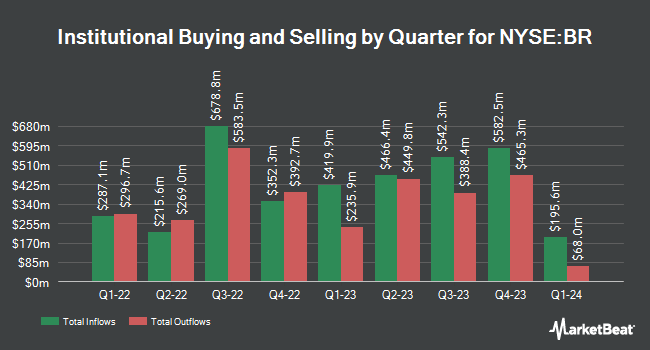

Geneva Capital Management LLC decreased its holdings in Broadridge Financial Solutions, Inc. (NYSE:BR - Free Report) by 2.6% during the 3rd quarter, according to the company in its most recent filing with the SEC. The fund owned 108,842 shares of the business services provider's stock after selling 2,942 shares during the period. Geneva Capital Management LLC owned approximately 0.09% of Broadridge Financial Solutions worth $23,404,000 as of its most recent SEC filing.

Several other hedge funds and other institutional investors also recently modified their holdings of the business. Bogart Wealth LLC lifted its holdings in Broadridge Financial Solutions by 384.0% during the 3rd quarter. Bogart Wealth LLC now owns 121 shares of the business services provider's stock worth $26,000 after buying an additional 96 shares during the period. EdgeRock Capital LLC acquired a new position in Broadridge Financial Solutions during the 2nd quarter worth about $32,000. Rothschild Investment LLC acquired a new position in Broadridge Financial Solutions during the 2nd quarter worth about $32,000. New Covenant Trust Company N.A. acquired a new position in Broadridge Financial Solutions during the 1st quarter worth about $34,000. Finally, Family Firm Inc. acquired a new position in Broadridge Financial Solutions during the 2nd quarter worth about $37,000. Institutional investors own 90.03% of the company's stock.

Analysts Set New Price Targets

Several research analysts have commented on BR shares. StockNews.com downgraded Broadridge Financial Solutions from a "buy" rating to a "hold" rating in a report on Saturday. Morgan Stanley lifted their price objective on Broadridge Financial Solutions from $200.00 to $207.00 and gave the stock an "equal weight" rating in a research report on Wednesday, November 6th. JPMorgan Chase & Co. lifted their price objective on Broadridge Financial Solutions from $224.00 to $225.00 and gave the stock a "neutral" rating in a research report on Tuesday, August 20th. Finally, Royal Bank of Canada reissued an "outperform" rating and issued a $246.00 price objective on shares of Broadridge Financial Solutions in a research report on Wednesday, November 6th. Four analysts have rated the stock with a hold rating and three have issued a buy rating to the company. According to MarketBeat.com, the company has a consensus rating of "Hold" and a consensus target price of $217.83.

Read Our Latest Research Report on Broadridge Financial Solutions

Insider Activity at Broadridge Financial Solutions

In related news, VP Thomas P. Carey sold 10,757 shares of the company's stock in a transaction that occurred on Monday, November 11th. The stock was sold at an average price of $226.82, for a total value of $2,439,902.74. Following the transaction, the vice president now owns 12,689 shares in the company, valued at approximately $2,878,118.98. This represents a 0.00 % decrease in their ownership of the stock. The transaction was disclosed in a document filed with the Securities & Exchange Commission, which is accessible through this link. In other Broadridge Financial Solutions news, VP Thomas P. Carey sold 10,757 shares of the stock in a transaction on Monday, November 11th. The stock was sold at an average price of $226.82, for a total transaction of $2,439,902.74. Following the sale, the vice president now owns 12,689 shares in the company, valued at $2,878,118.98. This represents a 0.00 % decrease in their ownership of the stock. The transaction was disclosed in a legal filing with the SEC, which is available at this link. Also, Chairman Richard J. Daly sold 21,938 shares of the stock in a transaction on Friday, September 6th. The stock was sold at an average price of $207.66, for a total value of $4,555,645.08. Following the sale, the chairman now owns 105,094 shares in the company, valued at approximately $21,823,820.04. This represents a 0.00 % decrease in their position. The disclosure for this sale can be found here. Over the last quarter, insiders have sold 140,996 shares of company stock worth $30,073,732. Insiders own 1.30% of the company's stock.

Broadridge Financial Solutions Stock Up 0.9 %

BR traded up $1.94 during midday trading on Wednesday, reaching $228.80. 114,760 shares of the company were exchanged, compared to its average volume of 518,534. The company has a debt-to-equity ratio of 1.63, a quick ratio of 1.39 and a current ratio of 1.39. The company's fifty day moving average price is $214.87 and its 200 day moving average price is $207.51. The company has a market cap of $26.74 billion, a price-to-earnings ratio of 39.65 and a beta of 1.05. Broadridge Financial Solutions, Inc. has a one year low of $179.79 and a one year high of $229.34.

Broadridge Financial Solutions (NYSE:BR - Get Free Report) last announced its earnings results on Tuesday, November 5th. The business services provider reported $1.00 earnings per share for the quarter, topping analysts' consensus estimates of $0.97 by $0.03. Broadridge Financial Solutions had a return on equity of 41.79% and a net margin of 10.57%. The firm had revenue of $1.42 billion for the quarter, compared to the consensus estimate of $1.48 billion. During the same quarter in the previous year, the business earned $1.09 EPS. The company's revenue was down .6% compared to the same quarter last year. As a group, analysts expect that Broadridge Financial Solutions, Inc. will post 8.53 EPS for the current year.

Broadridge Financial Solutions Profile

(

Free Report)

Broadridge Financial Solutions, Inc provides investor communications and technology-driven solutions for the financial services industry. The company's Investor Communication Solutions segment processes and distributes proxy materials to investors in equity securities and mutual funds, as well as facilitates related vote processing services; and distributes regulatory reports, class action, and corporate action/reorganization event information, as well as tax reporting solutions.

Featured Articles

Before you consider Broadridge Financial Solutions, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Broadridge Financial Solutions wasn't on the list.

While Broadridge Financial Solutions currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's list of the 10 best stocks to own in 2025 and why they should be in your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.