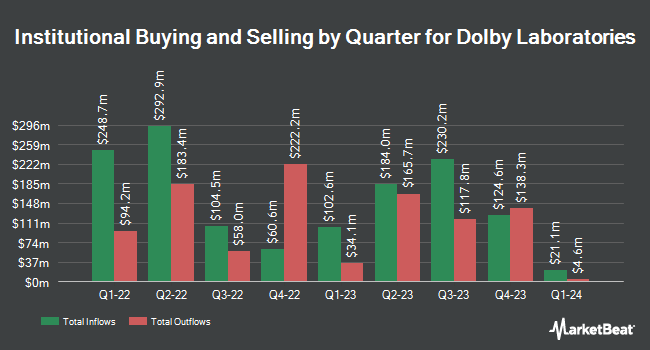

Geode Capital Management LLC increased its stake in Dolby Laboratories, Inc. (NYSE:DLB - Free Report) by 4.3% in the 3rd quarter, according to the company in its most recent filing with the SEC. The institutional investor owned 1,538,583 shares of the electronics maker's stock after acquiring an additional 63,293 shares during the quarter. Geode Capital Management LLC owned approximately 1.61% of Dolby Laboratories worth $117,767,000 at the end of the most recent reporting period.

Several other institutional investors and hedge funds also recently added to or reduced their stakes in DLB. Blue Trust Inc. grew its holdings in shares of Dolby Laboratories by 398.8% during the second quarter. Blue Trust Inc. now owns 414 shares of the electronics maker's stock worth $35,000 after buying an additional 331 shares in the last quarter. Point72 Hong Kong Ltd purchased a new stake in shares of Dolby Laboratories during the second quarter worth $37,000. Whittier Trust Co. of Nevada Inc. grew its holdings in shares of Dolby Laboratories by 192.4% during the second quarter. Whittier Trust Co. of Nevada Inc. now owns 576 shares of the electronics maker's stock worth $46,000 after buying an additional 379 shares in the last quarter. First Horizon Advisors Inc. grew its holdings in shares of Dolby Laboratories by 22.7% during the third quarter. First Horizon Advisors Inc. now owns 790 shares of the electronics maker's stock worth $60,000 after buying an additional 146 shares in the last quarter. Finally, Prospera Private Wealth LLC purchased a new stake in shares of Dolby Laboratories during the third quarter worth $93,000. Hedge funds and other institutional investors own 58.56% of the company's stock.

Wall Street Analysts Forecast Growth

DLB has been the subject of a number of research reports. Barrington Research reaffirmed an "outperform" rating and set a $100.00 target price on shares of Dolby Laboratories in a report on Wednesday, November 20th. StockNews.com raised shares of Dolby Laboratories from a "buy" rating to a "strong-buy" rating in a report on Wednesday, December 4th. Finally, Rosenblatt Securities upped their price objective on shares of Dolby Laboratories from $98.00 to $100.00 and gave the company a "buy" rating in a report on Wednesday, November 20th.

View Our Latest Stock Analysis on DLB

Insider Buying and Selling at Dolby Laboratories

In other news, SVP John D. Couling sold 7,000 shares of the stock in a transaction dated Monday, November 25th. The shares were sold at an average price of $80.50, for a total transaction of $563,500.00. Following the sale, the senior vice president now owns 106,806 shares of the company's stock, valued at approximately $8,597,883. This represents a 6.15 % decrease in their ownership of the stock. The sale was disclosed in a document filed with the Securities & Exchange Commission, which can be accessed through the SEC website. Also, CEO Kevin J. Yeaman sold 50,000 shares of the stock in a transaction dated Monday, November 25th. The stock was sold at an average price of $80.54, for a total transaction of $4,027,000.00. Following the sale, the chief executive officer now directly owns 83,721 shares in the company, valued at $6,742,889.34. This represents a 37.39 % decrease in their position. The disclosure for this sale can be found here. Insiders have sold 152,091 shares of company stock valued at $12,027,697 over the last 90 days. 39.54% of the stock is owned by insiders.

Dolby Laboratories Price Performance

Shares of DLB traded down $1.30 during mid-day trading on Wednesday, reaching $77.17. The stock had a trading volume of 736,389 shares, compared to its average volume of 415,829. Dolby Laboratories, Inc. has a 52-week low of $66.35 and a 52-week high of $87.12. The business's fifty day moving average is $76.01 and its 200 day moving average is $75.73. The firm has a market cap of $7.36 billion, a price-to-earnings ratio of 28.48 and a beta of 0.98.

Dolby Laboratories Increases Dividend

The business also recently announced a quarterly dividend, which was paid on Tuesday, December 10th. Shareholders of record on Tuesday, December 3rd were given a $0.33 dividend. The ex-dividend date was Tuesday, December 3rd. This represents a $1.32 dividend on an annualized basis and a yield of 1.71%. This is a boost from Dolby Laboratories's previous quarterly dividend of $0.30. Dolby Laboratories's dividend payout ratio is presently 48.71%.

Dolby Laboratories Profile

(

Free Report)

Dolby Laboratories, Inc creates audio and imaging technologies that transform entertainment at the cinema, DTV transmissions and devices, mobile devices, OTT video and music services, home entertainment devices, and automobiles. The company develops and licenses its audio technologies, such as AAC & HE-AAC, a digital audio codec solution used for a range of media applications; AVC, a digital video codec with high bandwidth efficiency used in various media devices; Dolby AC-4, a digital audio coding technology that delivers new audio experiences to a range of playback devices; and Dolby Atmos technology for cinema and various media devices.

Read More

Before you consider Dolby Laboratories, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Dolby Laboratories wasn't on the list.

While Dolby Laboratories currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering what the next stocks will be that hit it big, with solid fundamentals? Enter your email address to see which stocks MarketBeat analysts could become the next blockbuster growth stocks.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.