Cerity Partners LLC decreased its holdings in shares of GDS Holdings Limited (NASDAQ:GDS - Free Report) by 19.5% during the third quarter, according to its most recent disclosure with the SEC. The fund owned 1,211,256 shares of the company's stock after selling 293,311 shares during the period. Cerity Partners LLC owned approximately 0.64% of GDS worth $24,710,000 at the end of the most recent quarter.

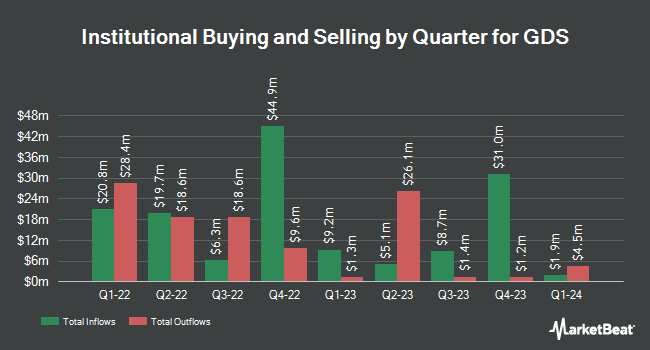

A number of other large investors have also modified their holdings of the business. Baupost Group LLC MA grew its stake in GDS by 63.5% during the 2nd quarter. Baupost Group LLC MA now owns 4,249,952 shares of the company's stock valued at $39,482,000 after purchasing an additional 1,649,952 shares during the last quarter. Farallon Capital Management LLC acquired a new position in GDS in the 1st quarter worth approximately $4,722,000. Swedbank AB purchased a new position in GDS during the 1st quarter worth approximately $2,174,000. Cubist Systematic Strategies LLC lifted its stake in GDS by 921.7% during the 2nd quarter. Cubist Systematic Strategies LLC now owns 112,568 shares of the company's stock valued at $1,046,000 after acquiring an additional 126,268 shares during the period. Finally, Pacer Advisors Inc. boosted its holdings in shares of GDS by 17.3% in the 2nd quarter. Pacer Advisors Inc. now owns 849,568 shares of the company's stock valued at $7,892,000 after acquiring an additional 125,395 shares during the last quarter. Hedge funds and other institutional investors own 33.71% of the company's stock.

GDS Price Performance

Shares of NASDAQ:GDS traded up $0.40 during trading on Monday, reaching $18.71. 1,065,673 shares of the company's stock traded hands, compared to its average volume of 1,614,171. The company has a quick ratio of 1.19, a current ratio of 1.19 and a debt-to-equity ratio of 2.25. GDS Holdings Limited has a fifty-two week low of $5.01 and a fifty-two week high of $24.74. The company has a 50-day simple moving average of $21.09 and a 200-day simple moving average of $14.76. The firm has a market cap of $3.57 billion, a PE ratio of -6.11 and a beta of 0.23.

Wall Street Analysts Forecast Growth

Several research firms have commented on GDS. Royal Bank of Canada upped their price target on shares of GDS from $14.00 to $26.00 and gave the company an "outperform" rating in a report on Monday, October 14th. Bank of America raised their target price on GDS from $12.40 to $22.40 and gave the stock a "buy" rating in a report on Tuesday, August 27th. Finally, Nomura Securities raised GDS to a "strong-buy" rating in a report on Monday, August 26th. One research analyst has rated the stock with a sell rating, one has given a hold rating, two have given a buy rating and one has issued a strong buy rating to the company. According to MarketBeat.com, the company presently has a consensus rating of "Moderate Buy" and an average price target of $18.47.

View Our Latest Stock Report on GDS

About GDS

(

Free Report)

GDS Holdings Limited, together with its subsidiaries, develops and operates data centers in the People's Republic of China. The company provides colocation services comprising critical facilities space, customer-available power, racks, and cooling; managed hosting services, including business continuity and disaster recovery, network management, data storage, system security, operating system, database, and server middleware services; managed cloud services; and consulting services.

Read More

Before you consider GDS, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and GDS wasn't on the list.

While GDS currently has a "Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's guide to investing in electric vehicle technologies (EV) and which EV stocks show the most promise.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.