Geode Capital Management LLC raised its holdings in shares of Gibraltar Industries, Inc. (NASDAQ:ROCK - Free Report) by 4.1% in the 3rd quarter, according to its most recent filing with the Securities & Exchange Commission. The institutional investor owned 838,932 shares of the construction company's stock after acquiring an additional 32,950 shares during the quarter. Geode Capital Management LLC owned approximately 2.77% of Gibraltar Industries worth $58,676,000 at the end of the most recent reporting period.

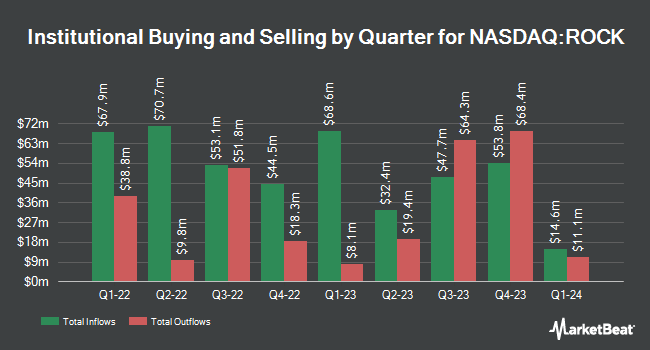

A number of other institutional investors have also made changes to their positions in ROCK. Victory Capital Management Inc. boosted its stake in shares of Gibraltar Industries by 27.8% during the 3rd quarter. Victory Capital Management Inc. now owns 1,481,674 shares of the construction company's stock worth $103,613,000 after acquiring an additional 322,422 shares during the period. State Street Corp lifted its position in shares of Gibraltar Industries by 4.6% during the 3rd quarter. State Street Corp now owns 1,278,283 shares of the construction company's stock valued at $89,390,000 after acquiring an additional 56,008 shares during the period. Pacer Advisors Inc. lifted its holdings in shares of Gibraltar Industries by 14.6% during the 2nd quarter. Pacer Advisors Inc. now owns 1,084,170 shares of the construction company's stock worth $74,320,000 after acquiring an additional 138,194 shares during the period. Barrow Hanley Mewhinney & Strauss LLC lifted its stake in Gibraltar Industries by 1.2% during the second quarter. Barrow Hanley Mewhinney & Strauss LLC now owns 844,373 shares of the construction company's stock worth $57,882,000 after purchasing an additional 9,764 shares during the last quarter. Finally, FMR LLC boosted its position in Gibraltar Industries by 1,663.5% during the 3rd quarter. FMR LLC now owns 726,667 shares of the construction company's stock worth $50,816,000 after buying an additional 685,462 shares during the period. Institutional investors own 98.39% of the company's stock.

Gibraltar Industries Stock Performance

Shares of NASDAQ ROCK traded up $0.02 during trading on Friday, hitting $60.61. 1,652,870 shares of the company traded hands, compared to its average volume of 180,964. The firm has a market capitalization of $1.84 billion, a price-to-earnings ratio of 16.84 and a beta of 1.15. Gibraltar Industries, Inc. has a fifty-two week low of $59.61 and a fifty-two week high of $87.40. The business's fifty day moving average is $68.85 and its 200 day moving average is $69.53.

Gibraltar Industries (NASDAQ:ROCK - Get Free Report) last posted its earnings results on Wednesday, October 30th. The construction company reported $1.27 earnings per share for the quarter, beating analysts' consensus estimates of $1.26 by $0.01. Gibraltar Industries had a return on equity of 13.13% and a net margin of 8.28%. The company had revenue of $361.20 million for the quarter, compared to analyst estimates of $360.43 million. During the same quarter last year, the company earned $1.38 earnings per share. The company's revenue for the quarter was down 7.6% on a year-over-year basis. On average, analysts predict that Gibraltar Industries, Inc. will post 4.18 EPS for the current year.

Analyst Upgrades and Downgrades

Separately, StockNews.com downgraded Gibraltar Industries from a "strong-buy" rating to a "buy" rating in a research report on Saturday.

Check Out Our Latest Stock Report on ROCK

Gibraltar Industries Profile

(

Free Report)

Gibraltar Industries, Inc manufactures and provides products and services for the renewable energy, residential, agtech, and infrastructure markets in the United States and internationally. It operates through four segments: Renewables, Residential, Agtech, and Infrastructure. The Renewables segment designs, engineers, manufactures, and installs solar racking and electrical balance of systems for commercial and distributed generation scale solar installations.

See Also

Before you consider Gibraltar Industries, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Gibraltar Industries wasn't on the list.

While Gibraltar Industries currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's list of seven best retirement stocks and why they should be in your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.