Staley Capital Advisers Inc. decreased its position in General Motors (NYSE:GM - Free Report) TSE: GMM.U by 1.9% in the fourth quarter, according to its most recent Form 13F filing with the SEC. The firm owned 1,327,017 shares of the auto manufacturer's stock after selling 25,410 shares during the period. General Motors accounts for about 3.1% of Staley Capital Advisers Inc.'s investment portfolio, making the stock its 8th biggest position. Staley Capital Advisers Inc. owned approximately 0.13% of General Motors worth $70,690,000 at the end of the most recent reporting period.

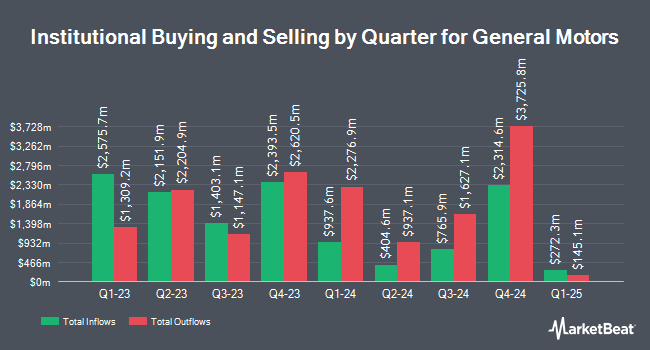

A number of other large investors have also recently modified their holdings of the company. Geode Capital Management LLC lifted its holdings in General Motors by 0.5% during the third quarter. Geode Capital Management LLC now owns 23,620,533 shares of the auto manufacturer's stock worth $1,055,395,000 after buying an additional 106,878 shares during the period. Hotchkis & Wiley Capital Management LLC lifted its holdings in General Motors by 6.1% during the third quarter. Hotchkis & Wiley Capital Management LLC now owns 17,278,448 shares of the auto manufacturer's stock worth $774,766,000 after buying an additional 989,750 shares during the period. Diamond Hill Capital Management Inc. lifted its holdings in General Motors by 3.9% during the third quarter. Diamond Hill Capital Management Inc. now owns 11,113,063 shares of the auto manufacturer's stock worth $498,310,000 after buying an additional 421,989 shares during the period. ACR Alpine Capital Research LLC lifted its holdings in General Motors by 39.8% during the fourth quarter. ACR Alpine Capital Research LLC now owns 7,397,404 shares of the auto manufacturer's stock worth $394,060,000 after buying an additional 2,104,528 shares during the period. Finally, Jacobs Levy Equity Management Inc. increased its position in shares of General Motors by 6.6% during the third quarter. Jacobs Levy Equity Management Inc. now owns 5,798,131 shares of the auto manufacturer's stock worth $259,988,000 after purchasing an additional 358,507 shares in the last quarter. Hedge funds and other institutional investors own 92.67% of the company's stock.

Wall Street Analyst Weigh In

GM has been the topic of a number of recent analyst reports. Wells Fargo & Company reaffirmed an "underweight" rating on shares of General Motors in a research report on Monday, February 3rd. The Goldman Sachs Group set a $73.00 price target on General Motors in a research report on Saturday, March 1st. Mizuho upped their price target on General Motors from $59.00 to $62.00 and gave the stock an "outperform" rating in a research report on Monday, December 9th. HSBC downgraded General Motors from a "buy" rating to a "hold" rating and set a $58.00 price target on the stock. in a research report on Wednesday, December 11th. Finally, Hsbc Global Res downgraded General Motors from a "strong-buy" rating to a "hold" rating in a research report on Wednesday, December 11th. Three analysts have rated the stock with a sell rating, eight have issued a hold rating and twelve have issued a buy rating to the company's stock. Based on data from MarketBeat.com, General Motors has a consensus rating of "Hold" and an average price target of $62.89.

View Our Latest Stock Analysis on GM

General Motors Price Performance

Shares of GM stock traded up $0.24 during mid-day trading on Tuesday, hitting $48.32. 21,878,027 shares of the stock were exchanged, compared to its average volume of 12,291,814. The firm has a fifty day moving average of $49.49 and a 200 day moving average of $50.51. The company has a quick ratio of 0.98, a current ratio of 1.13 and a debt-to-equity ratio of 1.38. General Motors has a 52-week low of $38.94 and a 52-week high of $61.24. The company has a market cap of $48.08 billion, a PE ratio of 7.86, a price-to-earnings-growth ratio of 0.67 and a beta of 1.42.

General Motors (NYSE:GM - Get Free Report) TSE: GMM.U last posted its earnings results on Tuesday, January 28th. The auto manufacturer reported $1.92 earnings per share (EPS) for the quarter, topping the consensus estimate of $1.75 by $0.17. General Motors had a net margin of 3.21% and a return on equity of 15.29%. Research analysts anticipate that General Motors will post 11.44 earnings per share for the current year.

General Motors Dividend Announcement

The business also recently declared a quarterly dividend, which will be paid on Thursday, March 20th. Investors of record on Friday, March 7th will be paid a $0.12 dividend. This represents a $0.48 dividend on an annualized basis and a yield of 0.99%. The ex-dividend date is Friday, March 7th. General Motors's dividend payout ratio is presently 7.80%.

General Motors announced that its board has approved a share buyback plan on Wednesday, February 26th that allows the company to repurchase $6.00 billion in shares. This repurchase authorization allows the auto manufacturer to buy up to 12.5% of its stock through open market purchases. Stock repurchase plans are often an indication that the company's management believes its shares are undervalued.

Insider Activity at General Motors

In related news, Director Alfred F. Kelly, Jr. purchased 12,000 shares of the firm's stock in a transaction that occurred on Thursday, January 30th. The shares were purchased at an average cost of $50.66 per share, with a total value of $607,920.00. Following the purchase, the director now owns 13,714 shares of the company's stock, valued at $694,751.24. This represents a 700.12 % increase in their position. The acquisition was disclosed in a filing with the Securities & Exchange Commission, which is available through this hyperlink. 0.72% of the stock is currently owned by corporate insiders.

About General Motors

(

Free Report)

General Motors Company designs, builds, and sells trucks, crossovers, cars, and automobile parts; and provide software-enabled services and subscriptions worldwide. The company operates through GM North America, GM International, Cruise, and GM Financial segments. It markets its vehicles primarily under the Buick, Cadillac, Chevrolet, GMC, Baojun, and Wuling brand names.

See Also

Before you consider General Motors, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and General Motors wasn't on the list.

While General Motors currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's list of seven stocks and why their long-term outlooks are very promising.

Get This Free Report