Gallagher Capital Advisors LLC purchased a new stake in shares of Lockheed Martin Co. (NYSE:LMT - Free Report) in the fourth quarter, according to the company in its most recent filing with the SEC. The fund purchased 1,795 shares of the aerospace company's stock, valued at approximately $872,000.

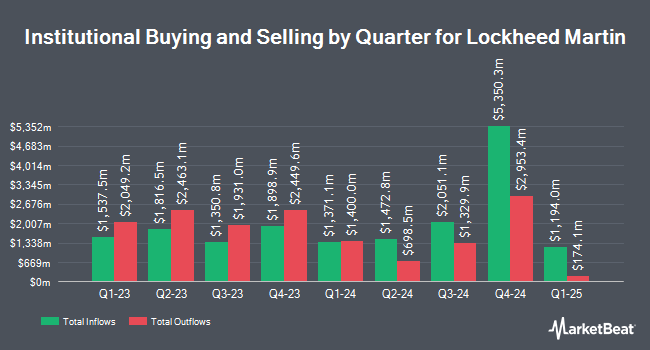

Other hedge funds and other institutional investors have also recently added to or reduced their stakes in the company. Charles Schwab Investment Management Inc. lifted its position in shares of Lockheed Martin by 17.9% during the 4th quarter. Charles Schwab Investment Management Inc. now owns 7,471,071 shares of the aerospace company's stock worth $3,630,492,000 after buying an additional 1,132,461 shares in the last quarter. Geode Capital Management LLC grew its stake in Lockheed Martin by 1.8% in the 3rd quarter. Geode Capital Management LLC now owns 4,827,645 shares of the aerospace company's stock valued at $2,816,898,000 after purchasing an additional 83,997 shares during the period. FMR LLC increased its position in shares of Lockheed Martin by 6.6% during the 3rd quarter. FMR LLC now owns 3,389,025 shares of the aerospace company's stock valued at $1,981,088,000 after purchasing an additional 209,591 shares during the last quarter. Wellington Management Group LLP raised its stake in shares of Lockheed Martin by 8.5% during the 3rd quarter. Wellington Management Group LLP now owns 3,074,855 shares of the aerospace company's stock worth $1,797,437,000 after purchasing an additional 240,306 shares during the period. Finally, Bank of New York Mellon Corp raised its stake in shares of Lockheed Martin by 0.9% during the 4th quarter. Bank of New York Mellon Corp now owns 1,743,757 shares of the aerospace company's stock worth $847,361,000 after purchasing an additional 15,085 shares during the period. 74.19% of the stock is owned by institutional investors.

Insiders Place Their Bets

In other news, VP Harry Edward Paul III sold 707 shares of the company's stock in a transaction on Wednesday, February 26th. The shares were sold at an average price of $442.61, for a total value of $312,925.27. Following the completion of the sale, the vice president now owns 2,278 shares of the company's stock, valued at approximately $1,008,265.58. This represents a 23.69 % decrease in their position. The sale was disclosed in a document filed with the Securities & Exchange Commission, which is accessible through this link. Also, insider Robert M. Lightfoot, Jr. sold 3,213 shares of Lockheed Martin stock in a transaction on Wednesday, February 26th. The stock was sold at an average price of $442.42, for a total transaction of $1,421,495.46. Following the completion of the transaction, the insider now owns 2,000 shares in the company, valued at approximately $884,840. The trade was a 61.63 % decrease in their position. The disclosure for this sale can be found here. Insiders sold a total of 7,133 shares of company stock valued at $3,155,916 in the last quarter. Corporate insiders own 0.17% of the company's stock.

Wall Street Analysts Forecast Growth

Several brokerages have commented on LMT. Susquehanna lowered their price objective on shares of Lockheed Martin from $590.00 to $550.00 and set a "positive" rating on the stock in a research report on Wednesday, January 29th. Barclays dropped their price objective on Lockheed Martin from $565.00 to $515.00 and set an "equal weight" rating on the stock in a research note on Monday, January 6th. Morgan Stanley lowered their target price on Lockheed Martin from $555.00 to $525.00 and set an "equal weight" rating on the stock in a research note on Wednesday, January 29th. Deutsche Bank Aktiengesellschaft cut Lockheed Martin from a "buy" rating to a "hold" rating and dropped their price target for the company from $611.00 to $523.00 in a research report on Thursday, January 2nd. Finally, Citigroup lowered their price objective on Lockheed Martin from $700.00 to $600.00 and set a "buy" rating on the stock in a research note on Tuesday, January 21st. One equities research analyst has rated the stock with a sell rating, six have issued a hold rating, eight have issued a buy rating and one has given a strong buy rating to the company's stock. According to MarketBeat.com, the company presently has an average rating of "Moderate Buy" and an average price target of $554.20.

Get Our Latest Analysis on Lockheed Martin

Lockheed Martin Price Performance

NYSE:LMT traded down $8.37 during trading hours on Tuesday, hitting $470.80. The stock had a trading volume of 1,048,648 shares, compared to its average volume of 1,118,368. The firm has a market capitalization of $110.82 billion, a price-to-earnings ratio of 21.15, a P/E/G ratio of 2.07 and a beta of 0.43. Lockheed Martin Co. has a one year low of $419.70 and a one year high of $618.95. The company has a 50 day simple moving average of $462.79 and a two-hundred day simple moving average of $520.80. The company has a debt-to-equity ratio of 3.10, a current ratio of 1.13 and a quick ratio of 0.95.

Lockheed Martin (NYSE:LMT - Get Free Report) last posted its earnings results on Tuesday, January 28th. The aerospace company reported $7.67 EPS for the quarter, topping the consensus estimate of $6.58 by $1.09. Lockheed Martin had a return on equity of 101.47% and a net margin of 7.51%. Research analysts forecast that Lockheed Martin Co. will post 27.15 earnings per share for the current fiscal year.

Lockheed Martin Dividend Announcement

The business also recently announced a quarterly dividend, which will be paid on Friday, March 28th. Shareholders of record on Monday, March 3rd will be given a dividend of $3.30 per share. The ex-dividend date of this dividend is Monday, March 3rd. This represents a $13.20 annualized dividend and a yield of 2.80%. Lockheed Martin's payout ratio is presently 59.30%.

About Lockheed Martin

(

Free Report)

Lockheed Martin Corporation, a security and aerospace company, engages in the research, design, development, manufacture, integration, and sustainment of technology systems, products, and services worldwide. The company operates through Aeronautics, Missiles and Fire Control, Rotary and Mission Systems, and Space segments.

Featured Stories

Before you consider Lockheed Martin, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Lockheed Martin wasn't on the list.

While Lockheed Martin currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Thinking about investing in Meta, Roblox, or Unity? Enter your email to learn what streetwise investors need to know about the metaverse and public markets before making an investment.

Get This Free Report