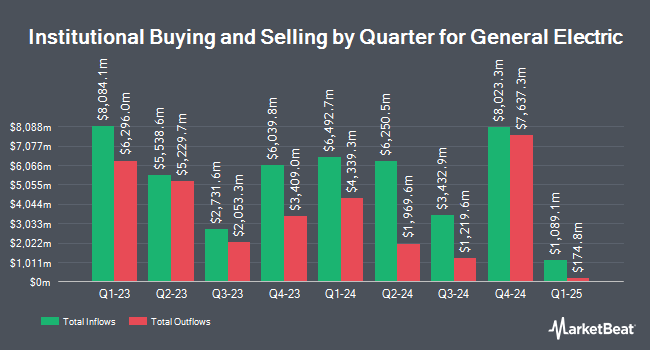

Retirement Systems of Alabama reduced its position in shares of General Electric (NYSE:GE - Free Report) by 7.1% during the 3rd quarter, according to its most recent Form 13F filing with the Securities and Exchange Commission. The institutional investor owned 554,037 shares of the conglomerate's stock after selling 42,038 shares during the quarter. Retirement Systems of Alabama owned 0.05% of General Electric worth $104,480,000 at the end of the most recent reporting period.

Other large investors have also recently added to or reduced their stakes in the company. Lantz Financial LLC boosted its holdings in shares of General Electric by 1.9% during the 2nd quarter. Lantz Financial LLC now owns 3,718 shares of the conglomerate's stock worth $591,000 after buying an additional 70 shares during the period. Silver Lake Advisory LLC acquired a new stake in General Electric during the 2nd quarter worth approximately $331,000. Valley National Advisers Inc. grew its holdings in General Electric by 6.7% in the 2nd quarter. Valley National Advisers Inc. now owns 2,003 shares of the conglomerate's stock valued at $318,000 after buying an additional 126 shares in the last quarter. Assenagon Asset Management S.A. lifted its holdings in shares of General Electric by 2.6% during the second quarter. Assenagon Asset Management S.A. now owns 30,462 shares of the conglomerate's stock worth $4,843,000 after buying an additional 762 shares in the last quarter. Finally, Triad Wealth Partners LLC bought a new stake in shares of General Electric in the second quarter valued at about $45,000. Institutional investors and hedge funds own 74.77% of the company's stock.

Analysts Set New Price Targets

GE has been the subject of several analyst reports. Wells Fargo & Company lifted their price objective on shares of General Electric from $210.00 to $225.00 and gave the stock an "overweight" rating in a research note on Wednesday. Sanford C. Bernstein raised their price objective on General Electric from $201.00 to $225.00 and gave the stock an "outperform" rating in a research note on Monday, October 14th. Deutsche Bank Aktiengesellschaft upped their target price on General Electric from $212.00 to $235.00 and gave the company a "buy" rating in a research report on Thursday, October 3rd. Bank of America raised their price target on General Electric from $180.00 to $200.00 and gave the stock a "buy" rating in a research report on Wednesday, October 23rd. Finally, Citigroup increased their price objective on shares of General Electric from $198.00 to $216.00 and gave the stock a "buy" rating in a research note on Thursday, October 10th. Two equities research analysts have rated the stock with a hold rating and fourteen have issued a buy rating to the company. According to data from MarketBeat, the company currently has an average rating of "Moderate Buy" and a consensus target price of $201.93.

Read Our Latest Report on General Electric

Insiders Place Their Bets

In other General Electric news, SVP Russell Stokes sold 15,550 shares of the company's stock in a transaction on Monday, November 18th. The shares were sold at an average price of $178.29, for a total transaction of $2,772,409.50. Following the transaction, the senior vice president now owns 148,857 shares in the company, valued at approximately $26,539,714.53. This represents a 9.46 % decrease in their ownership of the stock. The transaction was disclosed in a filing with the SEC, which is accessible through this hyperlink. Also, SVP Riccardo Procacci sold 7,000 shares of the company's stock in a transaction dated Wednesday, November 6th. The stock was sold at an average price of $181.13, for a total transaction of $1,267,910.00. Following the completion of the sale, the senior vice president now owns 13,289 shares in the company, valued at $2,407,036.57. This represents a 34.50 % decrease in their position. The disclosure for this sale can be found here. Company insiders own 0.66% of the company's stock.

General Electric Trading Up 0.7 %

NYSE:GE traded up $1.15 on Friday, reaching $165.98. 4,956,576 shares of the stock traded hands, compared to its average volume of 6,129,265. The company has a current ratio of 1.13, a quick ratio of 0.85 and a debt-to-equity ratio of 0.95. General Electric has a 1-year low of $95.92 and a 1-year high of $194.80. The company's 50 day moving average is $180.72 and its 200-day moving average is $172.42. The firm has a market capitalization of $179.64 billion, a price-to-earnings ratio of 29.17, a price-to-earnings-growth ratio of 1.66 and a beta of 1.17.

General Electric (NYSE:GE - Get Free Report) last announced its earnings results on Tuesday, October 22nd. The conglomerate reported $1.15 earnings per share for the quarter, topping analysts' consensus estimates of $1.13 by $0.02. The business had revenue of $9.84 billion during the quarter, compared to the consensus estimate of $9.02 billion. General Electric had a net margin of 11.48% and a return on equity of 18.93%. General Electric's quarterly revenue was up 5.8% on a year-over-year basis. During the same quarter last year, the firm earned $0.82 earnings per share. Equities research analysts anticipate that General Electric will post 4.24 EPS for the current fiscal year.

General Electric Dividend Announcement

The firm also recently declared a quarterly dividend, which will be paid on Monday, January 27th. Shareholders of record on Friday, December 27th will be paid a $0.28 dividend. This represents a $1.12 annualized dividend and a yield of 0.67%. General Electric's dividend payout ratio (DPR) is presently 19.68%.

About General Electric

(

Free Report)

General Electric Company, doing business as GE Aerospace, designs and produces commercial and defense aircraft engines, integrated engine components, electric power, and mechanical aircraft systems. It also offers aftermarket services to support its products. The company operates in the United States, Europe, China, Asia, the Americas, the Middle East, and Africa.

Recommended Stories

Before you consider General Electric, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and General Electric wasn't on the list.

While General Electric currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Need to stretch out your 401K or Roth IRA plan? Use these time-tested investing strategies to grow the monthly retirement income that your stock portfolio generates.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.