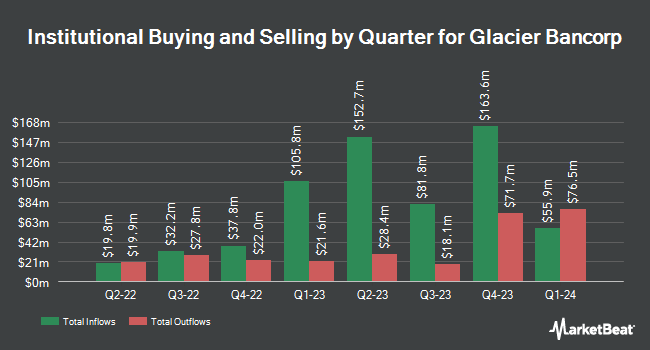

Gamco Investors INC. ET AL bought a new position in Glacier Bancorp, Inc. (NASDAQ:GBCI - Free Report) in the 4th quarter, according to the company in its most recent disclosure with the Securities & Exchange Commission. The firm bought 9,000 shares of the bank's stock, valued at approximately $452,000.

Several other institutional investors and hedge funds also recently bought and sold shares of the business. Mather Group LLC. boosted its holdings in shares of Glacier Bancorp by 97.6% during the 4th quarter. Mather Group LLC. now owns 733 shares of the bank's stock worth $37,000 after buying an additional 362 shares during the period. VisionPoint Advisory Group LLC acquired a new stake in shares of Glacier Bancorp in the fourth quarter valued at about $63,000. Smartleaf Asset Management LLC increased its stake in shares of Glacier Bancorp by 17.7% in the fourth quarter. Smartleaf Asset Management LLC now owns 2,869 shares of the bank's stock worth $144,000 after purchasing an additional 431 shares during the period. GAMMA Investing LLC lifted its position in shares of Glacier Bancorp by 20.9% during the 4th quarter. GAMMA Investing LLC now owns 3,042 shares of the bank's stock worth $153,000 after purchasing an additional 526 shares during the last quarter. Finally, Jones Financial Companies Lllp boosted its stake in Glacier Bancorp by 19.6% during the 4th quarter. Jones Financial Companies Lllp now owns 3,533 shares of the bank's stock valued at $177,000 after purchasing an additional 578 shares during the period. Hedge funds and other institutional investors own 80.17% of the company's stock.

Glacier Bancorp Price Performance

NASDAQ GBCI traded down $1.68 on Friday, hitting $40.95. 410,316 shares of the company were exchanged, compared to its average volume of 612,655. Glacier Bancorp, Inc. has a 1-year low of $34.48 and a 1-year high of $60.67. The firm has a 50 day moving average of $43.77 and a two-hundred day moving average of $49.13. The company has a market cap of $4.65 billion, a P/E ratio of 24.49 and a beta of 0.80. The company has a current ratio of 0.81, a quick ratio of 0.81 and a debt-to-equity ratio of 0.63.

Glacier Bancorp Dividend Announcement

The company also recently declared a quarterly dividend, which was paid on Thursday, April 17th. Stockholders of record on Tuesday, April 8th were paid a dividend of $0.33 per share. This represents a $1.32 annualized dividend and a dividend yield of 3.22%. The ex-dividend date was Tuesday, April 8th. Glacier Bancorp's dividend payout ratio (DPR) is presently 79.04%.

Wall Street Analyst Weigh In

Several equities research analysts have recently weighed in on the company. Piper Sandler reduced their price objective on Glacier Bancorp from $57.00 to $54.00 and set a "neutral" rating for the company in a research report on Monday, January 27th. Stephens upgraded Glacier Bancorp from a "hold" rating to a "strong-buy" rating in a research report on Monday, March 3rd. Finally, Raymond James reissued an "outperform" rating and issued a $55.00 target price (up previously from $52.00) on shares of Glacier Bancorp in a research note on Wednesday, January 15th. One analyst has rated the stock with a sell rating, three have assigned a hold rating, one has given a buy rating and one has given a strong buy rating to the company. Based on data from MarketBeat, Glacier Bancorp presently has a consensus rating of "Hold" and an average price target of $56.00.

Get Our Latest Report on Glacier Bancorp

Glacier Bancorp Company Profile

(

Free Report)

Glacier Bancorp, Inc operates as the bank holding company for Glacier Bank that provides commercial banking services to individuals, small to medium-sized businesses, community organizations, and public entities in the United States. The company offers retail banking, business banking, and mortgage origination and loan servicing services.

Featured Stories

Before you consider Glacier Bancorp, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Glacier Bancorp wasn't on the list.

While Glacier Bancorp currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Discover the top 7 AI stocks to invest in right now. This exclusive report highlights the companies leading the AI revolution and shaping the future of technology in 2025.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.