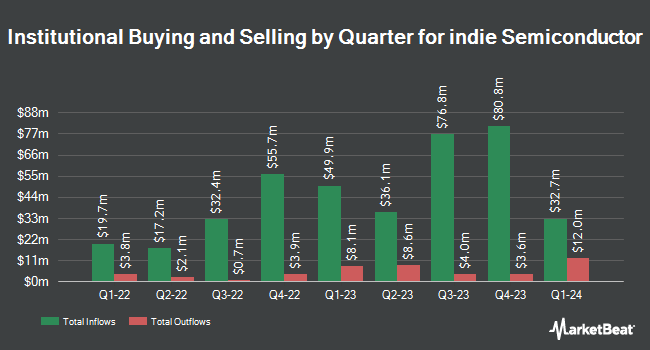

General American Investors Co. Inc. boosted its holdings in shares of indie Semiconductor, Inc. (NASDAQ:INDI - Free Report) by 46.5% in the 3rd quarter, according to the company in its most recent disclosure with the Securities and Exchange Commission (SEC). The fund owned 1,347,393 shares of the company's stock after purchasing an additional 427,928 shares during the period. General American Investors Co. Inc. owned approximately 0.68% of indie Semiconductor worth $5,376,000 at the end of the most recent quarter.

Other large investors have also recently added to or reduced their stakes in the company. Harbor Capital Advisors Inc. boosted its stake in shares of indie Semiconductor by 290.6% during the 3rd quarter. Harbor Capital Advisors Inc. now owns 3,195,910 shares of the company's stock worth $12,752,000 after acquiring an additional 2,377,612 shares in the last quarter. Tempus Wealth Planning LLC boosted its position in shares of indie Semiconductor by 61.6% in the 3rd quarter. Tempus Wealth Planning LLC now owns 36,121 shares of the company's stock valued at $144,000 after purchasing an additional 13,768 shares during the period. Creative Planning purchased a new position in indie Semiconductor in the 3rd quarter worth about $75,000. Artemis Investment Management LLP acquired a new stake in indie Semiconductor during the 3rd quarter worth about $4,478,000. Finally, American Trust purchased a new stake in indie Semiconductor during the second quarter valued at about $139,000. 67.73% of the stock is currently owned by institutional investors.

Insider Activity at indie Semiconductor

In related news, CFO Thomas Schiller sold 75,000 shares of the company's stock in a transaction on Tuesday, September 3rd. The shares were sold at an average price of $3.83, for a total value of $287,250.00. Following the completion of the sale, the chief financial officer now directly owns 977,192 shares in the company, valued at approximately $3,742,645.36. This represents a 0.00 % decrease in their ownership of the stock. The sale was disclosed in a document filed with the SEC, which is accessible through this link. Insiders own 8.20% of the company's stock.

indie Semiconductor Stock Down 1.7 %

Shares of NASDAQ:INDI traded down $0.06 during midday trading on Thursday, hitting $3.43. 2,918,721 shares of the stock were exchanged, compared to its average volume of 2,691,981. The business's fifty day simple moving average is $3.68 and its two-hundred day simple moving average is $5.15. The company has a debt-to-equity ratio of 0.31, a quick ratio of 2.20 and a current ratio of 2.66. indie Semiconductor, Inc. has a 52-week low of $3.16 and a 52-week high of $8.69. The company has a market capitalization of $677.14 million, a PE ratio of -6.88 and a beta of 1.22.

indie Semiconductor (NASDAQ:INDI - Get Free Report) last posted its quarterly earnings results on Thursday, August 8th. The company reported ($0.09) earnings per share for the quarter, hitting analysts' consensus estimates of ($0.09). indie Semiconductor had a negative return on equity of 22.48% and a negative net margin of 34.65%. The company had revenue of $52.40 million during the quarter, compared to the consensus estimate of $53.61 million. During the same period last year, the business earned ($0.11) EPS. The business's quarterly revenue was up .6% on a year-over-year basis. As a group, research analysts predict that indie Semiconductor, Inc. will post -0.7 earnings per share for the current fiscal year.

Analyst Upgrades and Downgrades

Several research firms have recently weighed in on INDI. Deutsche Bank Aktiengesellschaft dropped their target price on shares of indie Semiconductor from $9.00 to $7.00 and set a "buy" rating on the stock in a research report on Friday, August 9th. Benchmark cut their target price on shares of indie Semiconductor from $12.00 to $9.00 and set a "buy" rating on the stock in a research note on Tuesday. Finally, Roth Mkm decreased their target price on indie Semiconductor from $10.00 to $7.00 and set a "buy" rating for the company in a research report on Friday, August 9th. Seven analysts have rated the stock with a buy rating, According to MarketBeat, indie Semiconductor currently has a consensus rating of "Buy" and an average price target of $10.07.

Read Our Latest Research Report on INDI

About indie Semiconductor

(

Free Report)

indie Semiconductor, Inc provides automotive semiconductors and software solutions for advanced driver assistance systems, autonomous vehicle, in-cabin, connected car, and electrification applications in the United States, South America, rest of North America, Greater China, South Korea, rest of the Asia Pacific, and Europe.

Featured Stories

Before you consider indie Semiconductor, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and indie Semiconductor wasn't on the list.

While indie Semiconductor currently has a "Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Thinking about investing in Meta, Roblox, or Unity? Click the link to learn what streetwise investors need to know about the metaverse and public markets before making an investment.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.