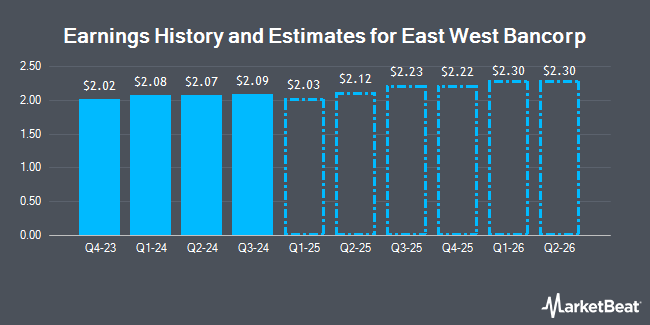

East West Bancorp, Inc. (NASDAQ:EWBC - Free Report) - Zacks Research increased their FY2024 earnings per share estimates for East West Bancorp in a report released on Monday, November 25th. Zacks Research analyst R. Department now forecasts that the financial services provider will post earnings of $8.29 per share for the year, up from their prior forecast of $8.22. The consensus estimate for East West Bancorp's current full-year earnings is $8.37 per share. Zacks Research also issued estimates for East West Bancorp's Q4 2024 earnings at $2.06 EPS, Q1 2025 earnings at $2.02 EPS, Q2 2025 earnings at $2.11 EPS, Q3 2025 earnings at $2.18 EPS, Q4 2025 earnings at $2.27 EPS, FY2025 earnings at $8.57 EPS, Q1 2026 earnings at $2.23 EPS, Q2 2026 earnings at $2.26 EPS and FY2026 earnings at $9.30 EPS.

EWBC has been the subject of several other research reports. Wedbush upped their price target on East West Bancorp from $100.00 to $110.00 and gave the company an "outperform" rating in a report on Wednesday, October 23rd. Truist Financial upped their target price on East West Bancorp from $93.00 to $101.00 and gave the company a "buy" rating in a research note on Wednesday, October 23rd. Piper Sandler lifted their price target on shares of East West Bancorp from $87.00 to $95.00 and gave the stock a "neutral" rating in a research note on Wednesday, October 23rd. StockNews.com upgraded shares of East West Bancorp from a "sell" rating to a "hold" rating in a research note on Tuesday, October 29th. Finally, Stephens lifted their target price on shares of East West Bancorp from $91.00 to $104.00 and gave the company an "overweight" rating in a research report on Thursday, October 24th. Two analysts have rated the stock with a hold rating and eleven have issued a buy rating to the stock. According to MarketBeat.com, the company presently has a consensus rating of "Moderate Buy" and an average price target of $102.25.

Check Out Our Latest Report on East West Bancorp

East West Bancorp Stock Performance

Shares of NASDAQ EWBC traded up $0.20 during mid-day trading on Wednesday, hitting $110.05. The company had a trading volume of 527,051 shares, compared to its average volume of 928,067. East West Bancorp has a 12 month low of $60.34 and a 12 month high of $113.95. The firm has a market cap of $15.26 billion, a P/E ratio of 13.87, a PEG ratio of 3.23 and a beta of 1.27. The business's 50-day simple moving average is $93.60 and its 200-day simple moving average is $83.03. The company has a debt-to-equity ratio of 0.46, a current ratio of 0.92 and a quick ratio of 0.92.

East West Bancorp (NASDAQ:EWBC - Get Free Report) last issued its quarterly earnings results on Tuesday, October 22nd. The financial services provider reported $2.09 earnings per share for the quarter, beating analysts' consensus estimates of $2.06 by $0.03. The firm had revenue of $1.16 billion during the quarter, compared to the consensus estimate of $641.80 million. East West Bancorp had a net margin of 24.96% and a return on equity of 16.07%. During the same period in the prior year, the firm earned $2.02 EPS.

Institutional Inflows and Outflows

Large investors have recently bought and sold shares of the company. Capital Performance Advisors LLP bought a new stake in shares of East West Bancorp during the third quarter worth $25,000. Wilmington Savings Fund Society FSB bought a new stake in East West Bancorp during the 3rd quarter worth about $26,000. Cullen Frost Bankers Inc. acquired a new position in East West Bancorp during the 2nd quarter valued at about $30,000. UMB Bank n.a. boosted its stake in shares of East West Bancorp by 362.8% in the 3rd quarter. UMB Bank n.a. now owns 361 shares of the financial services provider's stock valued at $30,000 after purchasing an additional 283 shares during the last quarter. Finally, American Capital Advisory LLC acquired a new stake in shares of East West Bancorp during the 2nd quarter worth approximately $31,000. Institutional investors and hedge funds own 89.53% of the company's stock.

Insider Activity

In other East West Bancorp news, Vice Chairman Douglas Paul Krause sold 12,000 shares of the stock in a transaction dated Tuesday, November 12th. The shares were sold at an average price of $106.61, for a total transaction of $1,279,320.00. Following the sale, the insider now owns 45,403 shares of the company's stock, valued at $4,840,413.83. This represents a 20.90 % decrease in their position. The sale was disclosed in a legal filing with the Securities & Exchange Commission, which can be accessed through this hyperlink. Also, Director Rudolph Estrada sold 469 shares of the firm's stock in a transaction dated Tuesday, November 5th. The shares were sold at an average price of $98.04, for a total transaction of $45,980.76. Following the completion of the sale, the director now owns 17,750 shares of the company's stock, valued at $1,740,210. The trade was a 2.57 % decrease in their position. The disclosure for this sale can be found here. Over the last 90 days, insiders sold 23,969 shares of company stock worth $2,458,276. Insiders own 1.04% of the company's stock.

East West Bancorp Dividend Announcement

The company also recently disclosed a quarterly dividend, which was paid on Friday, November 15th. Stockholders of record on Monday, November 4th were issued a dividend of $0.55 per share. This represents a $2.20 annualized dividend and a dividend yield of 2.00%. The ex-dividend date of this dividend was Monday, November 4th. East West Bancorp's payout ratio is 27.78%.

About East West Bancorp

(

Get Free Report)

East West Bancorp, Inc operates as the bank holding company for East West Bank that provides a range of personal and commercial banking services to businesses and individuals in the United States. The company operates through three segments: Consumer and Business Banking, Commercial Banking, and Other.

Read More

Before you consider East West Bancorp, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and East West Bancorp wasn't on the list.

While East West Bancorp currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

As the AI market heats up, investors who have a vision for artificial intelligence have the potential to see real returns. Learn about the industry as a whole as well as seven companies that are getting work done with the power of AI.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.