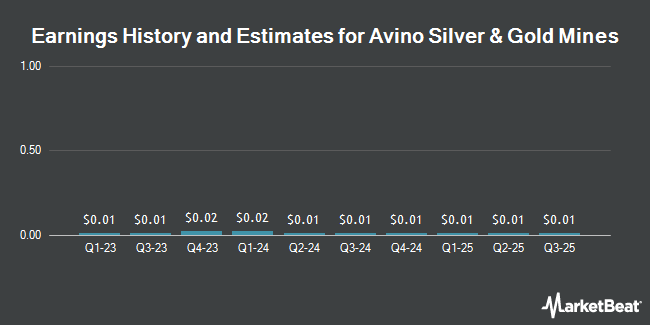

Avino Silver & Gold Mines Ltd. (NYSE:ASM - Free Report) - Equities researchers at HC Wainwright increased their FY2025 earnings estimates for shares of Avino Silver & Gold Mines in a research report issued on Wednesday, November 13th. HC Wainwright analyst H. Ihle now forecasts that the company will post earnings of $0.08 per share for the year, up from their previous estimate of $0.07. HC Wainwright currently has a "Buy" rating and a $1.80 price target on the stock. The consensus estimate for Avino Silver & Gold Mines' current full-year earnings is $0.05 per share.

Avino Silver & Gold Mines (NYSE:ASM - Get Free Report) last announced its earnings results on Tuesday, August 13th. The company reported $0.03 earnings per share (EPS) for the quarter, topping analysts' consensus estimates of $0.02 by $0.01. Avino Silver & Gold Mines had a return on equity of 12.29% and a net margin of 6.57%. The firm had revenue of $14.79 million during the quarter, compared to analysts' expectations of $13.50 million.

Other equities research analysts have also recently issued reports about the stock. Roth Mkm restated a "buy" rating and set a $1.80 price target (down from $1.90) on shares of Avino Silver & Gold Mines in a report on Thursday. Alliance Global Partners upped their price target on Avino Silver & Gold Mines from $1.70 to $2.20 and gave the stock a "buy" rating in a report on Friday, October 18th.

Read Our Latest Report on ASM

Avino Silver & Gold Mines Stock Performance

Shares of NYSE ASM traded down $0.08 during trading hours on Friday, hitting $1.03. 13,262,770 shares of the stock were exchanged, compared to its average volume of 1,150,916. Avino Silver & Gold Mines has a one year low of $0.44 and a one year high of $1.56. The company's 50 day moving average is $1.28 and its 200 day moving average is $1.12. The company has a debt-to-equity ratio of 0.02, a current ratio of 2.11 and a quick ratio of 1.30. The firm has a market capitalization of $144.67 million, a P/E ratio of 51.53 and a beta of 1.97.

Institutional Inflows and Outflows

A number of large investors have recently modified their holdings of ASM. Rathbones Group PLC bought a new position in shares of Avino Silver & Gold Mines during the 2nd quarter worth about $135,000. Marshall Wace LLP acquired a new position in Avino Silver & Gold Mines in the second quarter worth about $165,000. Finally, Tidal Investments LLC bought a new position in Avino Silver & Gold Mines during the first quarter worth about $1,906,000. 3.11% of the stock is currently owned by institutional investors and hedge funds.

Avino Silver & Gold Mines Company Profile

(

Get Free Report)

Avino Silver & Gold Mines Ltd., together with its subsidiaries, engages in the acquisition, exploration, and advancement of mineral properties in Canada. It primarily explores for silver, gold, and copper deposits. The company owns interests in 42 mineral claims and four leased mineral claims, including Avino mine area property comprising four exploration concessions covering 154.4 hectares, 24 exploitation concessions covering 1,284.7 hectares, and one leased exploitation concession covering 98.83 hectares; Gomez Palacio property consists of nine exploration concessions covering 2,549 hectares; and Unification La Platosa properties, which include three leased concessions located in the state of Durango, Mexico.

Recommended Stories

Before you consider Avino Silver & Gold Mines, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Avino Silver & Gold Mines wasn't on the list.

While Avino Silver & Gold Mines currently has a "Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Unlock your free copy of MarketBeat's comprehensive guide to pot stock investing and discover which cannabis companies are poised for growth. Plus, you'll get exclusive access to our daily newsletter with expert stock recommendations from Wall Street's top analysts.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.