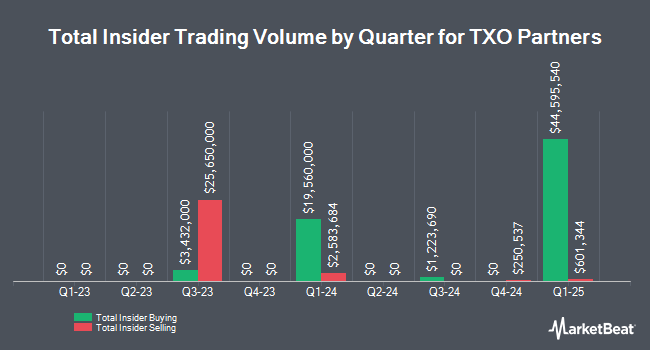

TXO Partners, L.P. (NYSE:TXO - Get Free Report) CEO Gary D. Simpson sold 31,517 shares of the company's stock in a transaction on Tuesday, April 1st. The shares were sold at an average price of $19.08, for a total value of $601,344.36. Following the transaction, the chief executive officer now directly owns 408,053 shares in the company, valued at $7,785,651.24. This represents a 7.17 % decrease in their position. The sale was disclosed in a legal filing with the Securities & Exchange Commission, which is accessible through the SEC website.

TXO Partners Stock Performance

TXO traded down $1.75 on Friday, hitting $17.01. The company's stock had a trading volume of 262,058 shares, compared to its average volume of 97,550. TXO Partners, L.P. has a 12 month low of $15.22 and a 12 month high of $23.56. The firm has a market cap of $700.27 million, a P/E ratio of -2.86 and a beta of 0.09. The company has a quick ratio of 1.02, a current ratio of 1.02 and a debt-to-equity ratio of 0.25. The company's 50 day simple moving average is $19.24 and its 200-day simple moving average is $18.08.

TXO Partners (NYSE:TXO - Get Free Report) last posted its quarterly earnings results on Tuesday, March 4th. The company reported $0.26 EPS for the quarter, missing analysts' consensus estimates of $0.39 by ($0.13). The company had revenue of $83.68 million during the quarter, compared to the consensus estimate of $83.68 million. TXO Partners had a positive return on equity of 8.05% and a negative net margin of 63.22%. Analysts forecast that TXO Partners, L.P. will post 1.02 EPS for the current year.

TXO Partners Increases Dividend

The company also recently disclosed a quarterly dividend, which was paid on Friday, March 21st. Stockholders of record on Friday, March 14th were given a $0.61 dividend. This is a positive change from TXO Partners's previous quarterly dividend of $0.58. This represents a $2.44 dividend on an annualized basis and a dividend yield of 14.34%. The ex-dividend date of this dividend was Friday, March 14th. TXO Partners's dividend payout ratio (DPR) is 353.62%.

Hedge Funds Weigh In On TXO Partners

Several hedge funds have recently bought and sold shares of TXO. Wilmington Savings Fund Society FSB purchased a new stake in TXO Partners during the fourth quarter valued at about $72,000. Thurston Springer Miller Herd & Titak Inc. lifted its holdings in TXO Partners by 109.7% in the 4th quarter. Thurston Springer Miller Herd & Titak Inc. now owns 8,916 shares of the company's stock worth $150,000 after buying an additional 4,664 shares during the period. M&T Bank Corp bought a new stake in TXO Partners in the fourth quarter valued at $253,000. XTX Topco Ltd bought a new stake in shares of TXO Partners during the fourth quarter valued at approximately $270,000. Finally, Virtu Financial LLC purchased a new stake in TXO Partners in the fourth quarter worth about $339,000. Hedge funds and other institutional investors own 27.44% of the company's stock.

About TXO Partners

(

Get Free Report)

TXO Partners, L.P., an oil and natural gas company, focuses on the acquisition, development, optimization, and exploitation of conventional oil, natural gas, and natural gas liquid reserves in North America. Its acreage positions are concentrated in the Permian Basin of West Texas and New Mexico and the San Juan Basin of New Mexico and Colorado.

Recommended Stories

Before you consider TXO Partners, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and TXO Partners wasn't on the list.

While TXO Partners currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering where to start (or end) with AI stocks? These 10 simple stocks can help investors build long-term wealth as artificial intelligence continues to grow into the future.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.