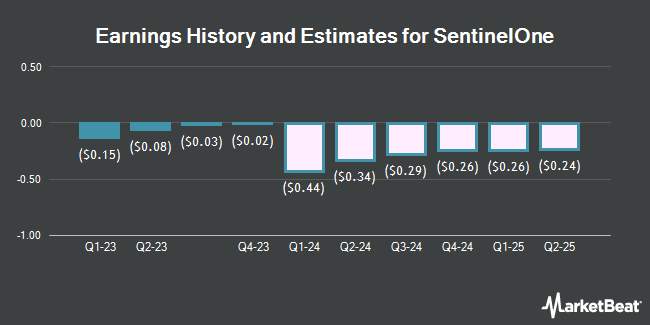

SentinelOne, Inc. (NYSE:S - Free Report) - Equities researchers at DA Davidson decreased their FY2025 earnings per share (EPS) estimates for shares of SentinelOne in a note issued to investors on Thursday, December 5th. DA Davidson analyst R. Kessinger now anticipates that the company will earn ($0.77) per share for the year, down from their previous estimate of ($0.73). DA Davidson currently has a "Neutral" rating and a $25.00 target price on the stock. The consensus estimate for SentinelOne's current full-year earnings is ($0.73) per share. DA Davidson also issued estimates for SentinelOne's FY2026 earnings at ($0.62) EPS.

SentinelOne (NYSE:S - Get Free Report) last released its quarterly earnings results on Wednesday, December 4th. The company reported ($0.21) EPS for the quarter, missing analysts' consensus estimates of $0.01 by ($0.22). The business had revenue of $210.60 million for the quarter, compared to the consensus estimate of $209.73 million. SentinelOne had a negative return on equity of 15.80% and a negative net margin of 37.61%. The firm's revenue was up 28.3% on a year-over-year basis. During the same quarter last year, the company earned ($0.21) earnings per share.

Several other research firms also recently issued reports on S. Barclays reduced their price objective on SentinelOne from $30.00 to $28.00 and set an "equal weight" rating on the stock in a report on Thursday. Susquehanna increased their price target on SentinelOne from $28.00 to $30.00 and gave the company a "positive" rating in a research note on Thursday. Canaccord Genuity Group reissued a "buy" rating and issued a $30.00 price target on shares of SentinelOne in a research note on Friday, October 18th. Wells Fargo & Company increased their price target on SentinelOne from $29.00 to $30.00 and gave the company an "overweight" rating in a research note on Wednesday, August 28th. Finally, Morgan Stanley reissued an "equal weight" rating and issued a $29.00 price target on shares of SentinelOne in a research note on Monday, December 2nd. One research analyst has rated the stock with a sell rating, six have assigned a hold rating, seventeen have issued a buy rating and two have issued a strong buy rating to the stock. According to data from MarketBeat, SentinelOne has a consensus rating of "Moderate Buy" and an average price target of $29.42.

Check Out Our Latest Analysis on SentinelOne

SentinelOne Stock Down 4.6 %

NYSE S traded down $1.19 during trading hours on Monday, reaching $24.59. 5,522,794 shares of the company's stock were exchanged, compared to its average volume of 5,255,020. SentinelOne has a one year low of $14.33 and a one year high of $30.76. The firm has a fifty day moving average of $26.31 and a 200-day moving average of $23.17.

Insiders Place Their Bets

In other news, CEO Tomer Weingarten sold 70,655 shares of the firm's stock in a transaction dated Monday, November 11th. The stock was sold at an average price of $27.63, for a total value of $1,952,197.65. Following the completion of the transaction, the chief executive officer now owns 1,019,541 shares in the company, valued at $28,169,917.83. This trade represents a 6.48 % decrease in their position. The sale was disclosed in a legal filing with the Securities & Exchange Commission, which is available at the SEC website. Also, insider Ric Smith sold 3,135 shares of the firm's stock in a transaction dated Wednesday, November 6th. The shares were sold at an average price of $26.25, for a total value of $82,293.75. Following the completion of the transaction, the insider now owns 582,512 shares of the company's stock, valued at $15,290,940. The trade was a 0.54 % decrease in their position. The disclosure for this sale can be found here. In the last 90 days, insiders sold 328,187 shares of company stock worth $8,016,623. Corporate insiders own 5.60% of the company's stock.

Institutional Investors Weigh In On SentinelOne

Several hedge funds have recently bought and sold shares of the company. Waldron Private Wealth LLC acquired a new stake in SentinelOne during the third quarter worth approximately $26,000. Blue Trust Inc. acquired a new stake in SentinelOne during the second quarter worth approximately $27,000. Allspring Global Investments Holdings LLC lifted its position in SentinelOne by 49.1% during the second quarter. Allspring Global Investments Holdings LLC now owns 1,318 shares of the company's stock worth $28,000 after acquiring an additional 434 shares during the last quarter. Unique Wealth Strategies LLC acquired a new stake in SentinelOne during the second quarter worth approximately $49,000. Finally, Capital Performance Advisors LLP acquired a new stake in SentinelOne during the third quarter worth approximately $55,000. 90.87% of the stock is currently owned by institutional investors and hedge funds.

SentinelOne Company Profile

(

Get Free Report)

SentinelOne, Inc operates as a cybersecurity provider in the United States and internationally. Its Singularity Platform delivers an artificial intelligence-powered autonomous threat prevention, detection, and response capabilities across an organization's endpoints, cloud workloads, and identify credentials, which enables seamless and autonomous protection against a spectrum of cyber threats.

Featured Articles

Before you consider SentinelOne, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and SentinelOne wasn't on the list.

While SentinelOne currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's guide to investing in electric vehicle technologies (EV) and which EV stocks show the most promise.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.