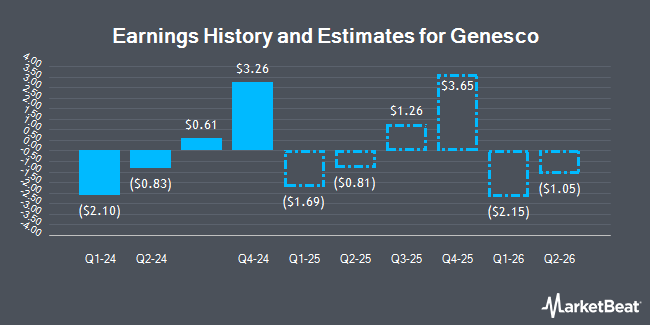

Genesco Inc. (NYSE:GCO - Free Report) - Research analysts at Seaport Res Ptn decreased their FY2027 earnings per share estimates for shares of Genesco in a report issued on Monday, March 3rd. Seaport Res Ptn analyst M. Kummetz now forecasts that the company will post earnings per share of $2.80 for the year, down from their previous forecast of $2.81. The consensus estimate for Genesco's current full-year earnings is $0.94 per share.

Genesco (NYSE:GCO - Get Free Report) last posted its quarterly earnings data on Friday, March 7th. The company reported $3.26 earnings per share (EPS) for the quarter, missing analysts' consensus estimates of $3.31 by ($0.05). The company had revenue of $745.95 million for the quarter, compared to analysts' expectations of $780.43 million. Genesco had a positive return on equity of 0.56% and a negative net margin of 1.13%. During the same quarter last year, the business posted $2.59 EPS.

Separately, StockNews.com lowered Genesco from a "buy" rating to a "hold" rating in a report on Friday.

Check Out Our Latest Stock Analysis on GCO

Genesco Stock Performance

NYSE GCO traded down $4.71 on Thursday, hitting $22.40. 1,046,685 shares of the stock traded hands, compared to its average volume of 163,043. The firm has a market capitalization of $251.10 million, a price-to-earnings ratio of -9.22 and a beta of 2.41. The business's fifty day moving average is $39.79 and its two-hundred day moving average is $34.29. The company has a debt-to-equity ratio of 0.19, a quick ratio of 0.32 and a current ratio of 1.56. Genesco has a 12 month low of $21.94 and a 12 month high of $44.80.

Hedge Funds Weigh In On Genesco

Several hedge funds have recently bought and sold shares of GCO. Olympiad Research LP bought a new position in Genesco in the 3rd quarter worth about $222,000. Empowered Funds LLC increased its position in shares of Genesco by 5.3% in the third quarter. Empowered Funds LLC now owns 58,548 shares of the company's stock worth $1,591,000 after purchasing an additional 2,948 shares during the last quarter. Quest Partners LLC raised its stake in Genesco by 54.9% in the third quarter. Quest Partners LLC now owns 1,854 shares of the company's stock valued at $50,000 after purchasing an additional 657 shares in the last quarter. Meeder Asset Management Inc. lifted its position in Genesco by 84.6% during the third quarter. Meeder Asset Management Inc. now owns 8,035 shares of the company's stock valued at $218,000 after purchasing an additional 3,683 shares during the last quarter. Finally, Connor Clark & Lunn Investment Management Ltd. lifted its position in Genesco by 139.9% during the third quarter. Connor Clark & Lunn Investment Management Ltd. now owns 36,279 shares of the company's stock valued at $986,000 after purchasing an additional 21,158 shares during the last quarter. Hedge funds and other institutional investors own 94.51% of the company's stock.

Insider Activity at Genesco

In other news, VP Daniel E. Ewoldsen sold 4,000 shares of the company's stock in a transaction dated Tuesday, December 17th. The stock was sold at an average price of $42.68, for a total transaction of $170,720.00. Following the sale, the vice president now directly owns 41,358 shares in the company, valued at $1,765,159.44. This represents a 8.82 % decrease in their ownership of the stock. The sale was disclosed in a filing with the SEC, which is available at this link. 7.09% of the stock is currently owned by corporate insiders.

Genesco Company Profile

(

Get Free Report)

Genesco Inc operates as a retailer and wholesaler of footwear, apparel, and accessories in the United States, Puerto Rico, Canada, the United Kingdom, and the Republic of Ireland. The company operates through four segments: Journeys Group, Schuh Group, Johnston & Murphy Group, and Genesco Brands.

Featured Articles

Before you consider Genesco, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Genesco wasn't on the list.

While Genesco currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering when you'll finally be able to invest in SpaceX, Starlink, or X.AI? Enter your email address to learn when Elon Musk will let these companies finally IPO.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.