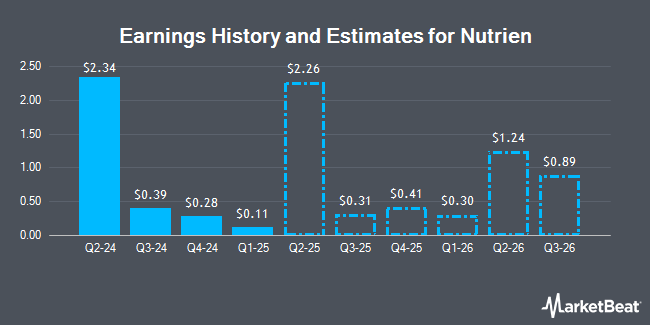

Nutrien Ltd. (NYSE:NTR - Free Report) - Equities research analysts at Raymond James boosted their FY2025 EPS estimates for Nutrien in a report released on Tuesday, December 3rd. Raymond James analyst S. Hansen now anticipates that the company will earn $3.62 per share for the year, up from their previous forecast of $3.51. Raymond James has a "Outperform" rating and a $60.00 price objective on the stock. The consensus estimate for Nutrien's current full-year earnings is $3.54 per share.

Nutrien (NYSE:NTR - Get Free Report) last announced its quarterly earnings results on Wednesday, November 6th. The company reported $0.39 EPS for the quarter, missing the consensus estimate of $0.43 by ($0.04). Nutrien had a return on equity of 6.99% and a net margin of 2.79%. The company had revenue of $5.35 billion for the quarter, compared to analyst estimates of $5.26 billion. During the same quarter in the prior year, the business earned $0.35 earnings per share. Nutrien's revenue was down 5.0% compared to the same quarter last year.

Other research analysts have also issued research reports about the company. Royal Bank of Canada reaffirmed an "outperform" rating and set a $60.00 price target on shares of Nutrien in a research report on Friday, September 20th. Wells Fargo & Company cut shares of Nutrien from an "overweight" rating to an "equal weight" rating and cut their target price for the company from $62.00 to $50.00 in a report on Tuesday, September 24th. The Goldman Sachs Group cut shares of Nutrien from a "buy" rating to a "neutral" rating and decreased their price target for the stock from $69.00 to $53.00 in a research note on Tuesday, September 10th. Barclays dropped their price objective on shares of Nutrien from $68.00 to $55.00 and set an "overweight" rating on the stock in a research note on Friday, August 16th. Finally, TD Securities decreased their target price on shares of Nutrien from $63.00 to $61.00 and set a "buy" rating for the company in a research note on Tuesday, November 12th. Three analysts have rated the stock with a sell rating, four have assigned a hold rating and eleven have issued a buy rating to the company's stock. According to MarketBeat, the company currently has a consensus rating of "Hold" and an average target price of $60.06.

Check Out Our Latest Report on NTR

Nutrien Stock Performance

Shares of NTR traded down $0.15 during midday trading on Friday, reaching $47.93. 1,544,052 shares of the stock were exchanged, compared to its average volume of 1,993,113. Nutrien has a twelve month low of $44.65 and a twelve month high of $60.87. The company has a debt-to-equity ratio of 0.38, a current ratio of 1.27 and a quick ratio of 0.82. The company has a market capitalization of $23.67 billion, a price-to-earnings ratio of 32.17, a PEG ratio of 1.70 and a beta of 0.80. The business's 50-day moving average price is $47.96 and its 200 day moving average price is $49.56.

Nutrien Increases Dividend

The business also recently disclosed a quarterly dividend, which will be paid on Friday, January 17th. Investors of record on Tuesday, December 31st will be paid a $0.939 dividend. This is a boost from Nutrien's previous quarterly dividend of $0.54. The ex-dividend date of this dividend is Tuesday, December 31st. This represents a $3.76 annualized dividend and a dividend yield of 7.84%. Nutrien's dividend payout ratio (DPR) is 144.97%.

Institutional Trading of Nutrien

A number of institutional investors have recently added to or reduced their stakes in the stock. Wilmington Savings Fund Society FSB purchased a new stake in shares of Nutrien during the 3rd quarter worth approximately $2,237,000. Virtu Financial LLC acquired a new position in Nutrien during the third quarter worth $815,000. TD Private Client Wealth LLC boosted its position in Nutrien by 4.1% during the third quarter. TD Private Client Wealth LLC now owns 43,610 shares of the company's stock worth $2,098,000 after purchasing an additional 1,717 shares in the last quarter. Toronto Dominion Bank grew its holdings in Nutrien by 11.9% in the third quarter. Toronto Dominion Bank now owns 4,220,354 shares of the company's stock valued at $202,830,000 after purchasing an additional 447,413 shares during the last quarter. Finally, Geode Capital Management LLC increased its position in shares of Nutrien by 9.4% in the third quarter. Geode Capital Management LLC now owns 2,319,603 shares of the company's stock valued at $112,454,000 after buying an additional 198,620 shares in the last quarter. Hedge funds and other institutional investors own 63.10% of the company's stock.

Nutrien Company Profile

(

Get Free Report)

Nutrien Ltd. provides crop inputs and services. The company operates through four segments: Retail, Potash, Nitrogen, and Phosphate. The Retail segment distributes crop nutrients, crop protection products, seeds, and merchandise products. The Potash segment provides granular and standard potash products.

See Also

Before you consider Nutrien, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Nutrien wasn't on the list.

While Nutrien currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

If a company's CEO, COO, and CFO were all selling shares of their stock, would you want to know?

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.