Retirement Systems of Alabama decreased its holdings in shares of Genpact Limited (NYSE:G - Free Report) by 3.4% during the 3rd quarter, according to the company in its most recent filing with the Securities and Exchange Commission (SEC). The institutional investor owned 434,605 shares of the business services provider's stock after selling 15,240 shares during the period. Retirement Systems of Alabama owned 0.25% of Genpact worth $17,041,000 at the end of the most recent reporting period.

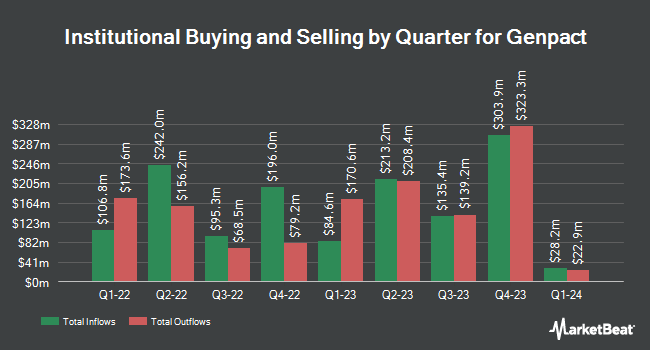

Other hedge funds also recently modified their holdings of the company. CWM LLC boosted its stake in Genpact by 160.8% during the 2nd quarter. CWM LLC now owns 952 shares of the business services provider's stock valued at $31,000 after purchasing an additional 587 shares during the last quarter. Blue Trust Inc. boosted its stake in Genpact by 11,038.0% in the 2nd quarter. Blue Trust Inc. now owns 8,799 shares of the business services provider's stock worth $290,000 after purchasing an additional 8,720 shares during the period. Nisa Investment Advisors LLC boosted its position in shares of Genpact by 329.6% in the second quarter. Nisa Investment Advisors LLC now owns 10,525 shares of the business services provider's stock valued at $339,000 after acquiring an additional 8,075 shares during the period. Lecap Asset Management Ltd. purchased a new stake in shares of Genpact in the second quarter worth $570,000. Finally, Bank of New York Mellon Corp grew its holdings in shares of Genpact by 8.9% during the second quarter. Bank of New York Mellon Corp now owns 1,512,259 shares of the business services provider's stock worth $48,680,000 after purchasing an additional 122,993 shares in the last quarter. Institutional investors own 96.03% of the company's stock.

Insider Transactions at Genpact

In other news, CEO Balkrishan Kalra sold 9,000 shares of the firm's stock in a transaction dated Monday, November 25th. The shares were sold at an average price of $46.40, for a total transaction of $417,600.00. Following the completion of the transaction, the chief executive officer now owns 267,404 shares in the company, valued at approximately $12,407,545.60. This trade represents a 3.26 % decrease in their position. The transaction was disclosed in a document filed with the SEC, which is accessible through this link. Corporate insiders own 2.80% of the company's stock.

Genpact Stock Performance

Shares of G stock traded down $0.06 during trading hours on Friday, reaching $44.67. 913,785 shares of the company's stock were exchanged, compared to its average volume of 1,348,975. The company's 50 day moving average is $42.38 and its two-hundred day moving average is $37.82. Genpact Limited has a 1 year low of $30.23 and a 1 year high of $47.98. The company has a market cap of $7.88 billion, a P/E ratio of 12.27, a price-to-earnings-growth ratio of 1.56 and a beta of 1.18. The company has a debt-to-equity ratio of 0.50, a current ratio of 1.85 and a quick ratio of 1.85.

Genpact Dividend Announcement

The business also recently announced a quarterly dividend, which will be paid on Monday, December 23rd. Stockholders of record on Monday, December 9th will be paid a $0.1525 dividend. The ex-dividend date of this dividend is Monday, December 9th. This represents a $0.61 dividend on an annualized basis and a dividend yield of 1.37%. Genpact's dividend payout ratio (DPR) is currently 16.76%.

Wall Street Analysts Forecast Growth

G has been the topic of a number of recent research reports. Needham & Company LLC increased their price target on shares of Genpact from $42.00 to $55.00 and gave the company a "buy" rating in a research report on Monday, November 11th. JPMorgan Chase & Co. lifted their price target on Genpact from $35.00 to $43.00 and gave the company a "neutral" rating in a research report on Friday, September 6th. TD Cowen boosted their price target on Genpact from $40.00 to $45.00 and gave the stock a "hold" rating in a research report on Friday, November 8th. Robert W. Baird raised their price objective on shares of Genpact from $44.00 to $48.00 and gave the company a "neutral" rating in a research note on Friday, November 8th. Finally, Jefferies Financial Group lifted their price objective on Genpact from $35.00 to $40.00 and gave the stock a "hold" rating in a report on Monday, September 9th. Eight investment analysts have rated the stock with a hold rating and two have given a buy rating to the stock. According to MarketBeat, the stock currently has a consensus rating of "Hold" and an average price target of $42.33.

Check Out Our Latest Analysis on G

About Genpact

(

Free Report)

Genpact Limited provides business process outsourcing and information technology services in India, rest of Asia, North and Latin America, and Europe. It operates through three segments: Financial services; Consumer and Healthcare; and High Tech and Manufacturing. The Financial Services segment offers retail customer onboarding, customer service, collections, card servicing operations, loan and payment operations, commercial loan, equipment and auto loan, mortgage origination, compliance services, reporting and monitoring, and wealth management operations support; financial crime and risk management services; and underwriting support, new business processing, policy administration, claims management, catastrophe modeling and actuarial services, as well as property and casualty claims.

Featured Stories

Before you consider Genpact, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Genpact wasn't on the list.

While Genpact currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Almost everyone loves strong dividend-paying stocks, but high yields can signal danger. Discover 20 high-yield dividend stocks paying an unsustainably large percentage of their earnings. Enter your email to get this report and avoid a high-yield dividend trap.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.