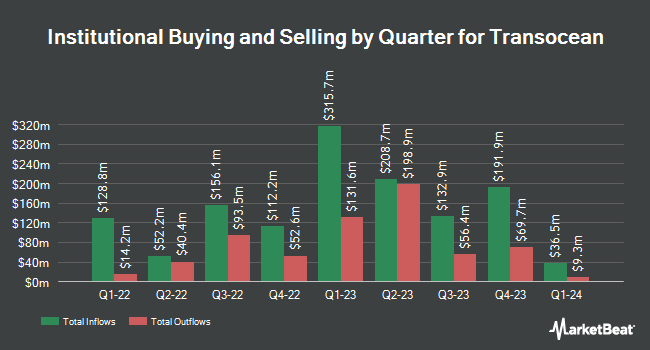

Geode Capital Management LLC raised its position in Transocean Ltd. (NYSE:RIG - Free Report) by 4.1% in the 3rd quarter, according to the company in its most recent disclosure with the Securities & Exchange Commission. The institutional investor owned 17,245,298 shares of the offshore drilling services provider's stock after acquiring an additional 680,242 shares during the period. Geode Capital Management LLC owned approximately 1.97% of Transocean worth $73,307,000 as of its most recent filing with the Securities & Exchange Commission.

Other institutional investors and hedge funds have also bought and sold shares of the company. Charles Schwab Investment Management Inc. increased its holdings in shares of Transocean by 7.7% during the third quarter. Charles Schwab Investment Management Inc. now owns 11,606,320 shares of the offshore drilling services provider's stock valued at $49,327,000 after acquiring an additional 826,229 shares in the last quarter. International Assets Investment Management LLC increased its stake in Transocean by 335.3% during the 3rd quarter. International Assets Investment Management LLC now owns 196,699 shares of the offshore drilling services provider's stock valued at $836,000 after purchasing an additional 151,507 shares in the last quarter. Barclays PLC raised its holdings in shares of Transocean by 60.1% in the third quarter. Barclays PLC now owns 1,623,924 shares of the offshore drilling services provider's stock worth $6,902,000 after buying an additional 609,681 shares during the last quarter. MetLife Investment Management LLC lifted its stake in shares of Transocean by 125.9% during the third quarter. MetLife Investment Management LLC now owns 415,031 shares of the offshore drilling services provider's stock worth $1,764,000 after buying an additional 231,334 shares during the period. Finally, The Manufacturers Life Insurance Company grew its holdings in shares of Transocean by 214.3% during the second quarter. The Manufacturers Life Insurance Company now owns 382,362 shares of the offshore drilling services provider's stock valued at $2,046,000 after buying an additional 260,710 shares during the last quarter. 67.73% of the stock is owned by hedge funds and other institutional investors.

Insiders Place Their Bets

In other news, EVP Roderick James Mackenzie sold 20,000 shares of the business's stock in a transaction that occurred on Monday, November 18th. The stock was sold at an average price of $4.29, for a total value of $85,800.00. Following the completion of the sale, the executive vice president now directly owns 310,857 shares in the company, valued at $1,333,576.53. The trade was a 6.04 % decrease in their ownership of the stock. The transaction was disclosed in a filing with the Securities & Exchange Commission, which is available through this link. Insiders own 13.16% of the company's stock.

Wall Street Analysts Forecast Growth

A number of brokerages have commented on RIG. Susquehanna lowered their price target on Transocean from $7.00 to $6.50 and set a "positive" rating for the company in a research report on Friday, November 1st. StockNews.com raised Transocean to a "sell" rating in a report on Tuesday, November 12th. DNB Markets upgraded shares of Transocean from a "hold" rating to a "buy" rating in a report on Tuesday, September 3rd. Benchmark restated a "hold" rating on shares of Transocean in a research note on Tuesday, December 3rd. Finally, Barclays upgraded shares of Transocean from an "equal weight" rating to an "overweight" rating and set a $4.50 price objective on the stock in a research note on Wednesday. Two analysts have rated the stock with a sell rating, four have issued a hold rating and four have assigned a buy rating to the company's stock. According to MarketBeat, the company presently has an average rating of "Hold" and an average price target of $6.25.

Check Out Our Latest Analysis on RIG

Transocean Stock Performance

Shares of RIG traded down $0.02 during trading hours on Friday, hitting $3.53. The stock had a trading volume of 30,870,342 shares, compared to its average volume of 18,764,072. The firm has a market capitalization of $3.09 billion, a price-to-earnings ratio of -4.71 and a beta of 2.75. The company has a debt-to-equity ratio of 0.64, a quick ratio of 1.34 and a current ratio of 1.64. The firm has a 50-day moving average price of $4.18 and a 200 day moving average price of $4.69. Transocean Ltd. has a fifty-two week low of $3.48 and a fifty-two week high of $6.88.

About Transocean

(

Free Report)

Transocean Ltd., together with its subsidiaries, provides offshore contract drilling services for oil and gas wells worldwide. It contracts mobile offshore drilling rigs, related equipment, and work crews to drill oil and gas wells. The company operates a fleet of mobile offshore drilling units, consisting of ultra-deepwater floaters and harsh environment floaters.

Read More

Before you consider Transocean, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Transocean wasn't on the list.

While Transocean currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Options trading isn’t just for the Wall Street elite; it’s an accessible strategy for anyone armed with the proper knowledge. Think of options as a strategic toolkit, with each tool designed for a specific financial task. Keep reading to learn how options trading can help you use the market’s volatility to your advantage.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.