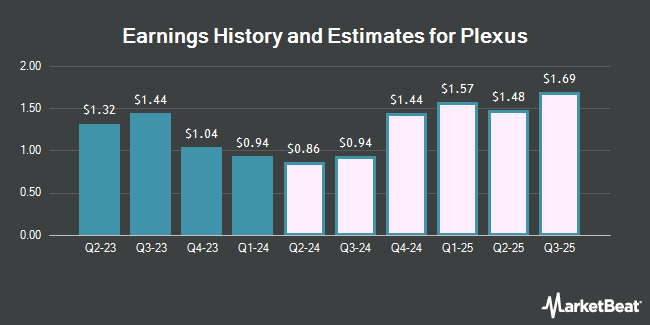

Plexus Corp. (NASDAQ:PLXS - Free Report) - Zacks Research raised their FY2025 EPS estimates for shares of Plexus in a note issued to investors on Monday, November 18th. Zacks Research analyst V. Doshi now forecasts that the technology company will post earnings per share of $6.07 for the year, up from their previous forecast of $6.06. The consensus estimate for Plexus' current full-year earnings is $6.13 per share. Zacks Research also issued estimates for Plexus' Q4 2025 earnings at $1.70 EPS, Q1 2026 earnings at $1.62 EPS, Q3 2026 earnings at $1.86 EPS and FY2027 earnings at $8.03 EPS.

Plexus (NASDAQ:PLXS - Get Free Report) last posted its quarterly earnings data on Wednesday, October 23rd. The technology company reported $1.85 earnings per share for the quarter, beating analysts' consensus estimates of $1.55 by $0.30. The business had revenue of $1.05 billion during the quarter, compared to the consensus estimate of $1.01 billion. Plexus had a return on equity of 9.51% and a net margin of 2.82%. Plexus's quarterly revenue was up 2.6% on a year-over-year basis. During the same period in the prior year, the business posted $1.44 earnings per share.

Several other research firms also recently weighed in on PLXS. StockNews.com raised shares of Plexus from a "hold" rating to a "buy" rating in a research note on Monday. Needham & Company LLC upped their price target on Plexus from $144.00 to $162.00 and gave the stock a "buy" rating in a research note on Friday, October 25th. KeyCorp assumed coverage on Plexus in a research note on Tuesday, October 22nd. They issued a "sector weight" rating for the company. Finally, Benchmark upped their target price on Plexus from $150.00 to $165.00 and gave the stock a "buy" rating in a research report on Monday, October 28th. Three analysts have rated the stock with a hold rating and three have issued a buy rating to the company. Based on data from MarketBeat, the company currently has a consensus rating of "Moderate Buy" and an average target price of $133.50.

Check Out Our Latest Stock Report on PLXS

Plexus Stock Down 0.7 %

Shares of Plexus stock opened at $156.65 on Thursday. The firm has a market cap of $4.24 billion, a price-to-earnings ratio of 39.06 and a beta of 0.87. The stock's 50-day moving average is $141.58 and its 200 day moving average is $123.42. The company has a debt-to-equity ratio of 0.07, a current ratio of 1.51 and a quick ratio of 0.71. Plexus has a one year low of $90.18 and a one year high of $169.41.

Hedge Funds Weigh In On Plexus

A number of institutional investors have recently bought and sold shares of the stock. Quarry LP raised its position in shares of Plexus by 573.5% in the 3rd quarter. Quarry LP now owns 229 shares of the technology company's stock worth $31,000 after acquiring an additional 195 shares in the last quarter. Quest Partners LLC raised its holdings in Plexus by 36,700.0% in the second quarter. Quest Partners LLC now owns 368 shares of the technology company's stock worth $38,000 after purchasing an additional 367 shares in the last quarter. Innealta Capital LLC bought a new position in Plexus in the second quarter worth $51,000. Point72 DIFC Ltd purchased a new stake in shares of Plexus in the 3rd quarter worth about $51,000. Finally, Point72 Asia Singapore Pte. Ltd. purchased a new stake in shares of Plexus in the 3rd quarter worth about $55,000. 94.45% of the stock is owned by institutional investors.

Insiders Place Their Bets

In other news, insider Michael J. Running sold 579 shares of the stock in a transaction dated Thursday, November 14th. The shares were sold at an average price of $153.93, for a total transaction of $89,125.47. Following the completion of the sale, the insider now directly owns 1,569 shares in the company, valued at approximately $241,516.17. This represents a 26.96 % decrease in their ownership of the stock. The transaction was disclosed in a document filed with the SEC, which is accessible through this hyperlink. Also, insider Victor (Pang Hau) Tan sold 1,000 shares of the stock in a transaction that occurred on Wednesday, August 28th. The stock was sold at an average price of $127.50, for a total value of $127,500.00. Following the completion of the sale, the insider now owns 8,605 shares of the company's stock, valued at approximately $1,097,137.50. This trade represents a 10.41 % decrease in their position. The disclosure for this sale can be found here. Over the last ninety days, insiders have sold 33,552 shares of company stock valued at $5,250,872. 2.39% of the stock is currently owned by corporate insiders.

Plexus Company Profile

(

Get Free Report)

Plexus Corp. provides electronic manufacturing services in the United States and internationally. It offers design, develop, supply chain, new product introduction, and manufacturing solutions, as well as sustaining services to companies in the healthcare/life sciences, industrial/commercial, aerospace/defense, and communications market sectors.

Featured Articles

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Plexus, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Plexus wasn't on the list.

While Plexus currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering where to start (or end) with AI stocks? These 10 simple stocks can help investors build long-term wealth as artificial intelligence continues to grow into the future.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.