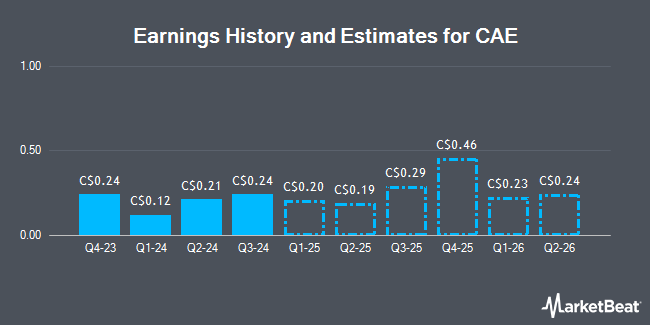

CAE Inc. (TSE:CAE - Free Report) NYSE: CAE - Equities researchers at Desjardins lifted their FY2025 EPS estimates for CAE in a note issued to investors on Wednesday, November 13th. Desjardins analyst B. Poirier now forecasts that the company will post earnings per share of $1.20 for the year, up from their previous estimate of $1.12. Desjardins also issued estimates for CAE's FY2027 earnings at $1.58 EPS.

A number of other research analysts also recently weighed in on CAE. CIBC raised their price objective on CAE from C$30.00 to C$33.00 in a research note on Thursday. Scotiabank lifted their price target on shares of CAE from C$30.00 to C$32.50 in a research report on Thursday. National Bankshares upped their price objective on shares of CAE from C$30.00 to C$34.00 in a report on Wednesday. Royal Bank of Canada lifted their target price on shares of CAE from C$27.00 to C$34.00 in a report on Thursday. Finally, TD Securities upped their price target on shares of CAE from C$33.00 to C$34.00 and gave the company a "buy" rating in a report on Thursday. One investment analyst has rated the stock with a sell rating, three have given a hold rating and four have issued a buy rating to the stock. According to data from MarketBeat, the company has a consensus rating of "Hold" and a consensus price target of C$32.35.

View Our Latest Stock Report on CAE

CAE Stock Down 0.8 %

TSE CAE traded down C$0.24 during trading on Friday, hitting C$30.67. 1,311,528 shares of the company traded hands, compared to its average volume of 632,255. The company has a market capitalization of C$9.78 billion, a P/E ratio of -28.66, a PEG ratio of 1.76 and a beta of 1.91. The business has a fifty day simple moving average of C$25.35 and a 200 day simple moving average of C$25.46. CAE has a 12 month low of C$22.28 and a 12 month high of C$31.08. The company has a current ratio of 0.89, a quick ratio of 0.71 and a debt-to-equity ratio of 74.24.

CAE (TSE:CAE - Get Free Report) NYSE: CAE last announced its quarterly earnings results on Tuesday, August 13th. The company reported C$0.21 EPS for the quarter, topping the consensus estimate of C$0.20 by C$0.01. CAE had a negative net margin of 7.39% and a negative return on equity of 7.43%. The company had revenue of C$1.07 billion for the quarter, compared to analyst estimates of C$1.05 billion.

CAE Company Profile

(

Get Free Report)

CAE Inc, together with its subsidiaries, provides simulation training and critical operations support solutions in Canada, the United States, the United Kingdom, Europe, Asia, Oceania and Africa, and Rest of Americas. It operates through three segments: Civil Aviation, Defense and Security, and Healthcare.

Recommended Stories

Before you consider CAE, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and CAE wasn't on the list.

While CAE currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat has just released its list of 20 stocks that Wall Street analysts hate. These companies may appear to have good fundamentals, but top analysts smell something seriously rotten. Are any of these companies lurking around your portfolio? Find out by clicking the link below.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.