q3 2025 earnings at $0.06 EPS, FY2025 earnings at ($0.55) EPS, Q1 2026 earnings at ($0.45) EPS, Q2 2026 earnings at $0.15 EPS, Q3 2026 earnings at $0.53 EPS and Q4 2026 earnings at $0.56 EPS.

A number of other research firms have also commented on XELB. Sidoti raised shares of Xcel Brands to a "hold" rating in a research report on Friday, January 31st. StockNews.com assumed coverage on Xcel Brands in a research report on Monday. They issued a "sell" rating for the company.

Get Our Latest Research Report on XELB

Xcel Brands Stock Up 6.4 %

XELB traded up $0.18 during midday trading on Friday, hitting $3.00. 75,815 shares of the company's stock traded hands, compared to its average volume of 7,663. The company has a market cap of $7.12 million, a PE ratio of -2.91 and a beta of 1.38. The stock's fifty day simple moving average is $3.57 and its 200-day simple moving average is $5.52. The company has a debt-to-equity ratio of 0.09, a current ratio of 0.52 and a quick ratio of 0.52. Xcel Brands has a one year low of $2.50 and a one year high of $9.97.

Institutional Investors Weigh In On Xcel Brands

A hedge fund recently raised its stake in Xcel Brands stock. Summit Trail Advisors LLC lifted its stake in Xcel Brands, Inc. (NASDAQ:XELB - Free Report) by 9.4% during the 4th quarter, according to its most recent 13F filing with the Securities & Exchange Commission. The fund owned 2,452,593 shares of the textile maker's stock after purchasing an additional 210,000 shares during the period. Summit Trail Advisors LLC owned 10.37% of Xcel Brands worth $1,248,000 at the end of the most recent quarter. 18.55% of the stock is owned by hedge funds and other institutional investors.

About Xcel Brands

(

Get Free Report)

Xcel Brands, Inc, together with its subsidiaries, operates as a media and consumer products company in the United States. The company designs, produces, markets, wholesales, and sells branded apparel, footwear, accessories, jewelry, home goods, and other consumer products; and acquires consumer lifestyle brands, including the Isaac Mizrahi, the LOGO by Lori Goldstein, the Judith Ripka, the Halston brand, the C Wonder, the TowerHill by Christie Brinkley brand (the CB brand), and other brands, as well as manages the Longaberger brand.

Featured Stories

Before you consider Xcel Brands, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Xcel Brands wasn't on the list.

While Xcel Brands currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Nuclear energy stocks are roaring. It's the hottest energy sector of the year. Cameco Corp, Paladin Energy, and BWX Technologies were all up more than 40% in 2024. The biggest market moves could still be ahead of us, and there are seven nuclear energy stocks that could rise much higher in the next several months. To unlock these tickers, enter your email address below.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.