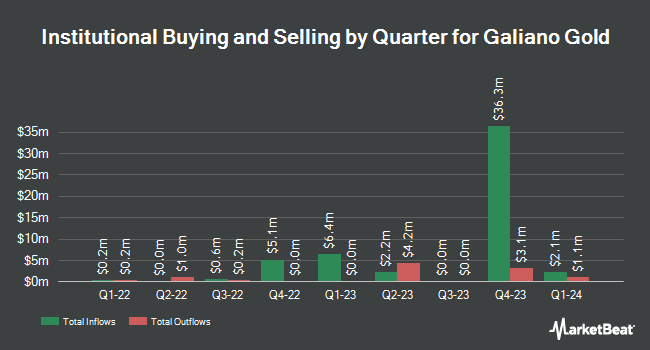

Aegis Financial Corp raised its position in Galiano Gold Inc. (NYSEAMERICAN:GAU - Free Report) by 2,154.8% in the 4th quarter, according to the company in its most recent filing with the Securities and Exchange Commission (SEC). The firm owned 2,392,299 shares of the company's stock after purchasing an additional 2,286,199 shares during the period. Galiano Gold accounts for 2.6% of Aegis Financial Corp's investment portfolio, making the stock its 10th biggest position. Aegis Financial Corp owned about 0.93% of Galiano Gold worth $2,978,000 at the end of the most recent quarter.

A number of other hedge funds have also recently made changes to their positions in the company. Ruffer LLP increased its holdings in shares of Galiano Gold by 4.8% in the 4th quarter. Ruffer LLP now owns 18,438,262 shares of the company's stock worth $22,960,000 after buying an additional 838,300 shares during the last quarter. De Lisle Partners LLP increased its stake in Galiano Gold by 14.0% in the third quarter. De Lisle Partners LLP now owns 815,416 shares of the company's stock valued at $1,154,000 after acquiring an additional 100,000 shares during the last quarter. The Manufacturers Life Insurance Company purchased a new stake in Galiano Gold during the third quarter valued at about $639,000. JPMorgan Chase & Co. bought a new stake in Galiano Gold during the third quarter worth about $147,000. Finally, XTX Topco Ltd bought a new stake in shares of Galiano Gold in the 3rd quarter worth approximately $64,000. 66.82% of the stock is currently owned by hedge funds and other institutional investors.

Analysts Set New Price Targets

GAU has been the subject of several recent analyst reports. BMO Capital Markets downgraded shares of Galiano Gold from an "outperform" rating to a "market perform" rating in a research note on Wednesday, January 29th. HC Wainwright reissued a "buy" rating and set a $2.80 price objective on shares of Galiano Gold in a research note on Wednesday, March 19th.

Read Our Latest Report on Galiano Gold

Galiano Gold Trading Down 2.4 %

GAU traded down $0.03 on Friday, hitting $1.23. 810,021 shares of the company's stock traded hands, compared to its average volume of 1,010,092. The firm has a 50 day simple moving average of $1.22. Galiano Gold Inc. has a one year low of $1.07 and a one year high of $2.00. The company has a market capitalization of $316.31 million, a price-to-earnings ratio of -61.50 and a beta of 1.05.

Galiano Gold Profile

(

Free Report)

Galiano Gold Inc engages in the exploration and evaluation of gold properties in Canada. Its flagship asset is the Asanko Gold Mine that covers an area of approximately 21,000 hectares located in Ghana, West Africa. The company was formerly known as Asanko Gold Inc and changed its name to Galiano Gold Inc in May 2020.

Further Reading

Before you consider Galiano Gold, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Galiano Gold wasn't on the list.

While Galiano Gold currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering when you'll finally be able to invest in SpaceX, Starlink, or X.AI? Enter your email address to learn when Elon Musk will let these companies finally IPO.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.