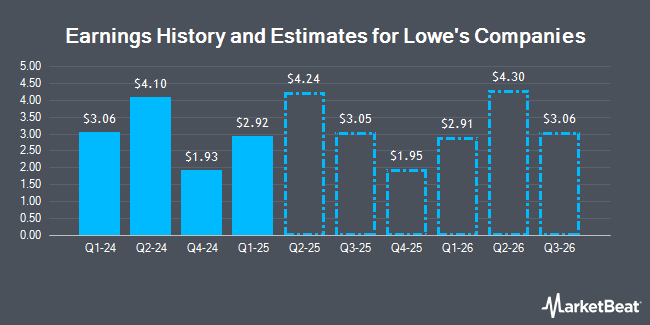

Lowe's Companies, Inc. (NYSE:LOW - Free Report) - Research analysts at DA Davidson decreased their FY2025 earnings per share (EPS) estimates for shares of Lowe's Companies in a report issued on Wednesday, November 20th. DA Davidson analyst M. Baker now expects that the home improvement retailer will post earnings of $11.84 per share for the year, down from their previous estimate of $11.91. DA Davidson currently has a "Neutral" rating and a $270.00 price target on the stock. The consensus estimate for Lowe's Companies' current full-year earnings is $11.82 per share. DA Davidson also issued estimates for Lowe's Companies' FY2026 earnings at $12.60 EPS.

Several other equities analysts also recently commented on LOW. Melius Research started coverage on Lowe's Companies in a report on Monday, September 23rd. They set a "buy" rating and a $290.00 price target on the stock. Evercore ISI raised their target price on shares of Lowe's Companies from $255.00 to $270.00 and gave the company an "in-line" rating in a research note on Wednesday. Piper Sandler boosted their target price on shares of Lowe's Companies from $262.00 to $307.00 and gave the stock an "overweight" rating in a research report on Monday, September 30th. Truist Financial upped their price target on shares of Lowe's Companies from $307.00 to $310.00 and gave the company a "buy" rating in a report on Wednesday. Finally, UBS Group lifted their price objective on Lowe's Companies from $270.00 to $290.00 and gave the stock a "buy" rating in a research note on Wednesday, August 21st. Ten research analysts have rated the stock with a hold rating and sixteen have assigned a buy rating to the company's stock. According to data from MarketBeat, the company has a consensus rating of "Moderate Buy" and an average price target of $277.92.

Read Our Latest Stock Analysis on LOW

Lowe's Companies Stock Performance

Shares of LOW stock opened at $263.03 on Thursday. The stock's 50 day simple moving average is $268.29 and its 200 day simple moving average is $244.36. Lowe's Companies has a twelve month low of $196.23 and a twelve month high of $287.01. The company has a market capitalization of $149.21 billion, a price-to-earnings ratio of 21.94, a PEG ratio of 2.15 and a beta of 1.10.

Lowe's Companies (NYSE:LOW - Get Free Report) last posted its earnings results on Tuesday, August 20th. The home improvement retailer reported $4.10 earnings per share for the quarter, beating the consensus estimate of $3.96 by $0.14. The company had revenue of $23.59 billion for the quarter, compared to analyst estimates of $23.93 billion. Lowe's Companies had a negative return on equity of 47.55% and a net margin of 8.19%. During the same period last year, the company earned $4.56 earnings per share. The business's revenue was down 5.5% compared to the same quarter last year.

Hedge Funds Weigh In On Lowe's Companies

Several large investors have recently made changes to their positions in the company. FMR LLC raised its holdings in Lowe's Companies by 10.2% during the 3rd quarter. FMR LLC now owns 26,010,730 shares of the home improvement retailer's stock worth $7,045,006,000 after purchasing an additional 2,399,897 shares during the last quarter. International Assets Investment Management LLC raised its stake in shares of Lowe's Companies by 1,889.7% during the third quarter. International Assets Investment Management LLC now owns 2,134,969 shares of the home improvement retailer's stock worth $578,256,000 after buying an additional 2,027,668 shares during the last quarter. Strategic Financial Concepts LLC lifted its holdings in Lowe's Companies by 20,275.6% in the second quarter. Strategic Financial Concepts LLC now owns 1,205,014 shares of the home improvement retailer's stock valued at $2,657,000 after buying an additional 1,199,100 shares during the period. Applied Finance Capital Management LLC boosted its stake in Lowe's Companies by 387.7% in the third quarter. Applied Finance Capital Management LLC now owns 811,374 shares of the home improvement retailer's stock valued at $219,761,000 after acquiring an additional 645,017 shares during the last quarter. Finally, Price T Rowe Associates Inc. MD grew its holdings in Lowe's Companies by 36.6% during the 1st quarter. Price T Rowe Associates Inc. MD now owns 1,840,704 shares of the home improvement retailer's stock worth $468,884,000 after acquiring an additional 493,180 shares during the period. Institutional investors and hedge funds own 74.06% of the company's stock.

Insider Activity at Lowe's Companies

In related news, CAO Dan Clayton Griggs, Jr. sold 6,769 shares of the firm's stock in a transaction that occurred on Thursday, September 12th. The shares were sold at an average price of $248.82, for a total value of $1,684,262.58. Following the completion of the sale, the chief accounting officer now owns 9,383 shares of the company's stock, valued at $2,334,678.06. This trade represents a 41.91 % decrease in their ownership of the stock. The sale was disclosed in a document filed with the SEC, which is available at the SEC website. Also, EVP Margrethe R. Vagell sold 5,730 shares of the stock in a transaction on Wednesday, October 2nd. The shares were sold at an average price of $271.45, for a total value of $1,555,408.50. Following the completion of the transaction, the executive vice president now owns 13,214 shares in the company, valued at $3,586,940.30. The trade was a 30.25 % decrease in their ownership of the stock. The disclosure for this sale can be found here. Insiders own 0.26% of the company's stock.

Lowe's Companies Increases Dividend

The firm also recently declared a quarterly dividend, which was paid on Wednesday, November 6th. Investors of record on Wednesday, October 23rd were given a dividend of $1.15 per share. The ex-dividend date of this dividend was Wednesday, October 23rd. This is a positive change from Lowe's Companies's previous quarterly dividend of $0.15. This represents a $4.60 dividend on an annualized basis and a yield of 1.75%. Lowe's Companies's dividend payout ratio is 38.37%.

Lowe's Companies Company Profile

(

Get Free Report)

Lowe's Companies, Inc, together with its subsidiaries, operates as a home improvement retailer in the United States. The company offers a line of products for construction, maintenance, repair, remodeling, and decorating. It also provides home improvement products, such as appliances, seasonal and outdoor living, lawn and garden, lumber, kitchens and bath, tools, paint, millwork, hardware, flooring, rough plumbing, building materials, décor, and electrical.

Read More

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Lowe's Companies, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Lowe's Companies wasn't on the list.

While Lowe's Companies currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's guide to investing in 5G and which 5G stocks show the most promise.

Get This Free Report