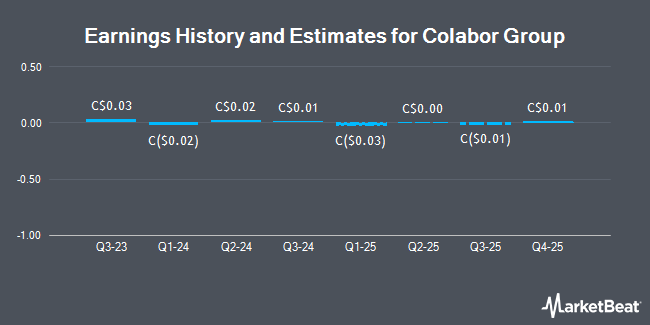

Colabor Group Inc. (TSE:GCL - Free Report) - Research analysts at Cormark decreased their FY2025 earnings per share estimates for Colabor Group in a report issued on Thursday, February 27th. Cormark analyst K. Mcphee now anticipates that the company will post earnings per share of $0.12 for the year, down from their previous forecast of $0.14. The consensus estimate for Colabor Group's current full-year earnings is $0.02 per share. Cormark also issued estimates for Colabor Group's FY2027 earnings at $0.25 EPS.

Separately, Desjardins increased their target price on shares of Colabor Group from C$1.85 to C$2.00 and gave the company a "buy" rating in a research note on Thursday, February 20th.

View Our Latest Analysis on GCL

Colabor Group Price Performance

Shares of TSE:GCL traded down C$0.01 during trading hours on Monday, hitting C$0.98. 4,055 shares of the company's stock traded hands, compared to its average volume of 124,720. The company's fifty day simple moving average is C$0.90 and its two-hundred day simple moving average is C$1.05. The company has a market cap of C$96.44 million, a price-to-earnings ratio of 107.74, a price-to-earnings-growth ratio of 0.61 and a beta of 0.83. The company has a debt-to-equity ratio of 153.61, a quick ratio of 0.76 and a current ratio of 1.62. Colabor Group has a 52 week low of C$0.79 and a 52 week high of C$1.52.

About Colabor Group

(

Get Free Report)

Colabor Group Inc, together with its subsidiaries, markets and distributes food and food-related products in Canada. It operates in two segments, Distribution and Wholesale. The Distribution segment offers frozen products, dry staples, dairy products, meat, seafood, fruits and vegetables, disposables, and sanitation products, as well as fish products.

Featured Articles

Before you consider Colabor Group, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Colabor Group wasn't on the list.

While Colabor Group currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Unlock the timeless value of gold with our exclusive 2025 Gold Forecasting Report. Explore why gold remains the ultimate investment for safeguarding wealth against inflation, economic shifts, and global uncertainties. Whether you're planning for future generations or seeking a reliable asset in turbulent times, this report is your essential guide to making informed decisions.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.