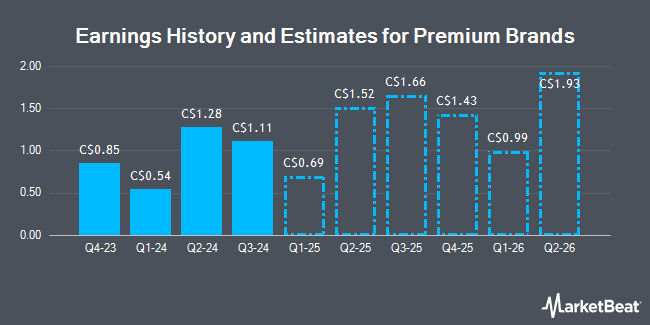

Premium Brands Holdings Co. (TSE:PBH - Free Report) - Equities research analysts at Raymond James increased their FY2025 earnings per share estimates for shares of Premium Brands in a research note issued on Monday, March 24th. Raymond James analyst M. Glen now forecasts that the company will post earnings of $5.05 per share for the year, up from their previous forecast of $4.89. Raymond James has a "Moderate Buy" rating on the stock. The consensus estimate for Premium Brands' current full-year earnings is $6.04 per share. Raymond James also issued estimates for Premium Brands' FY2026 earnings at $6.15 EPS.

Several other equities research analysts also recently weighed in on PBH. BMO Capital Markets boosted their target price on shares of Premium Brands from C$94.00 to C$100.00 and gave the stock an "outperform" rating in a research report on Monday, March 24th. Desjardins lowered their price objective on Premium Brands from C$95.00 to C$93.00 and set a "buy" rating for the company in a report on Monday, March 24th. Ventum Financial increased their target price on Premium Brands from C$109.00 to C$120.00 and gave the stock a "buy" rating in a report on Monday, March 24th. Royal Bank of Canada boosted their price target on Premium Brands from C$96.00 to C$97.00 and gave the company an "outperform" rating in a report on Thursday, March 20th. Finally, National Bankshares reduced their price objective on Premium Brands from C$99.00 to C$96.00 and set a "sector perform" rating on the stock in a research note on Thursday, February 27th. Two investment analysts have rated the stock with a hold rating and seven have issued a buy rating to the stock. According to data from MarketBeat, the company presently has an average rating of "Moderate Buy" and an average price target of C$102.90.

View Our Latest Analysis on Premium Brands

Premium Brands Stock Down 0.9 %

Shares of TSE:PBH traded down C$0.68 during midday trading on Tuesday, reaching C$78.13. The company had a trading volume of 109,483 shares, compared to its average volume of 90,718. The stock has a market capitalization of C$3.48 billion, a P/E ratio of 34.78, a PEG ratio of 1.10 and a beta of 0.98. The stock's fifty day moving average price is C$77.88 and its 200-day moving average price is C$82.68. The company has a debt-to-equity ratio of 163.00, a current ratio of 1.51 and a quick ratio of 1.16. Premium Brands has a one year low of C$74.00 and a one year high of C$97.10.

Premium Brands Company Profile

(

Get Free Report)

Premium Brands Holdings Corporation, through its subsidiaries, manufactures and distributes food products primarily in Canada and the United States. It operates in two segments, Specialty Foods and Premium Food Distribution. The company provides processed meat, deli products, meat snacks, beef jerky and halal, sandwiches, pastries, specialty and gourmet products, entrees, panini, wraps, subs, hamburgers, burgers, salads and kettle products, muffins, breads, pastas, pizza, and baking and sushi products.

Further Reading

Before you consider Premium Brands, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Premium Brands wasn't on the list.

While Premium Brands currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Unlock your free copy of MarketBeat's comprehensive guide to pot stock investing and discover which cannabis companies are poised for growth. Plus, you'll get exclusive access to our daily newsletter with expert stock recommendations from Wall Street's top analysts.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.