Generali Investments CEE investicni spolecnost a.s. bought a new position in shares of Southern Copper Co. (NYSE:SCCO - Free Report) during the fourth quarter, according to its most recent filing with the Securities and Exchange Commission. The institutional investor bought 14,969 shares of the basic materials company's stock, valued at approximately $1,364,000.

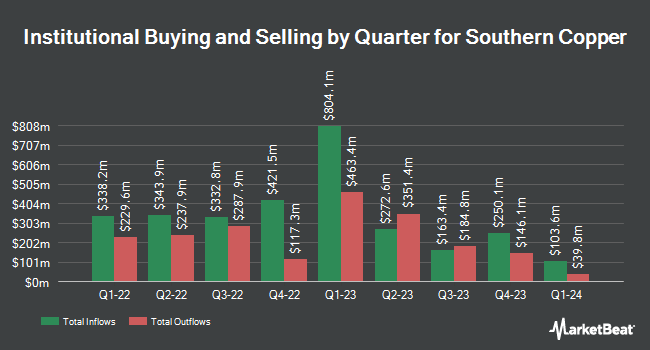

Several other hedge funds and other institutional investors also recently added to or reduced their stakes in SCCO. Connor Clark & Lunn Investment Management Ltd. raised its holdings in shares of Southern Copper by 7.2% in the 3rd quarter. Connor Clark & Lunn Investment Management Ltd. now owns 230,495 shares of the basic materials company's stock valued at $26,661,000 after purchasing an additional 15,386 shares in the last quarter. Nordea Investment Management AB increased its holdings in shares of Southern Copper by 15.3% in the 4th quarter. Nordea Investment Management AB now owns 108,753 shares of the basic materials company's stock valued at $9,969,000 after acquiring an additional 14,391 shares during the period. Two Sigma Advisers LP raised its position in Southern Copper by 384.4% in the 3rd quarter. Two Sigma Advisers LP now owns 90,173 shares of the basic materials company's stock valued at $10,430,000 after purchasing an additional 71,558 shares during the last quarter. JPMorgan Chase & Co. boosted its stake in Southern Copper by 74.6% during the 3rd quarter. JPMorgan Chase & Co. now owns 1,402,983 shares of the basic materials company's stock worth $162,283,000 after purchasing an additional 599,610 shares during the period. Finally, Robeco Institutional Asset Management B.V. grew its position in Southern Copper by 22.2% during the 4th quarter. Robeco Institutional Asset Management B.V. now owns 137,019 shares of the basic materials company's stock worth $12,487,000 after purchasing an additional 24,933 shares during the last quarter. Hedge funds and other institutional investors own 7.94% of the company's stock.

Wall Street Analysts Forecast Growth

SCCO has been the subject of a number of research reports. Scotiabank upped their target price on shares of Southern Copper from $52.00 to $72.00 and gave the company a "sector underperform" rating in a report on Monday. Morgan Stanley upgraded Southern Copper from an "underweight" rating to an "equal weight" rating and lowered their target price for the company from $106.30 to $102.00 in a research note on Thursday, December 12th. Finally, JPMorgan Chase & Co. upgraded Southern Copper from an "underweight" rating to a "neutral" rating and set a $92.50 price target for the company in a research note on Monday, December 2nd. Four research analysts have rated the stock with a sell rating, three have assigned a hold rating and three have given a buy rating to the company's stock. According to MarketBeat.com, the stock currently has an average rating of "Hold" and an average price target of $97.31.

Get Our Latest Stock Report on SCCO

Southern Copper Price Performance

Shares of Southern Copper stock traded up $1.44 during trading on Wednesday, hitting $90.30. 1,338,398 shares of the company were exchanged, compared to its average volume of 1,257,328. The company has a quick ratio of 2.31, a current ratio of 2.77 and a debt-to-equity ratio of 0.64. The firm has a 50 day moving average price of $93.72 and a 200 day moving average price of $100.87. The stock has a market capitalization of $70.93 billion, a price-to-earnings ratio of 20.90, a P/E/G ratio of 1.90 and a beta of 1.12. Southern Copper Co. has a fifty-two week low of $84.33 and a fifty-two week high of $129.79.

Southern Copper (NYSE:SCCO - Get Free Report) last issued its quarterly earnings results on Wednesday, February 12th. The basic materials company reported $1.01 EPS for the quarter, missing analysts' consensus estimates of $1.02 by ($0.01). Southern Copper had a return on equity of 40.27% and a net margin of 29.53%. On average, equities analysts expect that Southern Copper Co. will post 4.66 earnings per share for the current fiscal year.

Southern Copper Increases Dividend

The business also recently declared a quarterly dividend, which was paid on Thursday, February 27th. Shareholders of record on Tuesday, February 11th were issued a $0.70 dividend. This represents a $2.80 dividend on an annualized basis and a dividend yield of 3.10%. The ex-dividend date was Tuesday, February 11th. This is a positive change from Southern Copper's previous quarterly dividend of $0.60. Southern Copper's dividend payout ratio (DPR) is 64.81%.

Southern Copper Company Profile

(

Free Report)

Southern Copper Corporation engages in mining, exploring, smelting, and refining copper and other minerals in Peru, Mexico, Argentina, Ecuador, and Chile. The company is involved in the mining, milling, and flotation of copper ore to produce copper and molybdenum concentrates; smelting of copper concentrates to produce blister and anode copper; refining of anode copper to produce copper cathodes; production of molybdenum concentrate and sulfuric acid; production of refined silver, gold, and other materials; and mining and processing of zinc, copper, molybdenum, silver, gold, and lead.

Further Reading

Before you consider Southern Copper, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Southern Copper wasn't on the list.

While Southern Copper currently has a Reduce rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's list of seven stocks and why their long-term outlooks are very promising.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.