Geode Capital Management LLC lifted its stake in shares of Tyler Technologies, Inc. (NYSE:TYL - Free Report) by 2.2% in the third quarter, according to its most recent Form 13F filing with the Securities & Exchange Commission. The institutional investor owned 1,108,908 shares of the technology company's stock after purchasing an additional 24,284 shares during the period. Geode Capital Management LLC owned about 2.59% of Tyler Technologies worth $645,585,000 as of its most recent filing with the Securities & Exchange Commission.

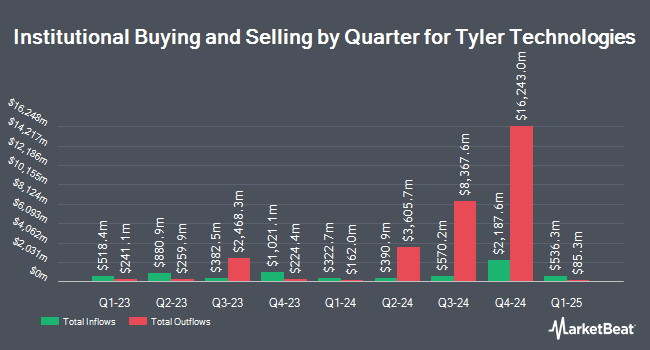

Several other hedge funds have also recently modified their holdings of TYL. Sequoia Financial Advisors LLC lifted its holdings in Tyler Technologies by 9.5% in the 2nd quarter. Sequoia Financial Advisors LLC now owns 890 shares of the technology company's stock valued at $447,000 after purchasing an additional 77 shares in the last quarter. Assenagon Asset Management S.A. boosted its position in Tyler Technologies by 73.2% during the second quarter. Assenagon Asset Management S.A. now owns 11,444 shares of the technology company's stock worth $5,754,000 after acquiring an additional 4,837 shares during the last quarter. Blue Trust Inc. grew its stake in Tyler Technologies by 329.4% during the 2nd quarter. Blue Trust Inc. now owns 73 shares of the technology company's stock valued at $37,000 after acquiring an additional 56 shares in the last quarter. Rovin Capital UT ADV grew its stake in Tyler Technologies by 5.6% during the 2nd quarter. Rovin Capital UT ADV now owns 1,535 shares of the technology company's stock valued at $772,000 after acquiring an additional 81 shares in the last quarter. Finally, Raymond James & Associates raised its holdings in Tyler Technologies by 5.7% in the 2nd quarter. Raymond James & Associates now owns 32,540 shares of the technology company's stock valued at $16,360,000 after acquiring an additional 1,749 shares during the last quarter. Institutional investors and hedge funds own 93.30% of the company's stock.

Analysts Set New Price Targets

A number of research firms have recently issued reports on TYL. Robert W. Baird upped their price target on Tyler Technologies from $625.00 to $700.00 and gave the company an "outperform" rating in a research report on Friday, October 25th. The Goldman Sachs Group restated a "buy" rating and issued a $627.00 target price on shares of Tyler Technologies in a report on Friday, September 13th. Truist Financial reiterated a "buy" rating and set a $685.00 price target (up previously from $600.00) on shares of Tyler Technologies in a report on Friday, October 25th. DA Davidson upped their price objective on shares of Tyler Technologies from $525.00 to $550.00 and gave the company a "neutral" rating in a report on Thursday, October 17th. Finally, Piper Sandler lifted their target price on shares of Tyler Technologies from $625.00 to $701.00 and gave the stock an "overweight" rating in a research note on Friday, October 25th. Three research analysts have rated the stock with a hold rating and twelve have given a buy rating to the company's stock. According to data from MarketBeat, Tyler Technologies has an average rating of "Moderate Buy" and a consensus price target of $642.62.

Get Our Latest Analysis on Tyler Technologies

Insider Activity at Tyler Technologies

In other Tyler Technologies news, insider John S. Marr, Jr. sold 12,000 shares of the stock in a transaction dated Monday, November 25th. The stock was sold at an average price of $613.66, for a total value of $7,363,920.00. Following the sale, the insider now owns 6,983 shares of the company's stock, valued at $4,285,187.78. This trade represents a 63.21 % decrease in their position. The transaction was disclosed in a document filed with the Securities & Exchange Commission, which is available at this link. Also, CEO H Lynn Moore, Jr. sold 6,250 shares of the business's stock in a transaction dated Wednesday, November 6th. The stock was sold at an average price of $605.82, for a total value of $3,786,375.00. Following the transaction, the chief executive officer now directly owns 75,000 shares of the company's stock, valued at approximately $45,436,500. This represents a 7.69 % decrease in their ownership of the stock. The disclosure for this sale can be found here. Over the last quarter, insiders sold 35,500 shares of company stock worth $21,952,888. Corporate insiders own 2.20% of the company's stock.

Tyler Technologies Trading Down 2.7 %

NYSE:TYL traded down $17.12 during trading hours on Friday, reaching $611.12. 199,967 shares of the stock were exchanged, compared to its average volume of 235,167. Tyler Technologies, Inc. has a twelve month low of $397.80 and a twelve month high of $638.56. The company has a quick ratio of 1.21, a current ratio of 1.21 and a debt-to-equity ratio of 0.18. The business has a 50-day moving average of $608.72 and a two-hundred day moving average of $565.52. The company has a market capitalization of $26.16 billion, a price-to-earnings ratio of 111.52, a PEG ratio of 5.66 and a beta of 0.76.

Tyler Technologies (NYSE:TYL - Get Free Report) last posted its earnings results on Wednesday, October 23rd. The technology company reported $2.52 earnings per share (EPS) for the quarter, topping the consensus estimate of $2.43 by $0.09. The firm had revenue of $543.34 million for the quarter, compared to analyst estimates of $547.34 million. Tyler Technologies had a return on equity of 9.79% and a net margin of 11.39%. Tyler Technologies's revenue was up 9.8% on a year-over-year basis. During the same quarter in the prior year, the company earned $1.66 EPS. On average, equities analysts predict that Tyler Technologies, Inc. will post 7.36 EPS for the current year.

About Tyler Technologies

(

Free Report)

Tyler Technologies, Inc provides integrated information management solutions and services for the public sector. It operates in two segments, Enterprise Software and Platform Technologies. The company offers platform and transformative technology solutions, including cybersecurity for government agencies; data and insights solutions; digital solutions that helps workers and policymakers to share, communicate, and leverage data; payments solutions, such as billing, presentment, merchant onboarding, collections, reconciliation, and disbursements; platform technologies, an application development platform that enables government workers to build solutions and applications; and outdoor recreation solutions, including campsite reservations, activity registrations, licensing sales and renewals, and real-time data for conservation and park management.

Featured Stories

Before you consider Tyler Technologies, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Tyler Technologies wasn't on the list.

While Tyler Technologies currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Like this article? Share it with a colleague.

Link copied to clipboard.