Geode Capital Management LLC grew its position in ACI Worldwide, Inc. (NASDAQ:ACIW - Free Report) by 1.3% in the 3rd quarter, according to the company in its most recent 13F filing with the Securities and Exchange Commission (SEC). The firm owned 2,502,628 shares of the technology company's stock after buying an additional 31,561 shares during the period. Geode Capital Management LLC owned 2.39% of ACI Worldwide worth $127,407,000 as of its most recent SEC filing.

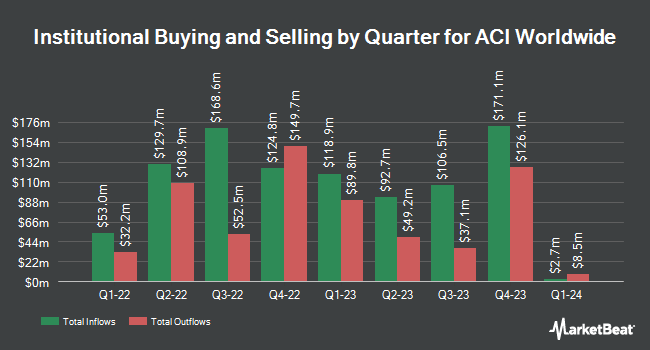

A number of other hedge funds and other institutional investors have also made changes to their positions in ACIW. Hood River Capital Management LLC boosted its position in shares of ACI Worldwide by 44.9% during the second quarter. Hood River Capital Management LLC now owns 2,400,340 shares of the technology company's stock worth $95,029,000 after buying an additional 743,595 shares during the period. Assenagon Asset Management S.A. increased its holdings in shares of ACI Worldwide by 144.1% in the 3rd quarter. Assenagon Asset Management S.A. now owns 482,740 shares of the technology company's stock valued at $24,571,000 after acquiring an additional 285,001 shares during the last quarter. Great Lakes Advisors LLC acquired a new stake in ACI Worldwide during the second quarter worth approximately $7,696,000. Allspring Global Investments Holdings LLC acquired a new position in shares of ACI Worldwide in the 2nd quarter valued at $7,353,000. Finally, Barclays PLC raised its stake in ACI Worldwide by 244.0% during the 3rd quarter. Barclays PLC now owns 226,173 shares of the technology company's stock worth $11,513,000 after acquiring an additional 160,425 shares in the last quarter. Institutional investors and hedge funds own 94.74% of the company's stock.

ACI Worldwide Trading Down 2.0 %

Shares of ACI Worldwide stock opened at $53.77 on Wednesday. The company has a quick ratio of 1.56, a current ratio of 1.56 and a debt-to-equity ratio of 0.72. The firm has a market cap of $5.64 billion, a price-to-earnings ratio of 25.48 and a beta of 1.19. ACI Worldwide, Inc. has a fifty-two week low of $28.79 and a fifty-two week high of $59.71. The business has a fifty day simple moving average of $53.73 and a 200-day simple moving average of $47.39.

Insider Activity at ACI Worldwide

In other ACI Worldwide news, CTO Abraham Kuruvilla sold 5,400 shares of ACI Worldwide stock in a transaction on Friday, December 6th. The shares were sold at an average price of $55.71, for a total transaction of $300,834.00. Following the sale, the chief technology officer now owns 81,107 shares in the company, valued at $4,518,470.97. The trade was a 6.24 % decrease in their ownership of the stock. The transaction was disclosed in a filing with the Securities & Exchange Commission, which is available at this link. Also, Director Adalio T. Sanchez sold 1,200 shares of the business's stock in a transaction on Wednesday, November 13th. The shares were sold at an average price of $57.28, for a total value of $68,736.00. Following the completion of the sale, the director now directly owns 43,272 shares in the company, valued at approximately $2,478,620.16. This represents a 2.70 % decrease in their position. The disclosure for this sale can be found here. 1.00% of the stock is currently owned by insiders.

Wall Street Analysts Forecast Growth

A number of equities analysts recently weighed in on the stock. DA Davidson lowered shares of ACI Worldwide from a "buy" rating to a "neutral" rating and lifted their price objective for the company from $57.00 to $60.00 in a research report on Friday, November 8th. Stephens lowered shares of ACI Worldwide from an "overweight" rating to an "equal weight" rating in a research report on Friday, October 18th. Four equities research analysts have rated the stock with a hold rating and three have assigned a buy rating to the company. According to data from MarketBeat, the company has an average rating of "Hold" and an average price target of $49.50.

Read Our Latest Stock Report on ACIW

ACI Worldwide Profile

(

Free Report)

ACI Worldwide, Inc, a software company, develops, markets, installs, and supports a range of software products and solutions for facilitating digital payments in the United States and internationally. The company operates in three segments: Banks, Merchants, and Billers. The company offers ACI Acquiring, a solution to process credit, debit, and prepaid card transactions, deliver digital innovation, and fraud prevention; ACI Issuing, a digital payment issuing solution for new payment offering; and ACI Enterprise Payments Platform that provides payment processing and orchestration capabilities for digital payments.

Recommended Stories

Before you consider ACI Worldwide, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and ACI Worldwide wasn't on the list.

While ACI Worldwide currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

If a company's CEO, COO, and CFO were all selling shares of their stock, would you want to know?

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.