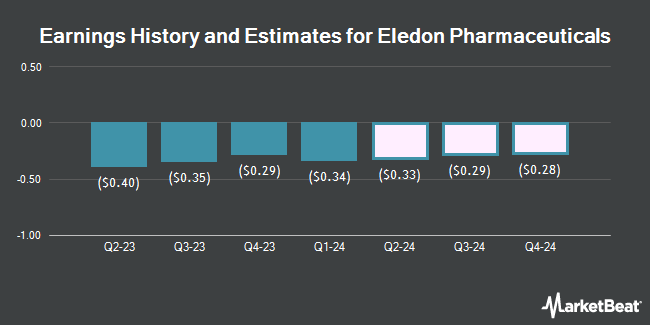

Eledon Pharmaceuticals, Inc. (NASDAQ:ELDN - Free Report) - Stock analysts at Leerink Partnrs issued their FY2029 earnings estimates for Eledon Pharmaceuticals in a research report issued on Wednesday, February 5th. Leerink Partnrs analyst T. Smith forecasts that the company will post earnings of ($0.50) per share for the year. The consensus estimate for Eledon Pharmaceuticals' current full-year earnings is ($0.81) per share.

Eledon Pharmaceuticals (NASDAQ:ELDN - Get Free Report) last released its quarterly earnings data on Tuesday, November 12th. The company reported ($0.32) EPS for the quarter, missing analysts' consensus estimates of ($0.30) by ($0.02).

Other equities research analysts have also recently issued reports about the company. Guggenheim initiated coverage on Eledon Pharmaceuticals in a research note on Tuesday, January 28th. They issued a "buy" rating and a $9.00 target price on the stock. HC Wainwright reiterated a "buy" rating and issued a $16.00 target price on shares of Eledon Pharmaceuticals in a research note on Wednesday, November 20th.

View Our Latest Stock Analysis on Eledon Pharmaceuticals

Eledon Pharmaceuticals Trading Down 2.7 %

Eledon Pharmaceuticals stock traded down $0.12 during mid-day trading on Friday, reaching $4.40. The company's stock had a trading volume of 149,757 shares, compared to its average volume of 306,310. The firm has a market cap of $262.86 million, a price-to-earnings ratio of -2.19 and a beta of 0.79. The business has a 50 day moving average price of $4.40 and a 200-day moving average price of $3.62. Eledon Pharmaceuticals has a twelve month low of $1.52 and a twelve month high of $5.54.

Institutional Investors Weigh In On Eledon Pharmaceuticals

A number of hedge funds have recently added to or reduced their stakes in the stock. Geode Capital Management LLC lifted its stake in Eledon Pharmaceuticals by 9.7% in the third quarter. Geode Capital Management LLC now owns 378,058 shares of the company's stock valued at $942,000 after buying an additional 33,569 shares during the last quarter. Inspire Investing LLC bought a new stake in shares of Eledon Pharmaceuticals during the fourth quarter valued at about $802,000. Renaissance Technologies LLC raised its stake in shares of Eledon Pharmaceuticals by 57.1% during the second quarter. Renaissance Technologies LLC now owns 136,773 shares of the company's stock valued at $361,000 after purchasing an additional 49,704 shares in the last quarter. Dimensional Fund Advisors LP bought a new stake in shares of Eledon Pharmaceuticals during the second quarter valued at about $80,000. Finally, Charles Schwab Investment Management Inc. raised its stake in shares of Eledon Pharmaceuticals by 100.1% during the fourth quarter. Charles Schwab Investment Management Inc. now owns 29,987 shares of the company's stock valued at $124,000 after purchasing an additional 15,000 shares in the last quarter. 56.77% of the stock is currently owned by institutional investors.

About Eledon Pharmaceuticals

(

Get Free Report)

Eledon Pharmaceuticals, Inc operates as a clinical stage biotechnology company. The company uses its immunology expertise in targeting the CD40 Ligand (CD40L, also called CD154) pathway to develop therapies to protect transplanted organs and prevent rejection, and to treat amyotrophic lateral sclerosis (ALS).

Recommended Stories

Before you consider Eledon Pharmaceuticals, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Eledon Pharmaceuticals wasn't on the list.

While Eledon Pharmaceuticals currently has a "Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat just released its list of 10 cheap stocks that have been overlooked by the market and may be seriously undervalued. Enter your email address and below to see which companies made the list.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.