Generali Investments CEE investicni spolecnost a.s. acquired a new position in shares of Sasol Limited (NYSE:SSL - Free Report) in the fourth quarter, according to its most recent 13F filing with the Securities and Exchange Commission (SEC). The firm acquired 367,196 shares of the oil and gas company's stock, valued at approximately $1,674,000. Generali Investments CEE investicni spolecnost a.s. owned about 0.06% of Sasol at the end of the most recent reporting period.

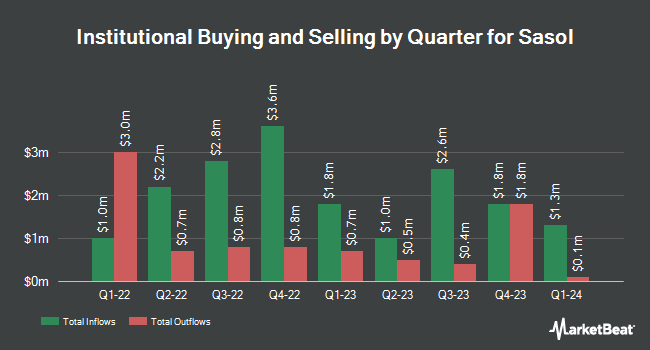

A number of other hedge funds and other institutional investors also recently made changes to their positions in the stock. ABC Arbitrage SA acquired a new stake in shares of Sasol during the fourth quarter worth $730,000. Barclays PLC grew its holdings in Sasol by 255.9% during the 3rd quarter. Barclays PLC now owns 9,912 shares of the oil and gas company's stock worth $67,000 after acquiring an additional 7,127 shares during the period. SBI Securities Co. Ltd. bought a new position in shares of Sasol in the 4th quarter worth about $50,000. Point72 Asset Management L.P. boosted its position in shares of Sasol by 312.8% during the 3rd quarter. Point72 Asset Management L.P. now owns 296,800 shares of the oil and gas company's stock valued at $2,006,000 after purchasing an additional 224,900 shares in the last quarter. Finally, Blue Trust Inc. grew its stake in Sasol by 80.4% during the fourth quarter. Blue Trust Inc. now owns 21,456 shares of the oil and gas company's stock worth $98,000 after purchasing an additional 9,564 shares during the period. 1.21% of the stock is owned by institutional investors and hedge funds.

Sasol Stock Up 0.3 %

Sasol stock traded up $0.02 during mid-day trading on Wednesday, reaching $4.41. The stock had a trading volume of 739,319 shares, compared to its average volume of 1,175,773. The firm has a market capitalization of $2.86 billion, a PE ratio of 1.94, a price-to-earnings-growth ratio of 0.17 and a beta of 2.31. Sasol Limited has a fifty-two week low of $4.04 and a fifty-two week high of $9.33. The stock's 50-day simple moving average is $4.64 and its 200-day simple moving average is $5.57. The company has a debt-to-equity ratio of 0.89, a quick ratio of 1.58 and a current ratio of 2.33.

Wall Street Analyst Weigh In

SSL has been the topic of a number of research analyst reports. StockNews.com upgraded Sasol from a "hold" rating to a "buy" rating in a report on Thursday, March 6th. Bank of America cut shares of Sasol from a "buy" rating to a "neutral" rating in a report on Thursday, February 6th.

Get Our Latest Report on Sasol

Sasol Profile

(

Free Report)

Sasol Limited operates as a chemical and energy company in South Africa and internationally. It offers alumina, such as battery materials, catalyst supports, abrasives and polishing, and polymer additives; cobalt fischer-tropsch catalysts; carbon-based and recarburiser products; graphite electrodes; and mono-ethylene glycol and chlor-alkali products, monomers, mining chemicals and reagents, blends and hydrocarbons, methanol products, polymers, phenolics, and fertilizers.

See Also

Before you consider Sasol, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Sasol wasn't on the list.

While Sasol currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's guide to investing in 5G and which 5G stocks show the most promise.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.