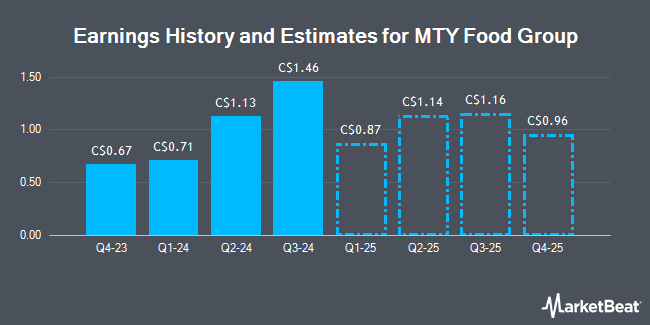

MTY Food Group Inc. (TSE:MTY - Free Report) - Analysts at National Bank Financial dropped their FY2025 EPS estimates for MTY Food Group in a report released on Wednesday, April 2nd. National Bank Financial analyst V. Shreedhar now forecasts that the company will post earnings of $3.86 per share for the year, down from their previous estimate of $3.87. The consensus estimate for MTY Food Group's current full-year earnings is $4.49 per share. National Bank Financial also issued estimates for MTY Food Group's FY2025 earnings at $3.86 EPS, FY2026 earnings at $4.27 EPS, FY2026 earnings at $4.27 EPS, FY2027 earnings at $4.70 EPS and FY2027 earnings at $4.70 EPS.

MTY Food Group Stock Performance

MTY stock traded down C$0.15 during midday trading on Friday, hitting C$37.73. The company's stock had a trading volume of 19,206 shares, compared to its average volume of 71,124. The stock has a market cap of C$879.76 million, a price-to-earnings ratio of 9.42, a PEG ratio of 0.75 and a beta of 1.95. The company has a quick ratio of 0.57, a current ratio of 0.61 and a debt-to-equity ratio of 142.67. The stock's 50-day moving average price is C$44.06 and its 200 day moving average price is C$45.74. MTY Food Group has a 1 year low of C$36.79 and a 1 year high of C$53.16.

MTY Food Group Increases Dividend

The business also recently disclosed a quarterly dividend, which was paid on Friday, February 14th. Shareholders of record on Friday, February 14th were given a $0.33 dividend. This is a positive change from MTY Food Group's previous quarterly dividend of $0.28. The ex-dividend date of this dividend was Tuesday, February 4th. This represents a $1.32 annualized dividend and a yield of 3.50%. MTY Food Group's payout ratio is currently 27.97%.

MTY Food Group Company Profile

(

Get Free Report)

MTY Food Group Inc operates and franchises quick-service, fast-casual, and casual dining restaurants in Canada, the United States, and internationally. It also sells retail products under a multitude of banners. The company was formerly known as iNsu Innovations Group Inc and changed its name to MTY Food Group Inc in July 2003.

Recommended Stories

Before you consider MTY Food Group, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and MTY Food Group wasn't on the list.

While MTY Food Group currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

If a company's CEO, COO, and CFO were all selling shares of their stock, would you want to know? MarketBeat just compiled its list of the twelve stocks that corporate insiders are abandoning. Complete the form below to see which companies made the list.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.