Generali Investments Management Co LLC bought a new stake in Mondelez International, Inc. (NASDAQ:MDLZ - Free Report) in the 4th quarter, according to the company in its most recent 13F filing with the Securities and Exchange Commission. The institutional investor bought 21,380 shares of the company's stock, valued at approximately $1,277,000.

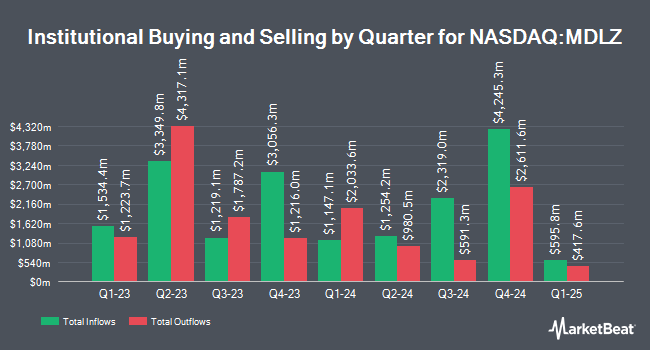

Several other large investors have also modified their holdings of the stock. Truvestments Capital LLC purchased a new stake in Mondelez International in the 3rd quarter valued at $25,000. Prospera Private Wealth LLC purchased a new stake in Mondelez International in the 3rd quarter valued at $27,000. Marshall Investment Management LLC purchased a new stake in Mondelez International in the 4th quarter valued at $26,000. Hager Investment Management Services LLC purchased a new stake in Mondelez International in the 4th quarter valued at $27,000. Finally, Kohmann Bosshard Financial Services LLC purchased a new stake in Mondelez International in the 4th quarter valued at $31,000. Institutional investors and hedge funds own 78.32% of the company's stock.

Analyst Ratings Changes

A number of equities analysts have commented on MDLZ shares. UBS Group cut their price objective on shares of Mondelez International from $76.00 to $63.00 and set a "neutral" rating for the company in a research report on Thursday, January 16th. Argus downgraded shares of Mondelez International from a "buy" rating to a "hold" rating in a research report on Friday, February 21st. Stifel Nicolaus cut their price target on shares of Mondelez International from $82.00 to $70.00 and set a "buy" rating for the company in a report on Friday, January 24th. Citigroup cut their price target on shares of Mondelez International from $78.00 to $71.00 and set a "buy" rating for the company in a report on Wednesday, January 8th. Finally, Royal Bank of Canada cut their price target on shares of Mondelez International from $75.00 to $69.00 and set an "outperform" rating for the company in a report on Thursday, February 6th. One analyst has rated the stock with a sell rating, seven have issued a hold rating and thirteen have issued a buy rating to the company. According to MarketBeat.com, Mondelez International presently has a consensus rating of "Moderate Buy" and a consensus target price of $69.74.

View Our Latest Stock Report on Mondelez International

Mondelez International Trading Up 0.9 %

MDLZ stock traded up $0.56 during trading on Friday, reaching $64.51. 25,429,793 shares of the stock traded hands, compared to its average volume of 7,508,716. The firm has a market capitalization of $83.45 billion, a PE ratio of 18.86, a P/E/G ratio of 4.34 and a beta of 0.50. The company has a debt-to-equity ratio of 0.58, a current ratio of 0.68 and a quick ratio of 0.48. The business's 50 day moving average price is $61.35 and its 200-day moving average price is $65.13. Mondelez International, Inc. has a 52-week low of $53.95 and a 52-week high of $76.06.

Mondelez International (NASDAQ:MDLZ - Get Free Report) last posted its earnings results on Tuesday, February 4th. The company reported $0.65 earnings per share (EPS) for the quarter, missing analysts' consensus estimates of $0.66 by ($0.01). Mondelez International had a return on equity of 16.75% and a net margin of 12.68%. As a group, sell-side analysts forecast that Mondelez International, Inc. will post 2.9 earnings per share for the current year.

Mondelez International Announces Dividend

The business also recently disclosed a quarterly dividend, which will be paid on Monday, April 14th. Shareholders of record on Monday, March 31st will be given a $0.47 dividend. This represents a $1.88 annualized dividend and a yield of 2.91%. The ex-dividend date is Monday, March 31st. Mondelez International's dividend payout ratio (DPR) is presently 54.97%.

Mondelez International announced that its board has initiated a share repurchase plan on Wednesday, December 11th that authorizes the company to repurchase $9.00 billion in shares. This repurchase authorization authorizes the company to buy up to 10.7% of its stock through open market purchases. Stock repurchase plans are typically an indication that the company's board believes its shares are undervalued.

Mondelez International Company Profile

(

Free Report)

Mondelez International, Inc, through its subsidiaries, manufactures, markets, and sells snack food and beverage products in the Latin America, North America, Asia, the Middle East, Africa, and Europe. It provides biscuits and baked snacks, including cookies, crackers, salted snacks, snack bars, and cakes and pastries; chocolates; and gums and candies, as well as various cheese and grocery, and powdered beverage products.

Read More

Before you consider Mondelez International, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Mondelez International wasn't on the list.

While Mondelez International currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Which stocks are likely to thrive in today's challenging market? Enter your email address and we'll send you MarketBeat's list of ten stocks that will drive in any economic environment.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.