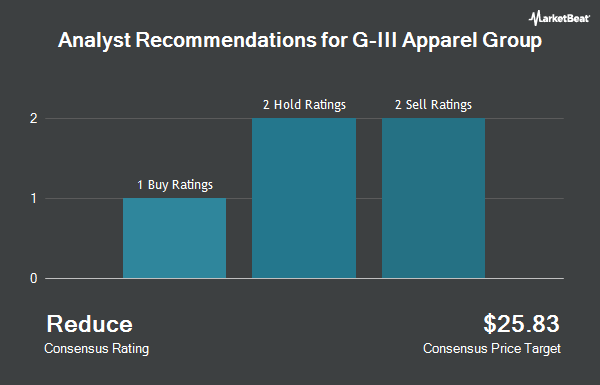

Shares of G-III Apparel Group, Ltd. (NASDAQ:GIII - Get Free Report) have received a consensus recommendation of "Hold" from the six research firms that are presently covering the company, Marketbeat reports. Two analysts have rated the stock with a sell rating, two have issued a hold rating and two have given a buy rating to the company. The average 12-month target price among analysts that have covered the stock in the last year is $30.00.

A number of equities research analysts recently issued reports on GIII shares. Barclays upped their target price on G-III Apparel Group from $23.00 to $27.00 and gave the company an "underweight" rating in a research note on Friday, September 6th. StockNews.com downgraded G-III Apparel Group from a "buy" rating to a "hold" rating in a research report on Tuesday, October 22nd. KeyCorp lifted their price objective on G-III Apparel Group from $32.00 to $34.00 and gave the stock an "overweight" rating in a research report on Friday, September 6th. Guggenheim initiated coverage on shares of G-III Apparel Group in a report on Wednesday, October 9th. They issued a "buy" rating and a $36.00 target price on the stock. Finally, Telsey Advisory Group reiterated a "market perform" rating and set a $29.00 price target on shares of G-III Apparel Group in a report on Thursday, September 5th.

Get Our Latest Analysis on GIII

Insider Buying and Selling

In related news, CEO Morris Goldfarb sold 67,014 shares of the stock in a transaction on Thursday, September 26th. The stock was sold at an average price of $30.30, for a total value of $2,030,524.20. Following the transaction, the chief executive officer now directly owns 3,923,071 shares of the company's stock, valued at approximately $118,869,051.30. This trade represents a 1.68 % decrease in their position. The sale was disclosed in a filing with the SEC, which can be accessed through the SEC website. Corporate insiders own 12.40% of the company's stock.

Hedge Funds Weigh In On G-III Apparel Group

A number of large investors have recently modified their holdings of GIII. Guidance Capital Inc. raised its stake in shares of G-III Apparel Group by 2.0% in the 3rd quarter. Guidance Capital Inc. now owns 16,861 shares of the textile maker's stock valued at $563,000 after acquiring an additional 331 shares during the period. SummerHaven Investment Management LLC increased its holdings in G-III Apparel Group by 1.4% in the 2nd quarter. SummerHaven Investment Management LLC now owns 37,809 shares of the textile maker's stock valued at $1,023,000 after purchasing an additional 516 shares in the last quarter. CWM LLC raised its position in G-III Apparel Group by 46.8% in the third quarter. CWM LLC now owns 2,777 shares of the textile maker's stock valued at $85,000 after purchasing an additional 885 shares during the period. Sanctuary Advisors LLC raised its position in G-III Apparel Group by 8.4% in the third quarter. Sanctuary Advisors LLC now owns 14,564 shares of the textile maker's stock valued at $439,000 after purchasing an additional 1,126 shares during the period. Finally, Point72 Asia Singapore Pte. Ltd. lifted its stake in shares of G-III Apparel Group by 93.2% during the third quarter. Point72 Asia Singapore Pte. Ltd. now owns 3,026 shares of the textile maker's stock worth $92,000 after purchasing an additional 1,460 shares in the last quarter. 92.13% of the stock is currently owned by hedge funds and other institutional investors.

G-III Apparel Group Price Performance

G-III Apparel Group stock traded up $1.75 during trading hours on Monday, hitting $31.38. The stock had a trading volume of 668,778 shares, compared to its average volume of 560,462. G-III Apparel Group has a 1-year low of $20.66 and a 1-year high of $35.68. The stock has a market capitalization of $1.38 billion, a price-to-earnings ratio of 7.41 and a beta of 2.19. The stock's fifty day moving average is $30.54 and its two-hundred day moving average is $28.48. The company has a debt-to-equity ratio of 0.27, a current ratio of 2.92 and a quick ratio of 1.80.

G-III Apparel Group (NASDAQ:GIII - Get Free Report) last issued its quarterly earnings data on Thursday, September 5th. The textile maker reported $0.52 EPS for the quarter, beating analysts' consensus estimates of $0.27 by $0.25. G-III Apparel Group had a net margin of 6.04% and a return on equity of 12.81%. The firm had revenue of $644.80 million for the quarter, compared to analysts' expectations of $649.54 million. The firm's revenue was down 2.3% on a year-over-year basis. During the same period in the prior year, the company earned $0.40 EPS. As a group, analysts predict that G-III Apparel Group will post 4.01 earnings per share for the current fiscal year.

G-III Apparel Group Company Profile

(

Get Free ReportG-III Apparel Group, Ltd. designs, sources, and markets women's and men's apparel in the United States and internationally. The company operates through two segments, Wholesale Operations and Retail Operations. Its products include outerwear, dresses, sportswear, swimwear, women's suits, and women's performance wear; and women's handbags, footwear, small leather goods, cold weather accessories, and luggage.

See Also

Before you consider G-III Apparel Group, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and G-III Apparel Group wasn't on the list.

While G-III Apparel Group currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering what the next stocks will be that hit it big, with solid fundamentals? Click the link below to learn more about how your portfolio could bloom.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.