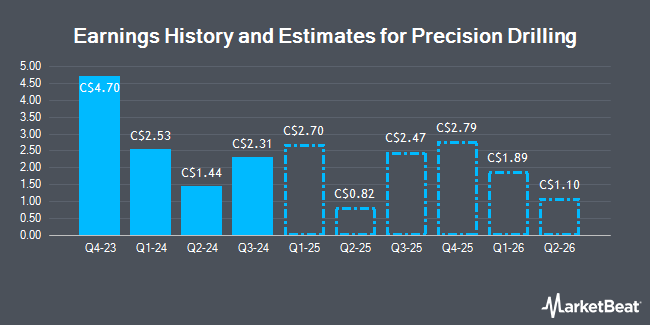

Precision Drilling Co. (TSE:PD - Free Report) NYSE: PDS - Raymond James decreased their FY2025 earnings estimates for shares of Precision Drilling in a research note issued to investors on Wednesday, April 9th. Raymond James analyst M. Barth now forecasts that the company will post earnings of $9.15 per share for the year, down from their prior forecast of $12.28. Raymond James currently has a "Outperform" rating and a $124.00 target price on the stock. Raymond James also issued estimates for Precision Drilling's FY2026 earnings at $11.31 EPS and FY2027 earnings at $15.39 EPS.

PD has been the topic of several other research reports. TD Securities decreased their price target on Precision Drilling from C$89.00 to C$69.00 and set a "hold" rating on the stock in a report on Wednesday. CIBC lowered their target price on shares of Precision Drilling from C$115.00 to C$95.00 in a report on Thursday, April 10th. BMO Capital Markets cut their price target on shares of Precision Drilling from C$100.00 to C$90.00 in a report on Thursday. Finally, Royal Bank of Canada reduced their price objective on shares of Precision Drilling from C$110.00 to C$89.00 and set an "outperform" rating on the stock in a research report on Thursday. One analyst has rated the stock with a hold rating and six have given a buy rating to the company's stock. According to MarketBeat.com, the stock has an average rating of "Moderate Buy" and an average price target of C$102.14.

View Our Latest Analysis on Precision Drilling

Precision Drilling Trading Up 2.7 %

PD stock traded up C$1.57 during midday trading on Monday, reaching C$60.04. 103,237 shares of the company traded hands, compared to its average volume of 151,291. The firm has a market capitalization of C$854.37 million, a price-to-earnings ratio of 3.53, a P/E/G ratio of -3.24 and a beta of 2.76. Precision Drilling has a 52-week low of C$51.38 and a 52-week high of C$109.20. The business has a 50 day moving average of C$66.80 and a 200-day moving average of C$79.98. The company has a debt-to-equity ratio of 51.98, a quick ratio of 1.36 and a current ratio of 1.54.

Insiders Place Their Bets

In related news, Director Carey Thomas Ford sold 5,108 shares of Precision Drilling stock in a transaction dated Wednesday, February 19th. The stock was sold at an average price of C$77.66, for a total value of C$396,686.26. Also, Senior Officer Veronica H. Foley sold 3,393 shares of the stock in a transaction dated Wednesday, February 19th. The stock was sold at an average price of C$77.66, for a total transaction of C$263,499.70. Insiders own 2.12% of the company's stock.

Precision Drilling Company Profile

(

Get Free Report)

Precision Drilling Corp is a leader in North American oil and gas services. It is a provider of contract drilling and completion and production services primarily to oil and natural gas exploration and production companies in Canada. Its segments are Contract Drilling Services which is the majority key revenue generator and other segments include Completion and Production Services.

Read More

Before you consider Precision Drilling, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Precision Drilling wasn't on the list.

While Precision Drilling currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Learn the basics of options trading and how to use them to boost returns and manage risk with this free report from MarketBeat. Click the link below to get your free copy.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.