Bridges Investment Management Inc. trimmed its position in shares of Generac Holdings Inc. (NYSE:GNRC - Free Report) by 46.1% in the 3rd quarter, according to the company in its most recent Form 13F filing with the Securities and Exchange Commission. The fund owned 84,666 shares of the technology company's stock after selling 72,538 shares during the period. Bridges Investment Management Inc. owned about 0.14% of Generac worth $13,452,000 as of its most recent SEC filing.

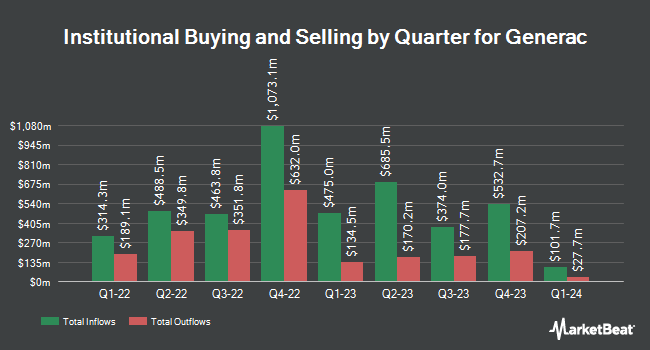

A number of other institutional investors also recently modified their holdings of GNRC. EntryPoint Capital LLC boosted its holdings in Generac by 73.2% in the first quarter. EntryPoint Capital LLC now owns 213 shares of the technology company's stock valued at $27,000 after acquiring an additional 90 shares in the last quarter. Sunbelt Securities Inc. increased its position in shares of Generac by 97.1% during the second quarter. Sunbelt Securities Inc. now owns 203 shares of the technology company's stock valued at $27,000 after buying an additional 100 shares during the period. Capital Advisors Ltd. LLC grew its holdings in shares of Generac by 611.1% during the 2nd quarter. Capital Advisors Ltd. LLC now owns 256 shares of the technology company's stock worth $34,000 after acquiring an additional 220 shares during the period. Blue Trust Inc. raised its holdings in Generac by 73.5% in the third quarter. Blue Trust Inc. now owns 229 shares of the technology company's stock worth $36,000 after purchasing an additional 97 shares in the last quarter. Finally, Fairfield Financial Advisors LTD purchased a new position in Generac during the second quarter valued at $38,000. 84.04% of the stock is currently owned by hedge funds and other institutional investors.

Generac Stock Performance

Shares of GNRC traded up $2.64 on Friday, reaching $189.35. The company's stock had a trading volume of 852,525 shares, compared to its average volume of 913,033. Generac Holdings Inc. has a 12-month low of $101.15 and a 12-month high of $190.42. The stock has a market capitalization of $11.27 billion, a P/E ratio of 39.28, a PEG ratio of 2.25 and a beta of 1.37. The company has a debt-to-equity ratio of 0.56, a current ratio of 2.03 and a quick ratio of 0.96. The stock's 50 day simple moving average is $159.83 and its two-hundred day simple moving average is $150.01.

Generac (NYSE:GNRC - Get Free Report) last posted its quarterly earnings data on Thursday, October 31st. The technology company reported $2.25 EPS for the quarter, topping the consensus estimate of $1.98 by $0.27. The firm had revenue of $1.17 billion during the quarter, compared to analyst estimates of $1.16 billion. Generac had a return on equity of 16.70% and a net margin of 7.17%. Generac's revenue was up 9.6% on a year-over-year basis. During the same period in the prior year, the business posted $1.64 EPS. Research analysts forecast that Generac Holdings Inc. will post 6.8 earnings per share for the current fiscal year.

Analyst Upgrades and Downgrades

A number of equities research analysts have weighed in on GNRC shares. Northland Securities upped their price objective on shares of Generac from $160.00 to $180.00 and gave the stock an "outperform" rating in a report on Thursday, August 1st. JPMorgan Chase & Co. lifted their price objective on Generac from $160.00 to $178.00 and gave the company a "neutral" rating in a research note on Thursday, October 17th. Stephens reissued an "overweight" rating and issued a $200.00 target price on shares of Generac in a research note on Monday, August 5th. StockNews.com raised Generac from a "hold" rating to a "buy" rating in a research report on Monday, October 28th. Finally, Citigroup raised their price objective on shares of Generac from $128.00 to $172.00 and gave the company a "neutral" rating in a research note on Tuesday, October 22nd. One equities research analyst has rated the stock with a sell rating, nine have given a hold rating and twelve have issued a buy rating to the company. According to data from MarketBeat.com, the company has a consensus rating of "Moderate Buy" and an average price target of $169.10.

Check Out Our Latest Report on GNRC

Insider Transactions at Generac

In related news, EVP Rajendra Kumar Kanuru sold 3,187 shares of the company's stock in a transaction on Wednesday, November 6th. The shares were sold at an average price of $183.58, for a total value of $585,069.46. Following the completion of the transaction, the executive vice president now owns 10,738 shares of the company's stock, valued at approximately $1,971,282.04. This represents a 0.00 % decrease in their position. The sale was disclosed in a filing with the SEC, which is accessible through this link. In other Generac news, CEO Aaron Jagdfeld sold 5,000 shares of the stock in a transaction that occurred on Tuesday, October 1st. The shares were sold at an average price of $158.93, for a total transaction of $794,650.00. Following the completion of the sale, the chief executive officer now directly owns 562,177 shares of the company's stock, valued at $89,346,790.61. This trade represents a 0.00 % decrease in their position. The sale was disclosed in a filing with the SEC, which is available through the SEC website. Also, EVP Rajendra Kumar Kanuru sold 3,187 shares of the business's stock in a transaction on Wednesday, November 6th. The stock was sold at an average price of $183.58, for a total transaction of $585,069.46. Following the completion of the sale, the executive vice president now owns 10,738 shares in the company, valued at approximately $1,971,282.04. The trade was a 0.00 % decrease in their position. The disclosure for this sale can be found here. Insiders have sold 42,268 shares of company stock valued at $7,584,853 over the last quarter. 2.90% of the stock is currently owned by company insiders.

About Generac

(

Free Report)

Generac Holdings Inc designs, manufactures, and distributes various energy technology products and solution worldwide. The company offers residential automatic standby generators, automatic transfer switch, air-cooled engine residential standby generators, and liquid-cooled engine generators; Mobile Link, a remote monitoring system for home standby generators; residential storage solution, which consists of a system of batteries, an inverter, photovoltaic optimizers, power electronic controls, and other components; smart home solutions, such as smart thermostats and a suite of home monitoring products.

Read More

Before you consider Generac, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Generac wasn't on the list.

While Generac currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Almost everyone loves strong dividend-paying stocks, but high yields can signal danger. Discover 20 high-yield dividend stocks paying an unsustainably large percentage of their earnings. Enter your email to get this report and avoid a high-yield dividend trap.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.