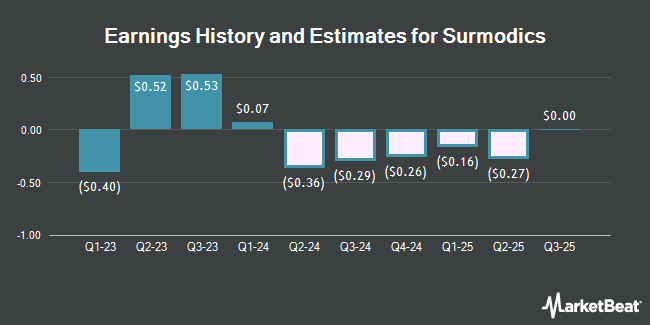

Surmodics, Inc. (NASDAQ:SRDX - Free Report) - Analysts at Zacks Research increased their FY2025 earnings per share (EPS) estimates for shares of Surmodics in a research report issued on Thursday, February 27th. Zacks Research analyst D. Dey now anticipates that the company will post earnings per share of $0.19 for the year, up from their prior estimate of $0.18. The consensus estimate for Surmodics' current full-year earnings is $0.20 per share. Zacks Research also issued estimates for Surmodics' Q3 2026 earnings at $0.16 EPS, FY2026 earnings at $0.76 EPS, Q1 2027 earnings at $0.20 EPS and FY2027 earnings at $0.84 EPS.

Surmodics (NASDAQ:SRDX - Get Free Report) last issued its quarterly earnings data on Thursday, February 6th. The company reported ($0.04) EPS for the quarter, topping the consensus estimate of ($0.08) by $0.04. Surmodics had a negative net margin of 11.48% and a negative return on equity of 4.39%.

Several other analysts also recently commented on the company. Needham & Company LLC reiterated a "hold" rating on shares of Surmodics in a research note on Thursday, January 30th. StockNews.com started coverage on shares of Surmodics in a research note on Monday, February 3rd. They set a "hold" rating on the stock. Five research analysts have rated the stock with a hold rating, According to data from MarketBeat, the stock currently has an average rating of "Hold" and an average price target of $50.00.

View Our Latest Research Report on Surmodics

Surmodics Stock Down 4.5 %

NASDAQ:SRDX traded down $1.40 during trading hours on Monday, reaching $29.62. 489,702 shares of the company traded hands, compared to its average volume of 317,519. The company has a current ratio of 5.45, a quick ratio of 4.29 and a debt-to-equity ratio of 0.26. The business's 50-day moving average price is $35.96 and its two-hundred day moving average price is $37.95. Surmodics has a 1 year low of $25.17 and a 1 year high of $42.44. The stock has a market capitalization of $423.45 million, a P/E ratio of -29.33 and a beta of 1.19.

Institutional Investors Weigh In On Surmodics

A number of institutional investors and hedge funds have recently added to or reduced their stakes in the company. Olympiad Research LP purchased a new stake in shares of Surmodics in the third quarter worth $1,884,000. Principal Financial Group Inc. bought a new position in Surmodics in the 3rd quarter worth $1,190,000. Wolverine Asset Management LLC increased its stake in Surmodics by 6.9% in the 3rd quarter. Wolverine Asset Management LLC now owns 27,766 shares of the company's stock worth $1,077,000 after buying an additional 1,800 shares in the last quarter. Quest Partners LLC raised its holdings in Surmodics by 107,100.0% during the third quarter. Quest Partners LLC now owns 1,072 shares of the company's stock valued at $42,000 after acquiring an additional 1,071 shares during the period. Finally, Phocas Financial Corp. purchased a new position in shares of Surmodics in the third quarter valued at about $3,430,000. Institutional investors own 96.63% of the company's stock.

Surmodics Company Profile

(

Get Free Report)

Surmodics, Inc, together with its subsidiaries, provides performance coating technologies for intravascular medical devices, and chemical and biological components for in vitro diagnostic immunoassay tests and microarrays in the United States and internationally. It operates through two segments, Medical Device and In Vitro Diagnostics (IVD).

Featured Articles

Before you consider Surmodics, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Surmodics wasn't on the list.

While Surmodics currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

If a company's CEO, COO, and CFO were all selling shares of their stock, would you want to know? MarketBeat just compiled its list of the twelve stocks that corporate insiders are abandoning. Complete the form below to see which companies made the list.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.