Geode Capital Management LLC lifted its position in shares of Ecolab Inc. (NYSE:ECL - Free Report) by 1.3% during the 3rd quarter, according to its most recent filing with the Securities and Exchange Commission (SEC). The fund owned 5,181,802 shares of the basic materials company's stock after purchasing an additional 68,043 shares during the period. Geode Capital Management LLC owned 1.83% of Ecolab worth $1,317,811,000 at the end of the most recent quarter.

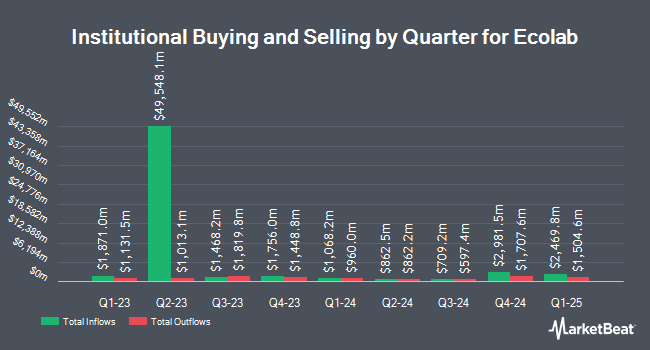

A number of other institutional investors and hedge funds also recently modified their holdings of ECL. Triad Wealth Partners LLC bought a new stake in Ecolab in the second quarter valued at approximately $26,000. Coastline Trust Co acquired a new stake in Ecolab during the 3rd quarter valued at $26,000. PSI Advisors LLC bought a new position in Ecolab during the second quarter worth $27,000. Kings Path Partners LLC bought a new position in Ecolab during the second quarter worth $27,000. Finally, MFA Wealth Advisors LLC bought a new position in shares of Ecolab in the second quarter valued at about $33,000. 74.91% of the stock is owned by institutional investors.

Insider Activity

In other news, major shareholder William H. Gates III sold 65,015 shares of Ecolab stock in a transaction dated Monday, November 4th. The shares were sold at an average price of $243.80, for a total transaction of $15,850,657.00. Following the completion of the transaction, the insider now directly owns 30,388,741 shares in the company, valued at $7,408,775,055.80. This trade represents a 0.21 % decrease in their ownership of the stock. The sale was disclosed in a filing with the Securities & Exchange Commission, which is available through this hyperlink. Also, Director Victoria Reich sold 393 shares of the company's stock in a transaction dated Thursday, September 12th. The stock was sold at an average price of $250.00, for a total transaction of $98,250.00. Following the completion of the sale, the director now owns 24,041 shares in the company, valued at $6,010,250. This represents a 1.61 % decrease in their position. The disclosure for this sale can be found here. Over the last 90 days, insiders have sold 834,959 shares of company stock worth $205,323,667. Company insiders own 0.04% of the company's stock.

Ecolab Trading Down 0.6 %

Ecolab stock traded down $1.55 during trading hours on Wednesday, reaching $245.50. 966,686 shares of the company's stock were exchanged, compared to its average volume of 1,086,480. The firm's 50 day simple moving average is $250.56 and its 200 day simple moving average is $245.70. Ecolab Inc. has a twelve month low of $192.37 and a twelve month high of $262.61. The company has a quick ratio of 0.97, a current ratio of 1.30 and a debt-to-equity ratio of 0.81. The firm has a market capitalization of $69.52 billion, a PE ratio of 34.57, a PEG ratio of 2.50 and a beta of 1.13.

Ecolab (NYSE:ECL - Get Free Report) last issued its quarterly earnings results on Tuesday, October 29th. The basic materials company reported $1.83 earnings per share (EPS) for the quarter, beating the consensus estimate of $1.82 by $0.01. The firm had revenue of $4 billion for the quarter, compared to analyst estimates of $4.03 billion. Ecolab had a return on equity of 22.12% and a net margin of 13.05%. The company's revenue was up 1.0% compared to the same quarter last year. During the same period in the previous year, the firm earned $1.54 earnings per share. Research analysts predict that Ecolab Inc. will post 6.65 earnings per share for the current year.

Ecolab Increases Dividend

The business also recently declared a quarterly dividend, which will be paid on Wednesday, January 15th. Shareholders of record on Tuesday, December 17th will be paid a $0.65 dividend. This is an increase from Ecolab's previous quarterly dividend of $0.57. This represents a $2.60 annualized dividend and a yield of 1.06%. The ex-dividend date of this dividend is Tuesday, December 17th. Ecolab's payout ratio is 36.47%.

Wall Street Analyst Weigh In

Several research analysts have weighed in on ECL shares. BMO Capital Markets increased their price target on shares of Ecolab from $260.00 to $279.00 and gave the company a "market perform" rating in a report on Wednesday, October 30th. Piper Sandler lifted their target price on Ecolab from $270.00 to $305.00 and gave the stock an "overweight" rating in a report on Thursday, September 26th. Royal Bank of Canada reiterated an "outperform" rating and issued a $306.00 price target on shares of Ecolab in a research report on Wednesday, October 30th. Barclays lifted their price objective on Ecolab from $260.00 to $300.00 and gave the company an "overweight" rating in a report on Monday, November 18th. Finally, Robert W. Baird boosted their target price on shares of Ecolab from $271.00 to $279.00 and gave the company a "neutral" rating in a research report on Wednesday, October 30th. Eight research analysts have rated the stock with a hold rating and nine have given a buy rating to the company's stock. Based on data from MarketBeat.com, Ecolab has an average rating of "Moderate Buy" and a consensus target price of $279.87.

Read Our Latest Analysis on Ecolab

Ecolab Profile

(

Free Report)

Ecolab Inc provides water, hygiene, and infection prevention solutions and services in the United States and internationally. The company operates through three segments: Global Industrial; Global Institutional & Specialty; and Global Healthcare & Life Sciences. The Global Industrial segment offers water treatment and process applications, and cleaning and sanitizing solutions to manufacturing, food and beverage processing, transportation, chemical, metals and mining, power generation, pulp and paper, commercial laundry, petroleum, refining, and petrochemical industries.

Recommended Stories

Before you consider Ecolab, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Ecolab wasn't on the list.

While Ecolab currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Almost everyone loves strong dividend-paying stocks, but high yields can signal danger. Discover 20 high-yield dividend stocks paying an unsustainably large percentage of their earnings. Enter your email to get this report and avoid a high-yield dividend trap.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.