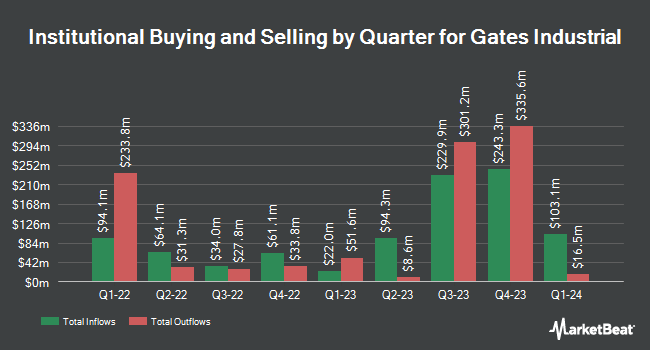

Diamond Hill Capital Management Inc. lessened its holdings in Gates Industrial Corp PLC (NYSE:GTES - Free Report) by 7.4% during the third quarter, according to the company in its most recent Form 13F filing with the Securities & Exchange Commission. The fund owned 3,993,682 shares of the company's stock after selling 318,790 shares during the period. Diamond Hill Capital Management Inc. owned about 1.57% of Gates Industrial worth $70,089,000 at the end of the most recent quarter.

Other institutional investors have also recently bought and sold shares of the company. Janney Montgomery Scott LLC grew its holdings in shares of Gates Industrial by 17.2% during the 1st quarter. Janney Montgomery Scott LLC now owns 43,009 shares of the company's stock valued at $762,000 after purchasing an additional 6,321 shares during the last quarter. Quantbot Technologies LP increased its holdings in shares of Gates Industrial by 13.1% during the first quarter. Quantbot Technologies LP now owns 69,222 shares of the company's stock worth $1,226,000 after buying an additional 8,042 shares in the last quarter. Swiss National Bank lifted its stake in shares of Gates Industrial by 18.4% in the 1st quarter. Swiss National Bank now owns 339,000 shares of the company's stock valued at $6,004,000 after acquiring an additional 52,800 shares during the last quarter. US Bancorp DE boosted its holdings in shares of Gates Industrial by 45.5% during the 1st quarter. US Bancorp DE now owns 59,116 shares of the company's stock valued at $1,047,000 after acquiring an additional 18,495 shares in the last quarter. Finally, Jupiter Asset Management Ltd. boosted its holdings in shares of Gates Industrial by 27.8% during the 1st quarter. Jupiter Asset Management Ltd. now owns 892,694 shares of the company's stock valued at $15,810,000 after acquiring an additional 193,981 shares in the last quarter. Institutional investors and hedge funds own 98.50% of the company's stock.

Gates Industrial Stock Up 0.2 %

Shares of NYSE GTES traded up $0.05 during midday trading on Monday, reaching $21.32. 799,995 shares of the company's stock traded hands, compared to its average volume of 3,070,324. The company has a market cap of $5.43 billion, a price-to-earnings ratio of 25.63 and a beta of 1.38. Gates Industrial Corp PLC has a one year low of $11.22 and a one year high of $21.54. The company has a quick ratio of 2.11, a current ratio of 3.02 and a debt-to-equity ratio of 0.70. The stock's 50 day simple moving average is $18.02 and its 200-day simple moving average is $17.26.

Gates Industrial declared that its Board of Directors has approved a share repurchase program on Wednesday, July 31st that permits the company to buyback $250.00 million in outstanding shares. This buyback authorization permits the company to purchase up to 5.4% of its shares through open market purchases. Shares buyback programs are usually a sign that the company's board of directors believes its shares are undervalued.

Insider Buying and Selling at Gates Industrial

In other Gates Industrial news, Director Wilson S. Neely bought 11,952 shares of Gates Industrial stock in a transaction that occurred on Wednesday, August 21st. The stock was purchased at an average price of $16.80 per share, with a total value of $200,793.60. Following the completion of the acquisition, the director now directly owns 6,000 shares in the company, valued at approximately $100,800. This trade represents a -200.00 % increase in their position. The transaction was disclosed in a document filed with the Securities & Exchange Commission, which is accessible through this link. 2.30% of the stock is owned by insiders.

Analyst Upgrades and Downgrades

Several equities analysts have commented on the company. Evercore ISI increased their target price on Gates Industrial from $15.00 to $16.00 and gave the company an "in-line" rating in a research report on Monday, August 19th. Robert W. Baird dropped their price objective on shares of Gates Industrial from $26.00 to $22.00 and set an "outperform" rating for the company in a report on Thursday, August 1st. KeyCorp boosted their target price on shares of Gates Industrial from $21.00 to $22.00 and gave the stock an "overweight" rating in a report on Thursday, October 31st. The Goldman Sachs Group raised their price objective on Gates Industrial from $18.00 to $20.00 and gave the stock a "neutral" rating in a research report on Thursday, August 1st. Finally, Barclays upped their target price on Gates Industrial from $16.00 to $21.00 and gave the company an "equal weight" rating in a report on Tuesday, November 5th. Four analysts have rated the stock with a hold rating and six have issued a buy rating to the company's stock. According to MarketBeat, the stock has an average rating of "Moderate Buy" and a consensus price target of $20.30.

Check Out Our Latest Research Report on GTES

Gates Industrial Company Profile

(

Free Report)

Gates Industrial Corporation PLC designs and manufactures power transmission equipment. Its products serves harsh and hazardous industries such as agriculture, construction, manufacturing and energy, to everyday consumer applications such as printers, power washers, automatic doors and vacuum cleaners and virtually every form of transportation.

Read More

Before you consider Gates Industrial, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Gates Industrial wasn't on the list.

While Gates Industrial currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat has just released its list of 20 stocks that Wall Street analysts hate. These companies may appear to have good fundamentals, but top analysts smell something seriously rotten. Are any of these companies lurking around your portfolio? Find out by clicking the link below.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.