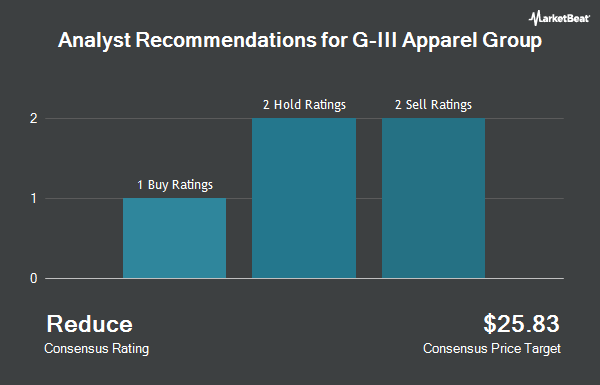

G-III Apparel Group, Ltd. (NASDAQ:GIII - Get Free Report) has earned a consensus rating of "Hold" from the six brokerages that are currently covering the stock, MarketBeat.com reports. Two analysts have rated the stock with a sell recommendation, two have issued a hold recommendation and two have given a buy recommendation to the company. The average 1-year price target among brokers that have issued a report on the stock in the last year is $33.33.

Several equities analysts have recently issued reports on the company. Telsey Advisory Group reaffirmed a "market perform" rating and set a $38.00 price target on shares of G-III Apparel Group in a research note on Wednesday, December 18th. StockNews.com lowered G-III Apparel Group from a "buy" rating to a "hold" rating in a research note on Wednesday. KeyCorp upped their price target on G-III Apparel Group from $34.00 to $40.00 and gave the company an "overweight" rating in a research note on Wednesday, December 11th. UBS Group cut their price target on G-III Apparel Group from $37.00 to $32.00 and set a "neutral" rating on the stock in a research note on Tuesday, March 4th. Finally, Guggenheim upped their price target on G-III Apparel Group from $36.00 to $38.00 and gave the company a "buy" rating in a research note on Wednesday, December 11th.

View Our Latest Report on G-III Apparel Group

Institutional Investors Weigh In On G-III Apparel Group

A number of institutional investors and hedge funds have recently added to or reduced their stakes in the stock. American Century Companies Inc. increased its holdings in G-III Apparel Group by 11.8% in the fourth quarter. American Century Companies Inc. now owns 1,461,446 shares of the textile maker's stock valued at $47,672,000 after purchasing an additional 153,913 shares during the last quarter. Charles Schwab Investment Management Inc. increased its holdings in shares of G-III Apparel Group by 0.6% in the third quarter. Charles Schwab Investment Management Inc. now owns 1,036,158 shares of the textile maker's stock worth $31,624,000 after acquiring an additional 6,598 shares in the last quarter. Geode Capital Management LLC increased its holdings in shares of G-III Apparel Group by 1.2% in the third quarter. Geode Capital Management LLC now owns 977,331 shares of the textile maker's stock worth $29,833,000 after acquiring an additional 11,196 shares in the last quarter. Prudential Financial Inc. increased its holdings in shares of G-III Apparel Group by 2.6% in the fourth quarter. Prudential Financial Inc. now owns 772,447 shares of the textile maker's stock worth $25,197,000 after acquiring an additional 19,723 shares in the last quarter. Finally, Marshall Wace LLP increased its holdings in shares of G-III Apparel Group by 80.6% in the fourth quarter. Marshall Wace LLP now owns 766,068 shares of the textile maker's stock worth $24,989,000 after acquiring an additional 341,870 shares in the last quarter. Institutional investors own 92.13% of the company's stock.

G-III Apparel Group Price Performance

G-III Apparel Group stock opened at $25.92 on Wednesday. The company has a debt-to-equity ratio of 0.13, a quick ratio of 1.75 and a current ratio of 2.63. The firm has a market cap of $1.14 billion, a P/E ratio of 6.80 and a beta of 2.09. The business's fifty day moving average is $29.83 and its two-hundred day moving average is $30.51. G-III Apparel Group has a 52 week low of $20.66 and a 52 week high of $36.18.

G-III Apparel Group (NASDAQ:GIII - Get Free Report) last posted its quarterly earnings data on Tuesday, December 10th. The textile maker reported $2.59 EPS for the quarter, topping analysts' consensus estimates of $2.26 by $0.33. G-III Apparel Group had a return on equity of 11.66% and a net margin of 5.59%. The company had revenue of $1.09 billion for the quarter, compared to analyst estimates of $1.10 billion. During the same quarter in the previous year, the firm earned $2.78 earnings per share. The business's revenue was up 1.9% on a year-over-year basis. Equities research analysts forecast that G-III Apparel Group will post 4.16 earnings per share for the current fiscal year.

About G-III Apparel Group

(

Get Free ReportG-III Apparel Group, Ltd. designs, sources, and markets women's and men's apparel in the United States and internationally. The company operates through two segments, Wholesale Operations and Retail Operations. Its products include outerwear, dresses, sportswear, swimwear, women's suits, and women's performance wear; and women's handbags, footwear, small leather goods, cold weather accessories, and luggage.

Further Reading

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider G-III Apparel Group, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and G-III Apparel Group wasn't on the list.

While G-III Apparel Group currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's list of seven best retirement stocks and why they should be in your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.