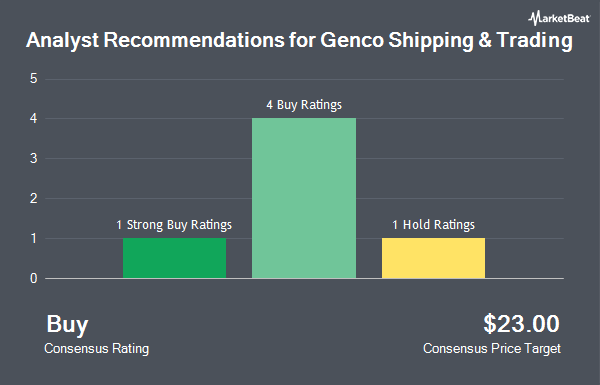

Shares of Genco Shipping & Trading Limited (NYSE:GNK - Get Free Report) have earned an average recommendation of "Moderate Buy" from the six brokerages that are presently covering the company, Marketbeat.com reports. Two analysts have rated the stock with a hold rating and four have assigned a buy rating to the company. The average twelve-month price objective among brokers that have issued a report on the stock in the last year is $24.20.

A number of research firms have commented on GNK. Deutsche Bank Aktiengesellschaft initiated coverage on shares of Genco Shipping & Trading in a research report on Wednesday, September 4th. They set a "buy" rating and a $22.00 price objective for the company. Stifel Nicolaus downgraded shares of Genco Shipping & Trading from a "buy" rating to a "hold" rating and cut their price objective for the stock from $26.00 to $17.00 in a research report on Wednesday, October 23rd. Finally, Jefferies Financial Group restated a "buy" rating and set a $25.00 price objective on shares of Genco Shipping & Trading in a report on Thursday, November 7th.

View Our Latest Research Report on GNK

Institutional Trading of Genco Shipping & Trading

Institutional investors have recently modified their holdings of the stock. Renaissance Technologies LLC lifted its position in Genco Shipping & Trading by 66.6% during the second quarter. Renaissance Technologies LLC now owns 1,050,030 shares of the shipping company's stock worth $22,376,000 after purchasing an additional 419,730 shares during the period. Charles Schwab Investment Management Inc. boosted its position in shares of Genco Shipping & Trading by 70.8% during the 3rd quarter. Charles Schwab Investment Management Inc. now owns 530,523 shares of the shipping company's stock worth $10,345,000 after acquiring an additional 219,907 shares in the last quarter. Algert Global LLC increased its stake in Genco Shipping & Trading by 694.2% in the second quarter. Algert Global LLC now owns 239,213 shares of the shipping company's stock valued at $5,098,000 after acquiring an additional 209,093 shares during the last quarter. American Century Companies Inc. raised its position in Genco Shipping & Trading by 16.4% during the second quarter. American Century Companies Inc. now owns 1,096,741 shares of the shipping company's stock valued at $23,372,000 after purchasing an additional 154,339 shares in the last quarter. Finally, Marshall Wace LLP acquired a new stake in shares of Genco Shipping & Trading in the 2nd quarter valued at $3,106,000. 58.62% of the stock is currently owned by institutional investors.

Genco Shipping & Trading Stock Down 1.5 %

GNK stock traded down $0.25 during mid-day trading on Tuesday, reaching $16.79. The company had a trading volume of 656,205 shares, compared to its average volume of 586,238. Genco Shipping & Trading has a 52 week low of $14.02 and a 52 week high of $23.43. The company has a market capitalization of $717.91 million, a price-to-earnings ratio of 10.69, a PEG ratio of 0.27 and a beta of 0.98. The company has a debt-to-equity ratio of 0.08, a current ratio of 3.09 and a quick ratio of 2.49. The stock has a 50 day simple moving average of $17.41 and a two-hundred day simple moving average of $19.04.

Genco Shipping & Trading (NYSE:GNK - Get Free Report) last announced its quarterly earnings results on Wednesday, November 6th. The shipping company reported $0.41 EPS for the quarter, meeting analysts' consensus estimates of $0.41. Genco Shipping & Trading had a net margin of 15.63% and a return on equity of 8.46%. The firm had revenue of $99.33 million during the quarter, compared to analysts' expectations of $72.02 million. During the same quarter last year, the company posted ($0.09) earnings per share. The company's revenue for the quarter was up 19.2% compared to the same quarter last year. As a group, equities analysts predict that Genco Shipping & Trading will post 1.74 earnings per share for the current fiscal year.

Genco Shipping & Trading Increases Dividend

The business also recently declared a quarterly dividend, which was paid on Monday, November 25th. Investors of record on Monday, November 18th were given a dividend of $0.40 per share. The ex-dividend date of this dividend was Monday, November 18th. This represents a $1.60 dividend on an annualized basis and a yield of 9.53%. This is an increase from Genco Shipping & Trading's previous quarterly dividend of $0.34. Genco Shipping & Trading's dividend payout ratio is currently 101.91%.

About Genco Shipping & Trading

(

Get Free ReportGenco Shipping & Trading Limited, together with its subsidiaries, engages in the ocean transportation of drybulk cargoes worldwide. The company owns and operates dry bulk vessels to transports iron ore, grains, coal, steel products, and other drybulk cargoes. It charters its vessels primarily to trading houses, including commodities traders; producers; and government-owned entities.

Featured Articles

Before you consider Genco Shipping & Trading, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Genco Shipping & Trading wasn't on the list.

While Genco Shipping & Trading currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Market downturns give many investors pause, and for good reason. Wondering how to offset this risk? Click the link below to learn more about using beta to protect yourself.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.