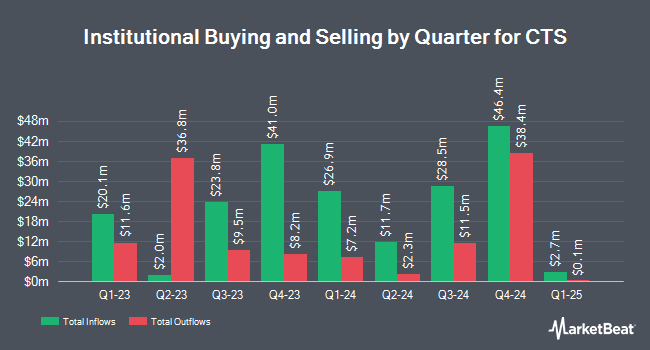

Geode Capital Management LLC lessened its holdings in CTS Co. (NYSE:CTS - Free Report) by 14.0% during the fourth quarter, according to the company in its most recent disclosure with the SEC. The firm owned 693,076 shares of the electronics maker's stock after selling 113,104 shares during the quarter. Geode Capital Management LLC owned about 2.30% of CTS worth $36,555,000 at the end of the most recent quarter.

Other institutional investors and hedge funds have also made changes to their positions in the company. Raymond James Financial Inc. bought a new position in shares of CTS during the fourth quarter valued at $15,852,000. Norges Bank purchased a new stake in CTS during the 4th quarter valued at about $4,439,000. Madison Investment Advisors LLC bought a new stake in CTS during the 4th quarter valued at about $3,787,000. JPMorgan Chase & Co. raised its holdings in CTS by 72.5% in the 4th quarter. JPMorgan Chase & Co. now owns 135,969 shares of the electronics maker's stock worth $7,170,000 after acquiring an additional 57,135 shares during the last quarter. Finally, Intech Investment Management LLC lifted its holdings in shares of CTS by 147.7% during the fourth quarter. Intech Investment Management LLC now owns 88,021 shares of the electronics maker's stock valued at $4,641,000 after purchasing an additional 52,482 shares in the last quarter. Institutional investors own 96.87% of the company's stock.

Analyst Ratings Changes

Separately, StockNews.com raised shares of CTS from a "hold" rating to a "buy" rating in a report on Monday, March 3rd.

Check Out Our Latest Stock Report on CTS

CTS Stock Performance

Shares of CTS traded up $0.70 on Friday, reaching $37.49. The company's stock had a trading volume of 200,183 shares, compared to its average volume of 156,178. CTS Co. has a 12-month low of $34.02 and a 12-month high of $59.68. The stock has a market capitalization of $1.13 billion, a P/E ratio of 19.73 and a beta of 0.61. The company has a debt-to-equity ratio of 0.17, a current ratio of 2.50 and a quick ratio of 1.95. The stock's 50 day simple moving average is $42.03 and its two-hundred day simple moving average is $48.50.

CTS (NYSE:CTS - Get Free Report) last issued its quarterly earnings data on Tuesday, February 4th. The electronics maker reported $0.53 earnings per share (EPS) for the quarter, missing analysts' consensus estimates of $0.59 by ($0.06). CTS had a net margin of 11.27% and a return on equity of 12.67%. Research analysts forecast that CTS Co. will post 2.28 earnings per share for the current fiscal year.

CTS Dividend Announcement

The business also recently disclosed a quarterly dividend, which will be paid on Friday, April 25th. Stockholders of record on Friday, March 28th will be given a dividend of $0.04 per share. The ex-dividend date of this dividend is Friday, March 28th. This represents a $0.16 dividend on an annualized basis and a dividend yield of 0.43%. CTS's payout ratio is currently 8.42%.

About CTS

(

Free Report)

CTS Corporation manufactures and sells sensors, actuators, and connectivity components in North America, Europe, and Asia. The company provides encoders, rotary position sensors, slide potentiometers, industrial and commercial rotary potentiometers. It also provides non-contacting, and contacting pedals; and eBrake pedals.

Featured Stories

Before you consider CTS, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and CTS wasn't on the list.

While CTS currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's list of seven best retirement stocks and why they should be in your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.