Generali Asset Management SPA SGR acquired a new position in shares of Akamai Technologies, Inc. (NASDAQ:AKAM - Free Report) during the 4th quarter, according to its most recent Form 13F filing with the Securities & Exchange Commission. The fund acquired 8,797 shares of the technology infrastructure company's stock, valued at approximately $841,000.

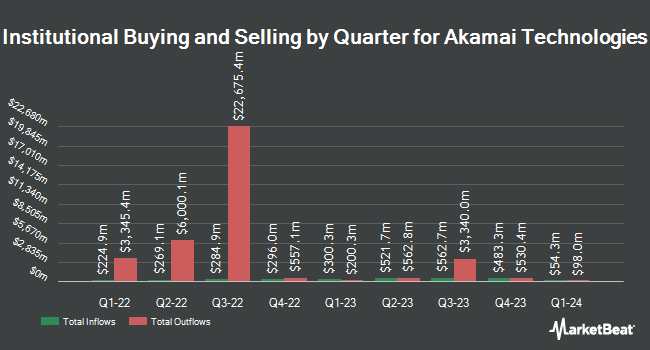

A number of other hedge funds and other institutional investors have also added to or reduced their stakes in AKAM. National Pension Service boosted its stake in shares of Akamai Technologies by 595.3% during the 4th quarter. National Pension Service now owns 318,912 shares of the technology infrastructure company's stock worth $30,504,000 after purchasing an additional 273,043 shares during the period. Geode Capital Management LLC boosted its position in shares of Akamai Technologies by 5.1% during the third quarter. Geode Capital Management LLC now owns 4,197,009 shares of the technology infrastructure company's stock valued at $423,066,000 after buying an additional 202,746 shares during the period. Tredje AP fonden boosted its position in shares of Akamai Technologies by 580.4% during the fourth quarter. Tredje AP fonden now owns 169,777 shares of the technology infrastructure company's stock valued at $16,239,000 after buying an additional 144,823 shares during the period. Retirement Systems of Alabama grew its stake in shares of Akamai Technologies by 20.0% during the third quarter. Retirement Systems of Alabama now owns 837,155 shares of the technology infrastructure company's stock valued at $84,511,000 after buying an additional 139,760 shares during the last quarter. Finally, Nordea Investment Management AB raised its holdings in shares of Akamai Technologies by 6.9% in the fourth quarter. Nordea Investment Management AB now owns 2,140,257 shares of the technology infrastructure company's stock worth $205,743,000 after buying an additional 138,380 shares during the period. 94.28% of the stock is currently owned by hedge funds and other institutional investors.

Analysts Set New Price Targets

A number of equities analysts recently issued reports on AKAM shares. Citigroup dropped their price objective on Akamai Technologies from $102.00 to $95.00 and set a "neutral" rating for the company in a report on Monday, February 24th. Royal Bank of Canada cut their price target on shares of Akamai Technologies from $100.00 to $90.00 and set a "sector perform" rating on the stock in a report on Friday, February 21st. TD Cowen lowered shares of Akamai Technologies from a "buy" rating to a "hold" rating and decreased their price objective for the company from $125.00 to $98.00 in a report on Friday, February 21st. Evercore ISI restated an "outperform" rating and issued a $110.00 target price on shares of Akamai Technologies in a research note on Tuesday, December 17th. Finally, Raymond James decreased their price target on shares of Akamai Technologies from $115.00 to $110.00 and set an "outperform" rating for the company in a research note on Friday, February 21st. One analyst has rated the stock with a sell rating, ten have assigned a hold rating, ten have assigned a buy rating and two have assigned a strong buy rating to the company. According to MarketBeat, Akamai Technologies has an average rating of "Moderate Buy" and an average target price of $106.55.

Check Out Our Latest Analysis on AKAM

Akamai Technologies Stock Down 1.1 %

Shares of AKAM stock traded down $0.92 during trading hours on Tuesday, reaching $81.85. 2,086,165 shares of the company's stock were exchanged, compared to its average volume of 1,830,108. Akamai Technologies, Inc. has a fifty-two week low of $75.50 and a fifty-two week high of $110.14. The stock's 50 day moving average is $90.45 and its 200-day moving average is $95.09. The company has a current ratio of 1.23, a quick ratio of 1.33 and a debt-to-equity ratio of 0.49. The company has a market cap of $12.30 billion, a price-to-earnings ratio of 25.11, a P/E/G ratio of 2.74 and a beta of 0.68.

Akamai Technologies (NASDAQ:AKAM - Get Free Report) last released its quarterly earnings results on Thursday, February 20th. The technology infrastructure company reported $1.19 EPS for the quarter, missing analysts' consensus estimates of $1.52 by ($0.33). Akamai Technologies had a net margin of 12.65% and a return on equity of 14.35%. The business had revenue of $1.02 billion during the quarter, compared to analysts' expectations of $1.02 billion. Analysts predict that Akamai Technologies, Inc. will post 4.6 earnings per share for the current fiscal year.

Insiders Place Their Bets

In related news, EVP Mani Sundaram sold 10,683 shares of the stock in a transaction that occurred on Friday, March 7th. The shares were sold at an average price of $86.52, for a total value of $924,293.16. Following the transaction, the executive vice president now owns 23,988 shares in the company, valued at approximately $2,075,441.76. This represents a 30.81 % decrease in their position. The sale was disclosed in a filing with the Securities & Exchange Commission, which can be accessed through this link. Also, EVP Aaron Ahola sold 4,000 shares of Akamai Technologies stock in a transaction that occurred on Friday, March 14th. The shares were sold at an average price of $80.92, for a total transaction of $323,680.00. Following the sale, the executive vice president now owns 25,211 shares of the company's stock, valued at approximately $2,040,074.12. The trade was a 13.69 % decrease in their ownership of the stock. The disclosure for this sale can be found here. Over the last quarter, insiders sold 35,394 shares of company stock valued at $3,019,323. Insiders own 1.80% of the company's stock.

Akamai Technologies Profile

(

Free Report)

Akamai Technologies, Inc provides cloud computing, security, and content delivery services in the United States and internationally. The company offers cloud solutions to keep infrastructure, websites, applications, application programming interfaces, and users safe from various cyberattacks and online threats while enhancing performance.

Featured Articles

Before you consider Akamai Technologies, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Akamai Technologies wasn't on the list.

While Akamai Technologies currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's list of seven stocks and why their long-term outlooks are very promising.

Get This Free Report