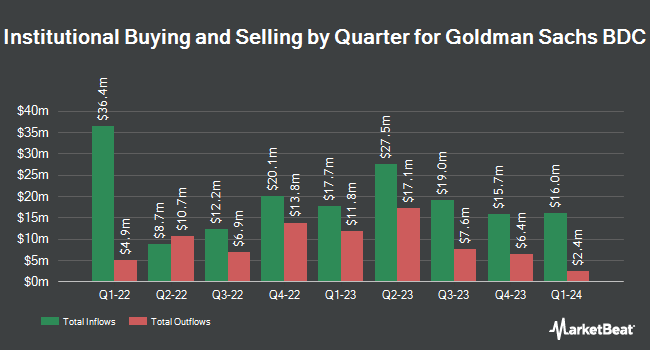

Generali Asset Management SPA SGR acquired a new stake in shares of Goldman Sachs BDC, Inc. (NYSE:GSBD - Free Report) in the fourth quarter, according to the company in its most recent filing with the SEC. The firm acquired 1,064,367 shares of the financial services provider's stock, valued at approximately $12,879,000. Generali Asset Management SPA SGR owned about 0.91% of Goldman Sachs BDC as of its most recent filing with the SEC.

Several other institutional investors and hedge funds have also recently modified their holdings of the business. Vision Financial Markets LLC acquired a new position in Goldman Sachs BDC in the fourth quarter valued at approximately $27,000. Nomura Asset Management Co. Ltd. grew its holdings in shares of Goldman Sachs BDC by 149.1% during the third quarter. Nomura Asset Management Co. Ltd. now owns 2,130 shares of the financial services provider's stock worth $29,000 after buying an additional 1,275 shares during the last quarter. Chicago Partners Investment Group LLC purchased a new stake in Goldman Sachs BDC in the 4th quarter valued at approximately $128,000. Wealthcare Advisory Partners LLC acquired a new stake in shares of Goldman Sachs BDC during the 4th quarter valued at approximately $135,000. Finally, Canton Hathaway LLC acquired a new stake in shares of Goldman Sachs BDC during the 4th quarter valued at approximately $137,000. Hedge funds and other institutional investors own 28.72% of the company's stock.

Analyst Upgrades and Downgrades

Separately, StockNews.com cut shares of Goldman Sachs BDC from a "hold" rating to a "sell" rating in a research note on Saturday, March 15th.

Get Our Latest Research Report on Goldman Sachs BDC

Goldman Sachs BDC Stock Performance

NYSE:GSBD traded down $0.02 during midday trading on Friday, reaching $12.26. The stock had a trading volume of 774,184 shares, compared to its average volume of 752,574. The company has a debt-to-equity ratio of 1.19, a current ratio of 1.26 and a quick ratio of 1.26. The stock has a market capitalization of $1.44 billion, a P/E ratio of 17.51 and a beta of 1.06. The firm's fifty day simple moving average is $12.61 and its 200-day simple moving average is $13.03. Goldman Sachs BDC, Inc. has a 1-year low of $11.72 and a 1-year high of $15.94.

Goldman Sachs BDC Increases Dividend

The firm also recently disclosed a quarterly dividend, which will be paid on Monday, April 28th. Stockholders of record on Monday, March 31st will be given a $0.16 dividend. This represents a $0.64 dividend on an annualized basis and a dividend yield of 5.22%. The ex-dividend date is Monday, March 31st. This is a positive change from Goldman Sachs BDC's previous quarterly dividend of $0.05. Goldman Sachs BDC's payout ratio is currently 224.56%.

Goldman Sachs BDC Profile

(

Free Report)

Goldman Sachs BDC, Inc is a business development company specializing in middle market and mezzanine investment in private companies. It seeks to make capital appreciation through direct originations of secured debt, senior secured debt, junior secured debt, including first lien, first lien/last-out unitranche and second lien debt, unsecured debt, including mezzanine debt and, to a lesser extent, investments in equities.

Featured Stories

Before you consider Goldman Sachs BDC, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Goldman Sachs BDC wasn't on the list.

While Goldman Sachs BDC currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Discover the top 7 AI stocks to invest in right now. This exclusive report highlights the companies leading the AI revolution and shaping the future of technology in 2025.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.